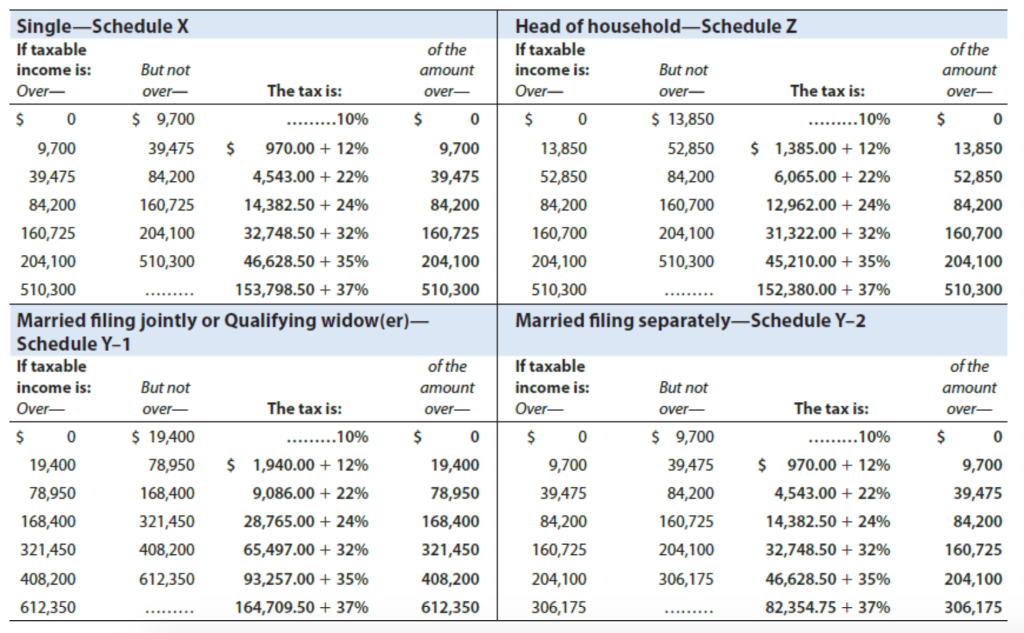

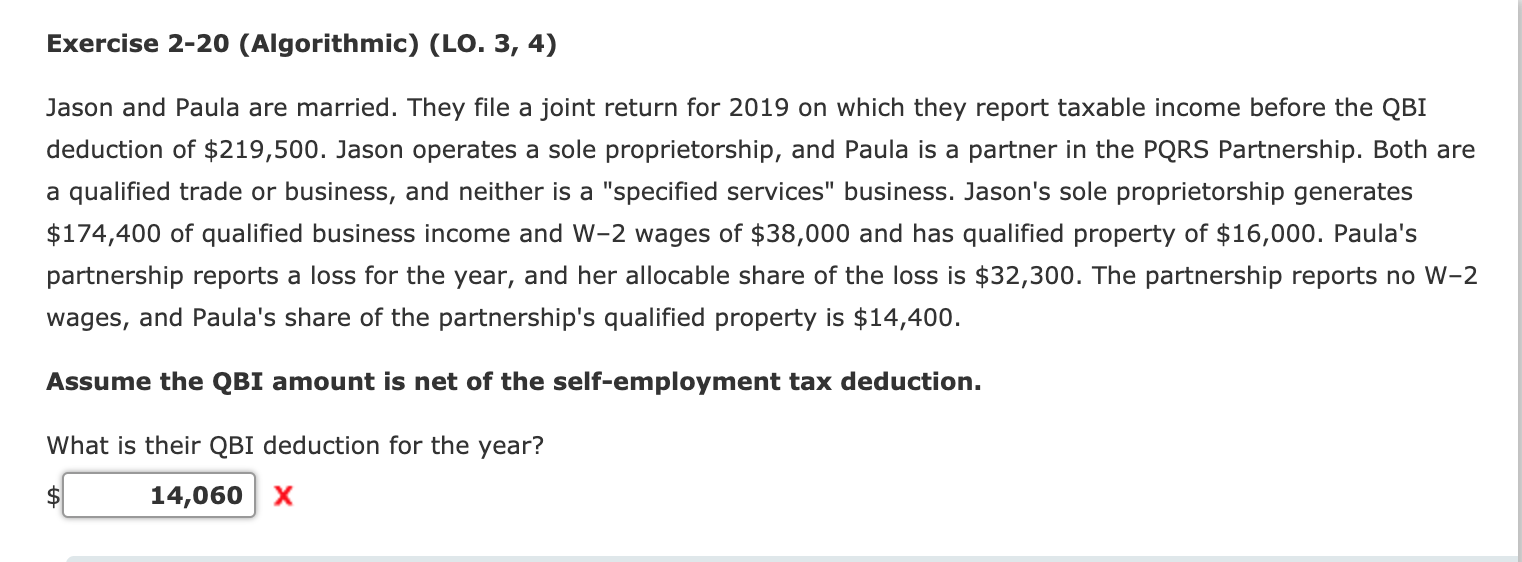

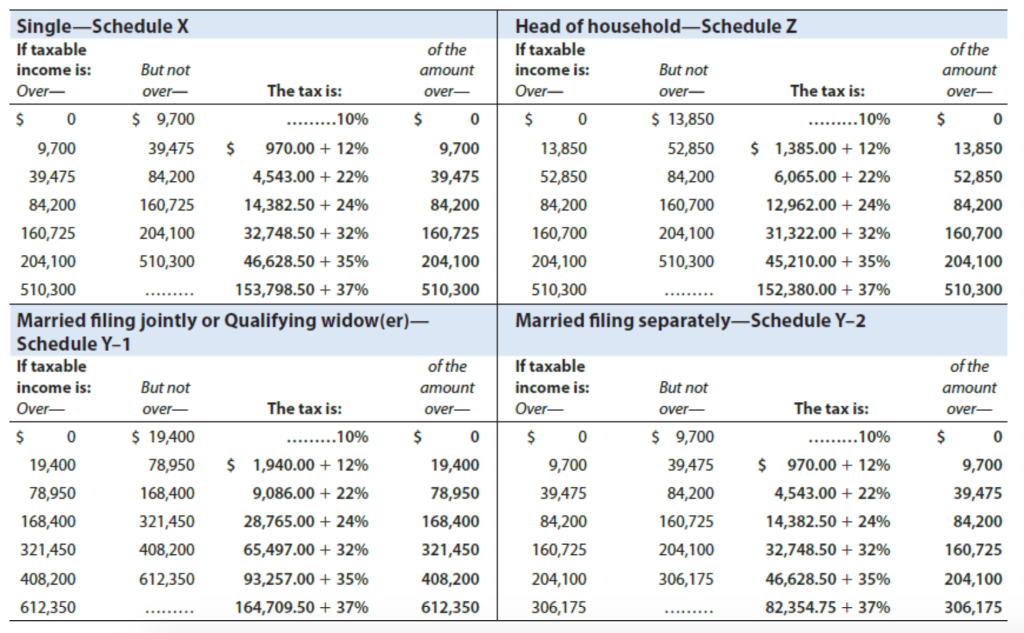

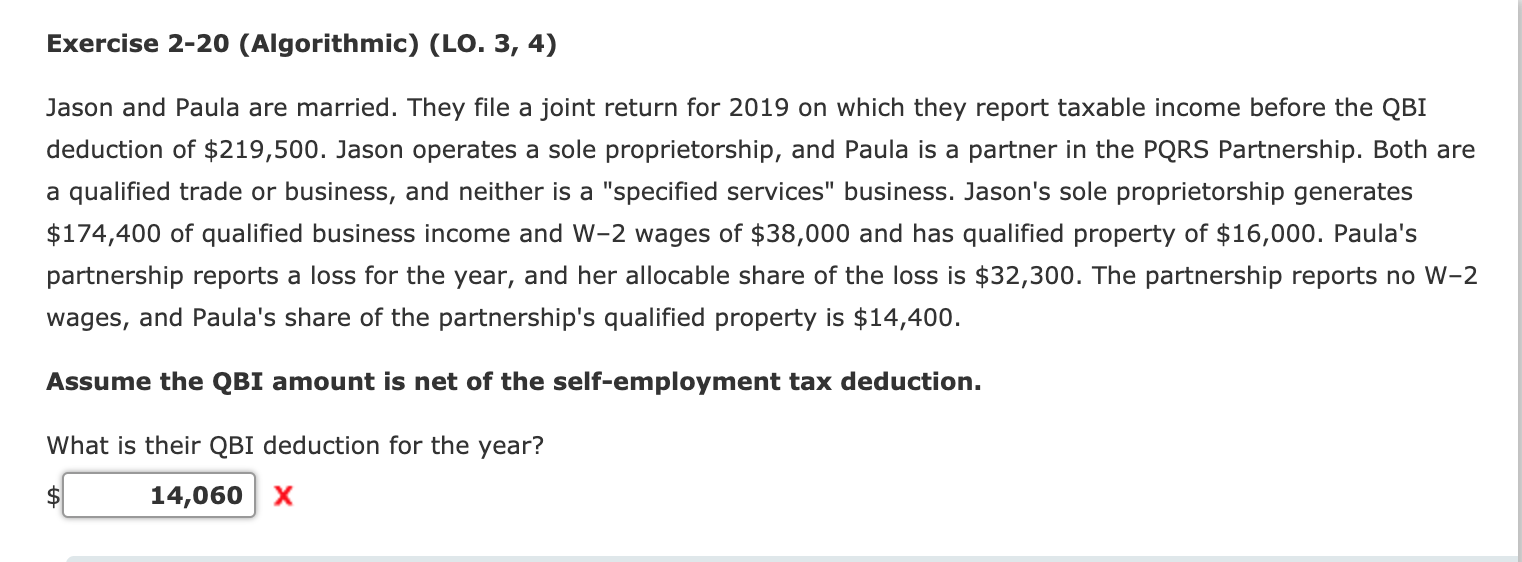

Head of household-Schedule Z If taxable income is: But not Over- over- The tax is: $ 0 $ 13,850 ......... 10% 13,850 52,850 $ 1,385.00 + 12% 52,850 84,200 6,065.00 + 22% 84,200 160,700 12,962.00 + 24% 160,700 204,100 31,322.00 + 32% 204,100 510,300 45,210.00 + 35% 510,300 ......... 152,380.00 + 37% Married filing separatelySchedule Y-2 Single-Schedule X If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 9,700 39,475 $ 970.00 + 12% 9,700 39,475 84,200 4,543.00 + 22% 39,475 84,200 160,725 14,382.50 +24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 204,100 510,300 46,628.50 + 35% 204,100 510,300 153,798.50 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 19,400 .........10% $ 0 19,400 78,950 $ 1,940.00 + 12% 19,400 78,950 168,400 9,086.00 + 22% 78,950 168,400 321,450 28,765.00 + 24% 168,400 321,450 408,200 65,497.00 + 32% 321,450 408,200 612,350 93,257.00 + 35% 408,200 612,350 164,709.50 + 37% 612,350 of the amount over- $ 0 13,850 52,850 84,200 160,700 204,100 510,300 If taxable income is: Over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175 But not over- $ 9,700 39,475 84,200 160,725 204,100 306,175 The tax is: ......... 