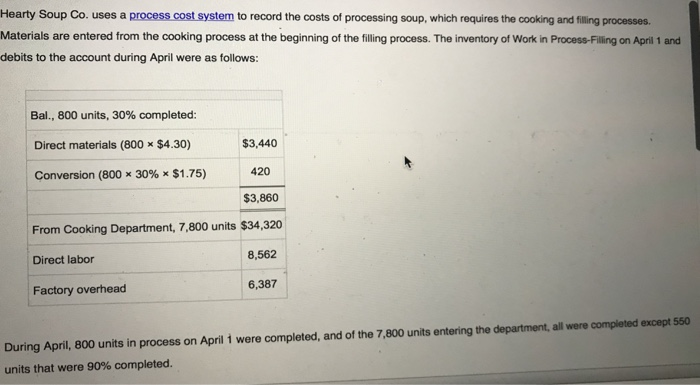

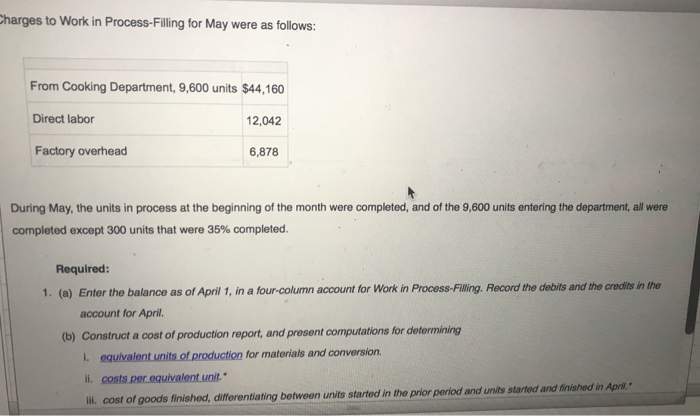

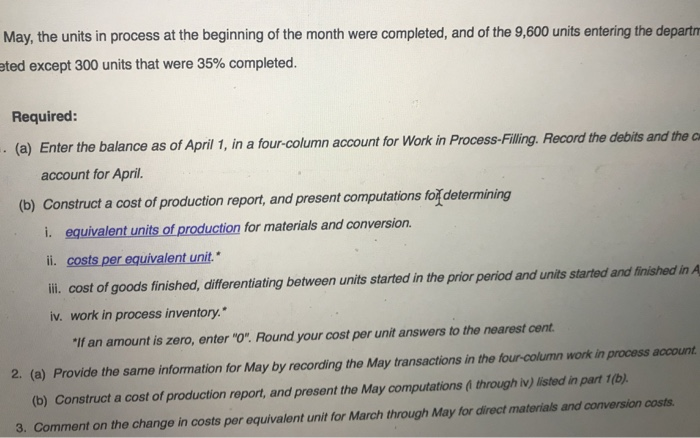

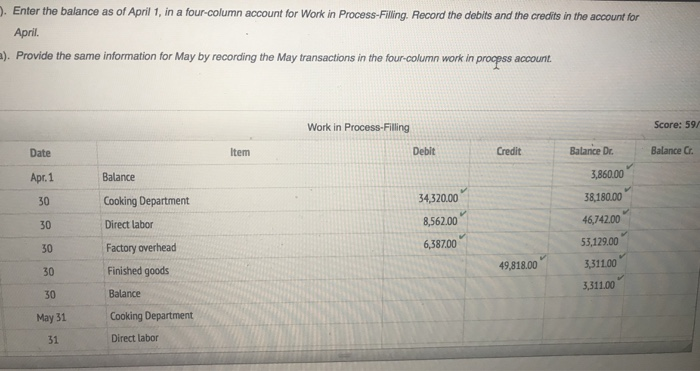

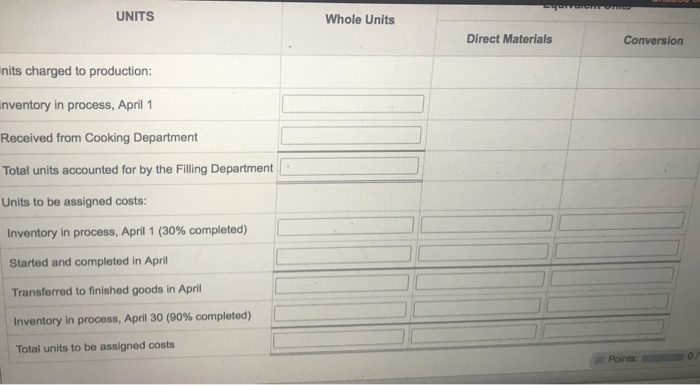

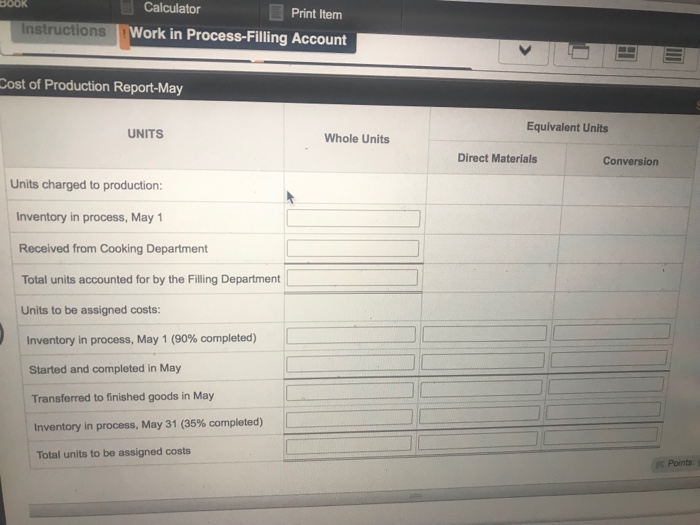

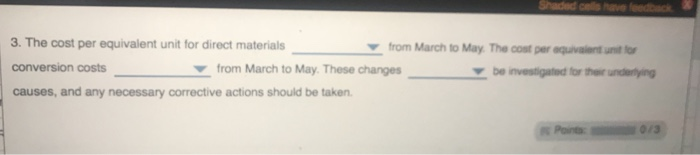

Hearty Soup Co. uses a process cost system to record the costs of processing soup, which requires the cooking and filling processes. Materials are entered from the cooking process at the beginning of the filling process. The inventory of Work in Process-Filling on April 1 and debits to the account during April were as follows: Bal., 800 units, 30% completed: Direct materials (800x $4.30) Conversion (800 30%x $1.75) $3,440 420 $3,860 From Cooking Department, 7,800 units $34,320 Direct labor Factory overhead 8,562 6,387 During April, 800 units in process on April 1 were completed, and of the 7,800 units entering the department, all were compieted except 550 units that were 90% completed. harges to Work in Process-Filling for May were as follows: From Cooking Department, 9,600 units $44,160 Direct labor Factory overhead 12,042 6,878 During May, the units in process at the beginning of the month were completed, and of the 9,600 units entering the department, all were completed except 300 units that were 35% completed. Required: 1. (a) Enter the balance as of April 1, in a four-column account for Work in Process-Filling. Record the debilis and the credits in the account for April (b) Construct a cost of production report, and present computations for determining for materials and conversion ii. costs per equivalent unit ii. cost of goods finished, differentiating between units started in the prior period and units started and inished in Apri. May, the units in process at the beginning of the month were completed, and of the 9,600 units entering the departn ted except 300 units that were 35% completed. Required: (a) Enter the balance as of April 1, in a four-column account for Work in Process-Filling. Record the debits and the c account for April. (b) Construct a cost of production report, and present computations fot determining i. equivalent units of production for materials and conversion ii. costsperequivalentunit." ili cost of goods finished, differentiating between units