Question

Healthy Feedmills management also considers to invest in a new feed processing machines for the lalakos plant, thanks to the growing poultry feed and processed

Healthy Feedmills management also considers to invest in a new feed processing machines for the lalakos plant, thanks to the growing poultry feed and processed meat products demand from central and east Java area. Semarang plant currently operates at higher production level compare to that of the peraso plant. Considering peraso plant productivity ratio, the new machine should have bigger capacity than the one considered for peraso plant operation. The new machine costs 550.000.000 and requires installation costs of 100.000.000. The existing/old machine can be sold currently for 80.000.000 before taxes.

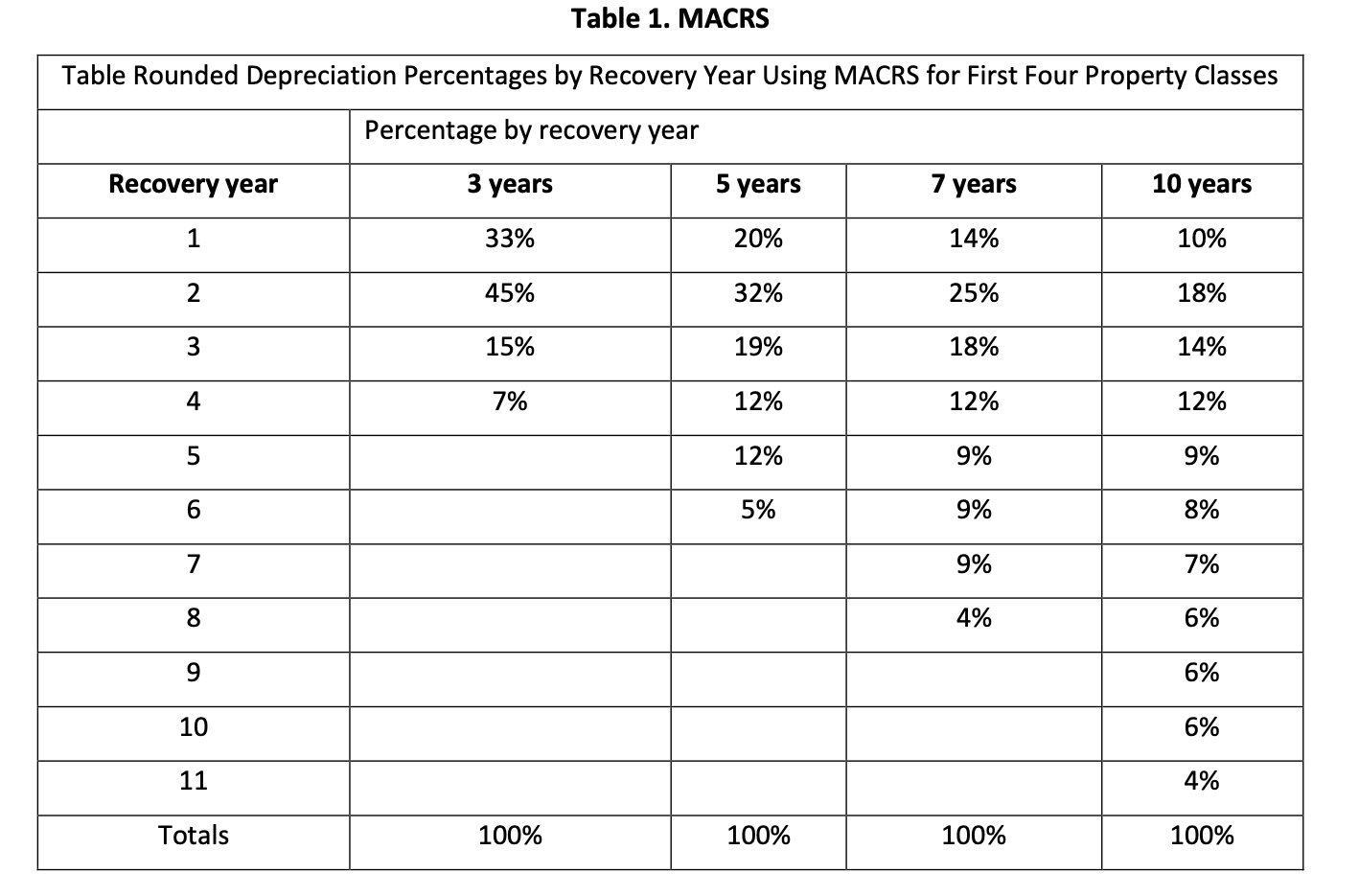

The existing feed processing machine is 2 years old, cost 280.000.000 new, and has a 150.000.000 book value and a remaining useful life of 5 years. The machine was being depreciated under MACRS (table provided), using a 5-year recovery period. Thus, it has the final 4 years of depreciation remaining. If it is held for 5 more years, the machines market value at the end of year 5 will be $0.

Over its 5-year life, the new machine would reduce the plants operating costs by 175.000.000 per year. The new machine will be depreciated under MACRS, using a 5-year recovery period. The new machine can be sold for 185.000.000 net of removal and cleanup costs at the end of 5 years. An increased investment in net working capital of 70.000.000 will be needed to support operations if the new machine is acquired. Assume that the firm has adequate operating income against which to deduct any loss experienced on the sale of the existing machine. The company has a 11% cost of capital (WACC) and is subject to a 25% tax rate.

a. Determine: (1) the initial investment required by the new feed producing machine, (2) operating

cash flows, terminal cash flow, depreciation schedules, and various capital budgeting technique (for example NPV, IRR). Based on our calculations, should the company (Healthy Feedmill) purchase the existing machine with a new one?

b.If the companys cost of capital increase by 5%, would your recommendation change? What WACC level would you change your recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started