Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding it difficult

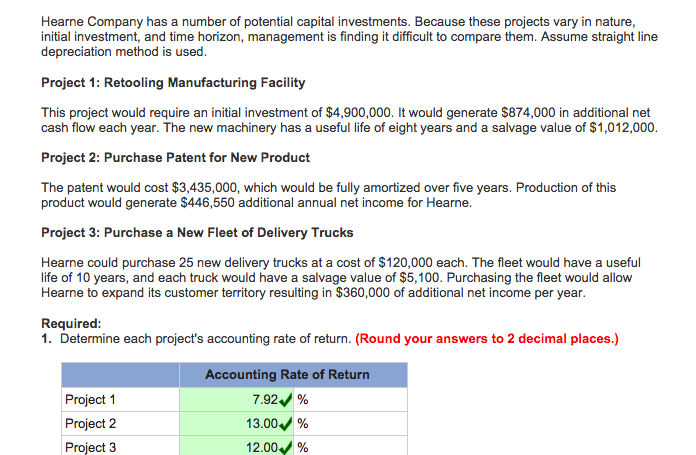

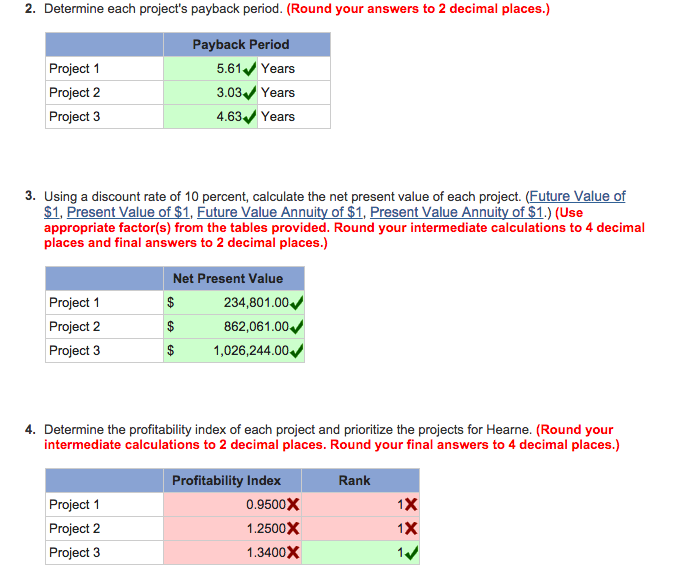

Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding it difficult to compare them. Assume straight line depreciation method is used. Project 1: Retooling Manufacturing Facility This project would require an initial investment of $4,900,000. It would generate $874,000 in additional net cash flow each year. The new machinery has a useful life of eight years and a salvage value of $1,012,000. Project 2: Purchase Patent for New Product The patent would cost $3,435,000, which would be fully amortized over five years. Production of this product would generate $446,550 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $120,000 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of $5,100. Purchasing the fleet would allow Hlearne to esgane is customer beitory reuinin $50,00 dfaa et income er year. Required: 1. Determine each project's accounting rate of return. (Round your answers to 2 decimal places.) Accounting Rate of Return Project 1 Project 2 Project 3 732 1300 12.00 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started