Question

Headlands Agency sells an insurance policy offered by Capital Insurance Company for a commission of $117 on January 2, 2017. Headland will receive an additional

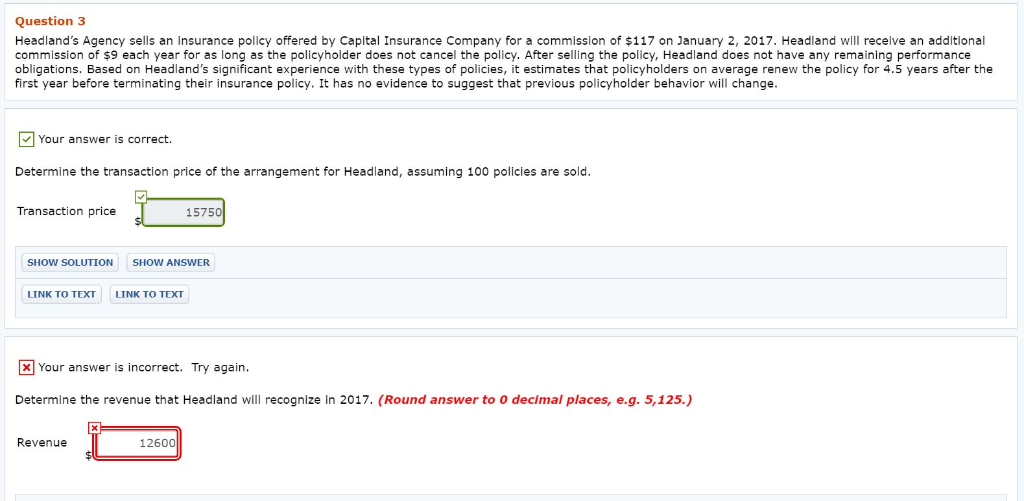

Headlands Agency sells an insurance policy offered by Capital Insurance Company for a commission of $117 on January 2, 2017. Headland will receive an additional commission of $9 each year for as long as the policyholder does not cancel the policy. After selling the policy, Headland does not have any remaining performance obligations. Based on Headlands significant experience with these types of policies, it estimates that policyholders on average renew the policy for 4.5 years after the first year before terminating their insurance policy. It has no evidence to suggest that previous policyholder behavior will change.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started