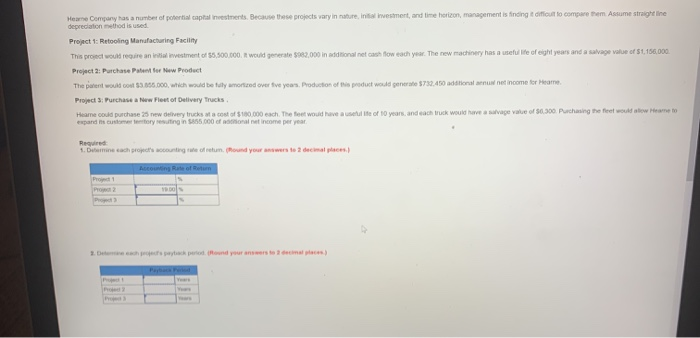

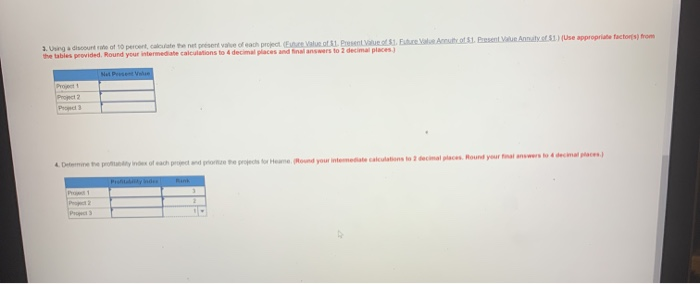

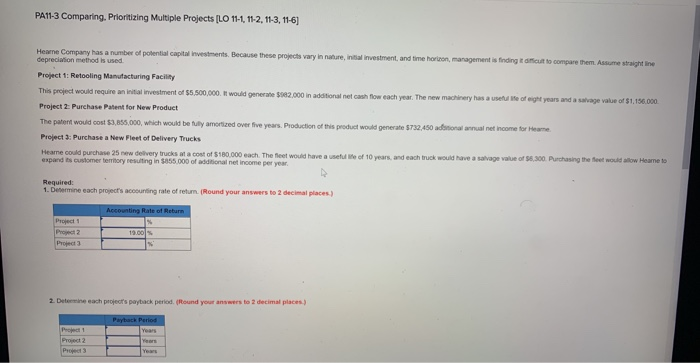

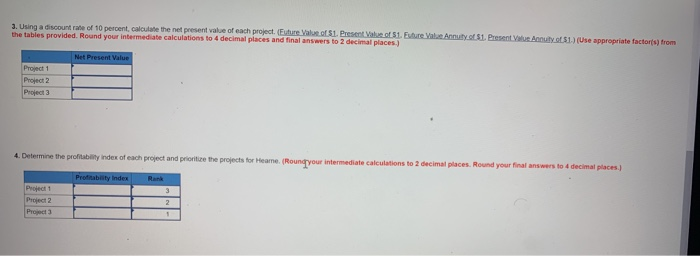

Hearne Company has a number of potential catalnestents. Because these projects vary in nature initial investment, and time horizon, management is finding tifoult to compare them Assume straight line depreciation Bethod is used Project: Retooling Manufacturing Facility This project would require an investment of $5.500.000 would generate 5982,000 in additional net cash flow each year. The new machinery has a useful life of eight years and a salvage value of $1,156,000 Project Purchase Patent for New Product The parent would com 33.000.000, which would be tudy amortized over two years Production of product would generate 5733.480 additional net income for Home Project Purchase a new Fleet of Delivery Trucks Heame could purchase 5 new delivery trucks at a cost of $100.000 each. The feet would have a useful le of 10 years, and each truck would have a salvage value of 0.300. Purchasing the feet would allow to expand its customer Sertory resulting in 5865.000 oficional e income per year Required 1. De each projects accounting to return (Mound your answers to 2 decimal places Accounting Rate of Return 3. Using a discount of 10 percent, cate the net present value of each projecte Value of 51. Present Value 51. ure Value Autot 51. Presente Anna 5) (Use appropriate factors from the tables provided. Round your intermediate calculations to & decimal places and find answers to 3 decimal places Not whe Pett Pro2 4. Depoint of each and projects for Home (ound your intermediate calculations to decimal places Hound your answers to decimals) PA11-3 Comparing. Prioritizing Multiple Projects [LO 11-1, 11-2, 11-3, 11-6] Home Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding out to compare them. Assume straight line depreciation method is used Project 1: Retooling Manufacturing Facility This project would require an initial investment of 55,500,000. It would generate $662,000 in additional net cash flow each year. The new machinery has a useful te of eight years and a salvage value of $1,190.000 Project 2: Purchase Patent for New Product The patent would cost $3,855,000, which would be fuy amortized over five years. Production of this product would generate 5732,480 adoronal annual net income for Hearne Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $100.000 each. The feet would have a use of 10 years, and each truck would have a salvage value of 56.300 Purchasing the foot would allow Heame to expand its customer territory resulting in 465.000 of additional net income per year Required: 1. Determine each project's accounting rate of return (Round your answers to 2 decimal places) Accounting Rate of Return Project Project 2 19.00 2. Det each projects payback period (found your answers to 2 decimal places) Payback Period Years Project 2 Projects Year Years 3. Using a discount rate of 10 percent, calculate the net present value of each project. (Euture Value of $1. Present Value $1. Esture Value Annuly $1. Present out of $1.) (Use appropriate factor(s) from the tables provided. Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Net Present Value Project 1 Project 2 Project 3 4. Determine the profitability index of each project and prioritize the projects for Heame. (Round your intermediate calculations to 2 decimal places. Round your final answers to decimal places. Profitability Index Rank Project 1 Project 2 Project 3 3 2 1