10% $ 970.00 + 12% 4,543.00 + 22% 14,382.50 + 24% 32,748.50 + 32% 46,628.50 + 35% 82,354.75 + 37% amount over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175 Exercise 2-20 (Algorithmic) (LO. 3, 4) Jason and Paula are married. They file a joint return for 2019 on which they report taxable income before the QBI deduction of $219,500. Jason operates a sole proprietorship, and Paula is a partner in the PQRS Partnership. Both are a qualified trade or business, and neither is a "specified services" business. Jason's sole proprietorship generates $174,400 of qualified business income and W-2 wages of $38,000 and has qualified property of $16,000. Paula's partnership reports a loss for the year, and her allocable share of the loss is $32,300. The partnership reports no W-2 wages, and Paula's share of the partnership's qualified property is $14,400. Assume the QBI amount is net of the self-employment tax deduction. What is their QBI deduction for the year? $ 14,060 x Head of household-Schedule Z If taxable income is: But not Over- over- The tax is: $ 0 $ 13,850 ......... 10% 13,850 52,850 $ 1,385.00 + 12% 52,850 84,200 6,065.00 + 22% 84,200 160,700 12,962.00 + 24% 160,700 204,100 31,322.00 + 32% 204,100 510,300 45,210.00 + 35% 510,300 ......... 152,380.00 + 37% Married filing separatelySchedule Y-2 Single-Schedule X If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 9,700 39,475 $ 970.00 + 12% 9,700 39,475 84,200 4,543.00 + 22% 39,475 84,200 160,725 14,382.50 +24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 204,100 510,300 46,628.50 + 35% 204,100 510,300 153,798.50 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 