started in the prior period and units started and finished in A iv. work in process inventory. If an amount is zero, enter "O". Round your cost per unit answers to the nearest cent 2. (a) Provide the same information for May by recording the May transactions in the four-column work in process account (b) Construct a cost of production report, and present the May computations A through iv) listed in part 1(b) 3. Comment on the change in costs per equivalent unit for March through May for direct materials and conversion costs . Enter the balance as of April 1, in a four-column account for Work in Process-Filling. Record the debits and the credits in the account for April. ). Provide the same information for May by recording the May transactions in the four-column work in procpss account Work in Process-Filling Score: 59 Date Item Debit Credit Balanice Dr. Balance Cr. Apr. 1 30 30 30 30 30 May 31 Balance Cooking Department Direct labor Factory overhead Finished goods 34,320.00 8,562.00 6,38700 38,180.00 46,742.00 53,129.00 3,311.00 3,311.00 49,818.00 Cooking Department 31 Direct labor UNITS Whole Units Direct Materials Conversion nits charged to production: nventory in process, April 1 Received from Cooking Department Total units accounted for by the Filling Department Units to be assigned costs: Inventory in process, April 1 (30% completed) Started and completed in April Transferred to finished goods in April Inventory in process, April 30 (90% completed) Total units to be assigned costs o/ Points Calculator Print Item Instructions ork in Process-Filling Account Cost of Production Report-May Equivalent Units UNITS Whole Units Direct Materials Conversion Units charged to production: Inventory in process, May 1 Received from Cooking Department Total units accounted for by the Filling Department Units to be assigned costs: Inventory in process, May 1 (90% completed) Started and completed in May Transferred to finished goods in May Inventory in process, May 31 (35% completed) Total units to be assigned costs Points 3. The cost per equivalent unit for direct materials conversion costs causes, and any necessary corrective actions should be taken from March to May The cost per equvaient unit tor from March to May. These changes benvestigated ther unaning Points 0/3