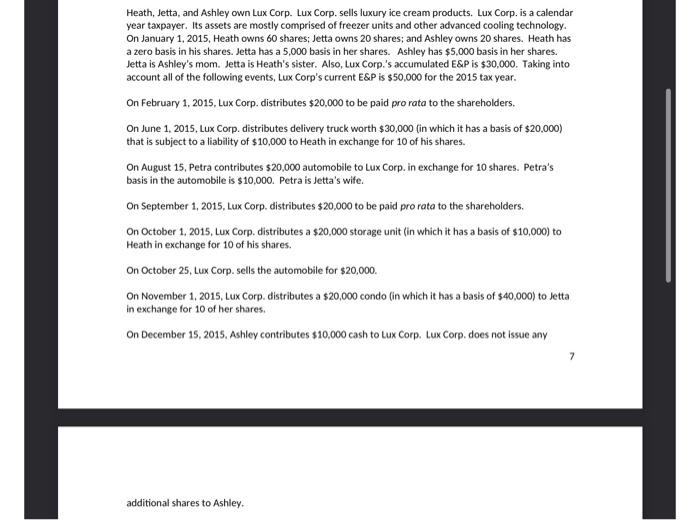

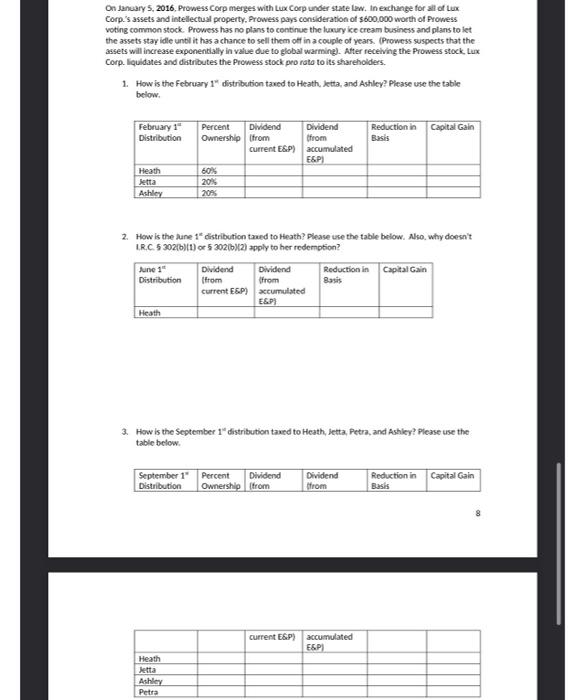

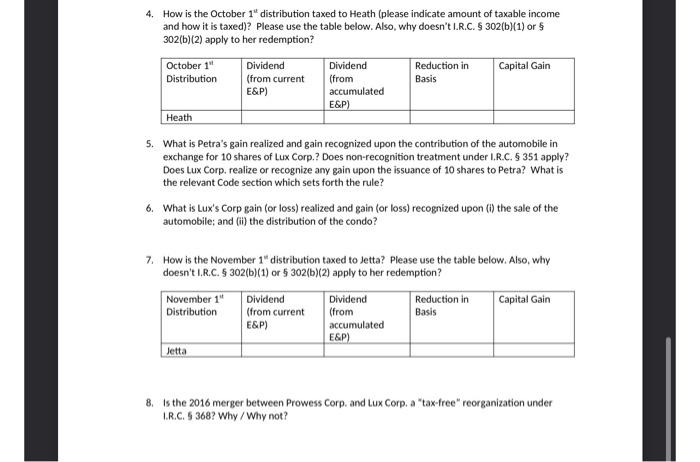

Heath, Jetta, and Ashley own Lux Corp. Lux Corp. sells luxury ice cream products. Lux Corp. is a calendar year taxpayer. Its assets are mostly comprised of freezer units and other advanced cooling technology On January 1, 2015, Heath owns 60 shares; Jetta owns 20 shares; and Ashley owns 20 shares. Heath has a zero basis in his shares. Jetta has a 5,000 basis in her shares. Ashley has $5,000 basis in her shares. Jetta is Ashley's mom. Jetta is Heath's sister. Also, Lux Corp.'s accumulated E&P is $30,000. Taking into account all of the following events, Lux Corp's current E&P is $50,000 for the 2015 tax year. On February 1, 2015, Lux Corp. distributes $20,000 to be paid pro rata to the shareholders. On June 1, 2015 Lux Corp. distributes delivery truck worth $30,000 (in which it has a basis of $20.000) that is subject to a liability of $10,000 to Heath in exchange for 10 of his shares. On August 15, Petra contributes $20,000 automobile to Lux Corp. in exchange for 10 shares. Petra's basis in the automobile is $10,000. Petra is Jetta's wife. On September 1, 2015, Lux Corp. distributes $20,000 to be paid pro rata to the shareholders. On October 1, 2015, Lux Corp, distributes a $20,000 storage unit (in which it has a basis of $10,000) to Heath in exchange for 10 of his shares. On October 25, Lux Corp. sells the automobile for $20,000 On November 1, 2015, Lux Corp. distributes a $20,000 condo in which it has a basis of $40,000) to Jetta in exchange for 10 of her shares. On December 15, 2015, Ashley contributes $10,000 cash to Lux Corp. Lux Corp. does not issue any additional shares to Ashley On January 5, 2016, Prowess Corp merges with Lux Corp under state law. In exchange for all of Lux Corp.'s assets and intellectual property. Prowess pays consideration of $600.000 worth of Prowess voting common stock. Prowess has no plans to continue the luxury ice cream business and plans to let the assets stay idle until it has a chance to sell them off in a couple of years. Prowess suspects that the assets will increase exponentially in value due to global warming). After receiving the Prowess stock. Lux Corp. liquidates and distributes the Prowess stock pro rata to its shareholders. 1. How is the February 1" distribution taxed to Heath, Jetta, and Ashley? Please use the table below. February 1" Distribution Reduction in Basis Capital Gain Percent Dividend Dividend Ownership from throm current E&P) accumulated E6P 60% 20% 208 Heath Jetta Ashley 2. How is the sune 1 distribution taned to Heath? Please use the table below. Also, why doesn't IR.C. 5 2026 (1) or 5 302012) apply to her redemption? June 19 Dividend Dividend Reduction in Capital Gain Distribution from from Basis current E5P) xccumulated EL.P) Heath 3. How is the September 1* distribution taxed to Heath, Jetta, Petra, and Ashley? Please use the table below. September 1" Percent Dividend Distribution Ownership from Dividend from Reduction in Capital Gain Basis current E&P) accumulated ESP) Heath Jetta Ashley Petra 4. How is the October 1" distribution taxed to Heath (please indicate amount of taxable income and how it is taxed)? Please use the table