Question

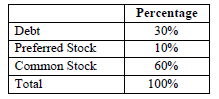

Heard Ski, Inc., is a regional manufacturer of ski equipment. The firms target financing mix appears as follows: The corporations management is currently involved in

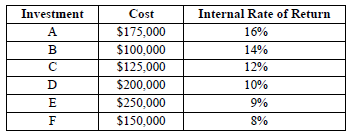

Heard Ski, Inc., is a regional manufacturer of ski equipment. The firms target financing mix appears as follows:  The corporations management is currently involved in evaluating the capital budget. Six investments are under consideration. The costs and the expected internal rates of return for these projects are given as follows:

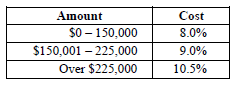

The corporations management is currently involved in evaluating the capital budget. Six investments are under consideration. The costs and the expected internal rates of return for these projects are given as follows:  As the accept-reject criterion, Paul Heard, president of the firm, has compiled the necessary data for computing the firms weighted marginal cost of capital. The cost information indicates the following: 1.Debt can be raised at the following before-tax costs:

As the accept-reject criterion, Paul Heard, president of the firm, has compiled the necessary data for computing the firms weighted marginal cost of capital. The cost information indicates the following: 1.Debt can be raised at the following before-tax costs:  2.Preferred stock can be issued paying an annual dividend of $8.50. The par value of the stock is $100. Also, the market price of the stock is $100. If new stock were issued, the company would receive a net price of $80 on the first $75,000. Thereafter, the net amount received would be reduced to $75. 3.Common equity is provided first by internally generated funds. Profits for the year that should be available for reinvestment purposes are projected at $150,000. Additional common stock can be issued at the current $72 market price less than 15 percent in flotation costs. However, if more than $225,000 in new common stock is required, a 20 percent flotation cost is expected. The dividend per share was $2.75 last year, and the long-term growth rate for dividends is 9percent. a. Given that the firms marginal tax rate is 34 percent, compute the companys weighted marginal cost of capital at a financing level up to $1 million. b. Construct a graph that presents the firms weighted marginal cost of capital relative to the amount of financing. c. What is the appropriate size of the capital budget, and which projects should be accepted?

2.Preferred stock can be issued paying an annual dividend of $8.50. The par value of the stock is $100. Also, the market price of the stock is $100. If new stock were issued, the company would receive a net price of $80 on the first $75,000. Thereafter, the net amount received would be reduced to $75. 3.Common equity is provided first by internally generated funds. Profits for the year that should be available for reinvestment purposes are projected at $150,000. Additional common stock can be issued at the current $72 market price less than 15 percent in flotation costs. However, if more than $225,000 in new common stock is required, a 20 percent flotation cost is expected. The dividend per share was $2.75 last year, and the long-term growth rate for dividends is 9percent. a. Given that the firms marginal tax rate is 34 percent, compute the companys weighted marginal cost of capital at a financing level up to $1 million. b. Construct a graph that presents the firms weighted marginal cost of capital relative to the amount of financing. c. What is the appropriate size of the capital budget, and which projects should be accepted?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started