19,400 .........10% $ 0 19,400 78,950 $ 1,940.00 + 12% 19,400 78,950 168,400 9,086.00 + 22% 78,950 168,400 321,450 28,765.00 + 24% 168,400 321,450 408,200 65,497.00 + 32% 321,450 408,200 612,350 93,257.00 + 35% 408,200 612,350 164,709.50 + 37% 612,350 of the amount over- $ 0 13,850 52,850 84,200 160,700 204,100 510,300 If taxable income is: Over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175 But not over- $ 9,700 39,475 84,200 160,725 204,100 306,175 The tax is: ......... 10% $ 970.00 + 12% 4,543.00 + 22% 14,382.50 + 24% 32,748.50 + 32% 46,628.50 + 35% 82,354.75 + 37% amount over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175 Exercise 2-20 (Algorithmic) (LO. 3, 4) Jason and Paula are married. They file a joint return for 2019 on which they report taxable income before the QBI deduction of $219,500. Jason operates a sole proprietorship, and Paula is a partner in the PQRS Partnership. Both are a qualified trade or business, and neither is a "specified services" business. Jason's sole proprietorship generates $174,400 of qualified business income and W-2 wages of $38,000 and has qualified property of $16,000. Paula's partnership reports a loss for the year, and her allocable share of the loss is $32,300. The partnership reports no W-2 wages, and Paula's share of the partnership's qualified property is $14,400. Assume the QBI amount is net of the self-employment tax deduction. What is their QBI deduction for the year? $ 14,060 x