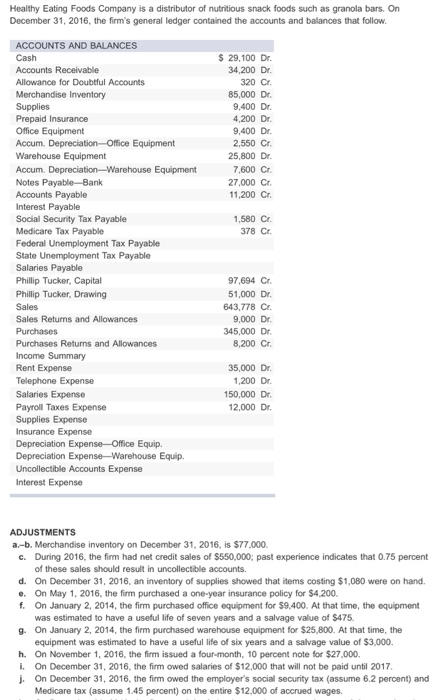

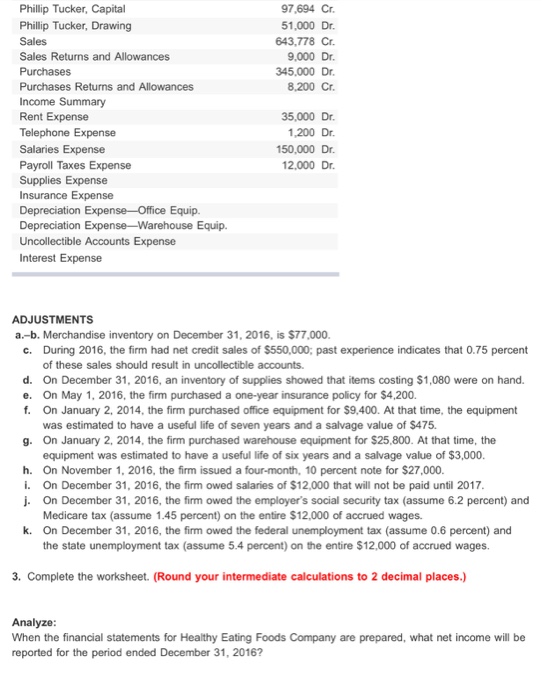

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 2016, the firm's general ledger contained the account and balances that follow. ts ACCOUNTS AND BALANCES 29,100 Dr. Accounts Receivable 34,200 Dr. lowance for Doubtful Accounts Merchandise Inventory 85,000 Dr. Suppl 9,400 Dr. Prepaid 4.200 Dr. Office Equipment 9,400 Dr. Accum. Depreciation-Office Equipment 2,550 Cr. Warehouse Equipment 25,800 Dr. Accum. Depreciation-warehouse Equipment 7,600 Cr. Notes Payable-Bank 27,000 Cr. Accounts Payable 11,200 Cr. Interest Payable Social Security Tax Payable 1,580 Cr. Medicare Tax Payable 378 Cr. Federal Unemployment Tax Payable State Unemployment Tax Payable Salaries Payable Philip Tucker Capital 97,694 Cr. Phillip Tucker, Drawing 51,000 Dr. 643,778 Cr. Sales Returns and Al 9,000 Dr. 345,000 Dr. Purchases Returns and Allowances 8,200 Cr. Rent Expense 35,000 Dr. Telephone Expense 1,200 Dr. Salaries Expense 150,000 Dr. Payroll Taxes Expense 12,000 Dr. Supplies Expense Insurance Expense Depreciation Expense-Office Equip. Depreciation Expense- Warehouse Equip. Uncollectible Accounts Expense Interest Expense ADJUSTMENTS a.-b. Merchandise inventory on December 31, 2016, is $77.000. c. During 2016, the firm had net credit sales of $550,000: past experience indicates that 0.75 percent of these sales should result in uncollectible accounts. d. On December 31, 2016, an inventory of supplies showed that items costing $1.080 were on hand. e. On May 1, 2016, the firm purchased a one-year insurance policy for $4.200. f. On January 2, 2014, the firm purchased office equipment for $9400. At that time, the equipment was estimated to have a useful life of seven years and a salvage value of $475. g. On January 2, 2014, the firm purchased warehouse equipment for $25.800. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $3,000. h. On November 1, 2016, the firm issued a four-month, 10 percent note for $27,000. i. On December 31, 2016, the firm owed salaries of $12,000 that will not be paid until 2017 j. On December 31, 2016, the firm owed the employer's social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $12,000 of accrued wages