Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Health Care Finance- week 2 financial excercises part 2 x & for LAB A company needs to decide if it will move forward with two

Health Care Finance- week 2 financial excercises part 2

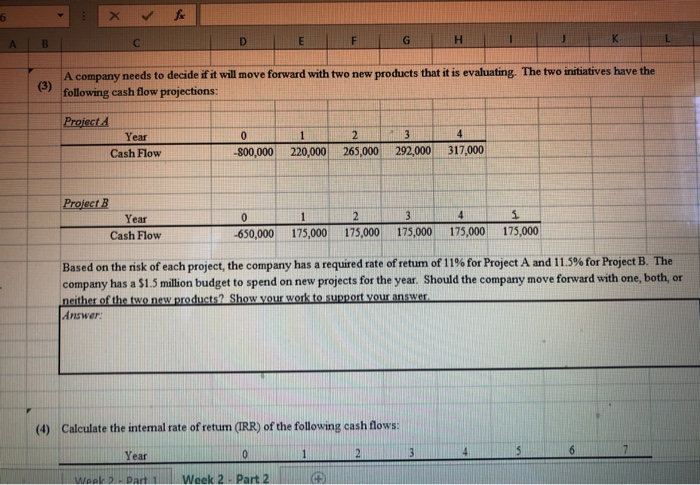

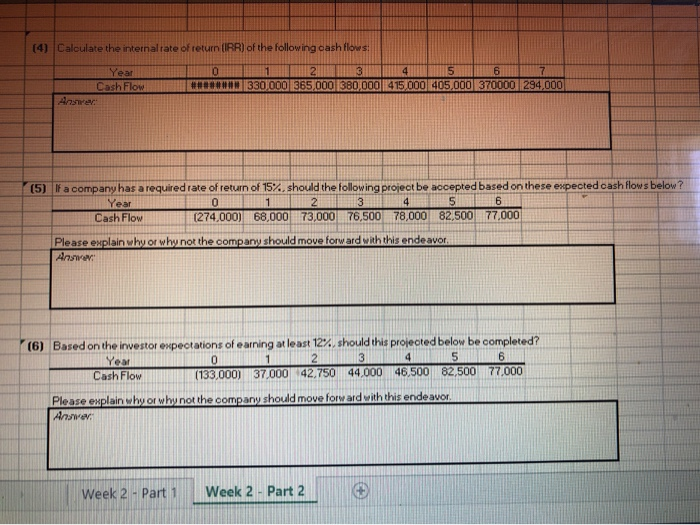

x & for LAB A company needs to decide if it will move forward with two new products that it is evaluating. The two initiatives have the following cash flow projections: Project Year Cash Flow Cash Flow .60.00 2,000 25,0 202,00 31,00|| -800,000 220,000 265,000 292,000 317,000 Project B Year Cash Flow - -650,000 650,000 17500 175,000 17:00 1795,000 175.000 175,000 175,000 175,000 175,000 175,000 Based on the risk of each project, the company has a required rate of retum of 11% for Project A and 11.5% for Project B. The company has a $1.5 million budget to spend on new projects for the year. Should the company move forward with one, both, or neither of the two new products. Show your work to support your answer Answer: (4) Calculate the intemal rate of retum (IRR) of the following cash flows Year Wenko Dart Week 2 Part 2 (4) Calculate the internal rate of return (IRR) of the following cash flows: 0 1 2 3 4 5 6 SOLO 330.000 365.000 380,000 415.000 405.000 370000 1294,000 | Cash Flow (5) Fa company has a required rate of return of 15% should the following project be accepted based on these expected cash flows below Year 1 2 3 4 5 6 Cash Flow (274.000) 68,000 73.000 76,500 78,000 82,500 77,000 Please explain why or why not the company should move forward with this endeavor. Anm 0 4 5 (6) Based on the investor expectations of earning atleast 12% should this projected below be completed? 12 Cash Flow (133.000 37.000 42.750 44.000 46.500 82.500 77.000 Please explain why or why not the company should move forward with this endeavor Answer: Week 2 - Part 1 Week 2 - Part 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started