below. Also, why doesn't I.R.C. 9 302(b)(1) or 302(b)(2) apply to her redemption? October 1" Dividend Dividend Reduction in Capital Gain Distribution (from current (from Basis E&P) accumulated E&P) Heath 5. What is Petra's gain realized and gain recognized upon the contribution of the automobile in exchange for 10 shares of Lux Corp.? Does non-recognition treatment under 1.R.C.5 351 apply? Does Lux Corp. realize or recognize any gain upon the issuance of 10 shares to Petra? What is the relevant Code section which sets forth the rule? 6. What is Lux's Corp gain (or loss) realized and gain (or loss) recognized upon (1) the sale of the automobile; and (ii) the distribution of the condo? 7. How is the November 1" distribution taxed to Jetta? Please use the table below. Also, why doesn't I.R.C. $ 302(b)(1) or $ 302(b)(2) apply to her redemption? November 1" Dividend Dividend Reduction in Capital Gain Distribution (from current (from Basis E&P) accumulated E&P) Jetta a 8. Is the 2016 merger between Prowess Corp. and Lux Corp. a "tax-free" reorganization under LR.C. S 368? Why/Why not? Heath, Jetta, and Ashley own Lux Corp. Lux Corp. sells luxury ice cream products. Lux Corp. is a calendar year taxpayer. Its assets are mostly comprised of freezer units and other advanced cooling technology On January 1, 2015, Heath owns 60 shares; Jetta owns 20 shares; and Ashley owns 20 shares. Heath has a zero basis in his shares. Jetta has a 5,000 basis in her shares. Ashley has $5,000 basis in her shares. Jetta is Ashley's mom. Jetta is Heath's sister. Also, Lux Corp.'s accumulated E&P is $30,000. Taking into account all of the following events, Lux Corp's current E&P is $50,000 for the 2015 tax year. On February 1, 2015, Lux Corp. distributes $20,000 to be paid pro rata to the shareholders. On June 1, 2015 Lux Corp. distributes delivery truck worth $30,000 (in which it has a basis of $20.000) that is subject to a liability of $10,000 to Heath in exchange for 10 of his shares. On August 15, Petra contributes $20,000 automobile to Lux Corp. in exchange for 10 shares. Petra's basis in the automobile is $10,000. Petra is Jetta's wife. On September 1, 2015, Lux Corp. distributes $20,000 to be paid pro rata to the shareholders. On October 1, 2015, Lux Corp, distributes a $20,000 storage unit (in which it has a basis of $10,000) to Heath in exchange for 10 of his shares. On October 25, Lux Corp. sells the automobile for $20,000 On November 1, 2015, Lux Corp. distributes a $20,000 condo in which it has a basis of $40,000) to Jetta in exchange for 10 of her shares. On December 15, 2015, Ashley contributes $10,000 cash to Lux Corp. Lux Corp. does not issue any additional shares to Ashley On January 5, 2016, Prowess Corp merges with Lux Corp under state law. In exchange for all of Lux Corp.'s assets and intellectual property. Prowess pays consideration of $600.000 worth of Prowess voting common stock. Prowess has no plans to continue the luxury ice cream business and plans to let the assets stay idle until it has a chance to sell them off in a couple of years. Prowess suspects that the assets will increase exponentially in value due to global warming). After receiving the Prowess stock. Lux Corp. liquidates and distributes the Prowess stock pro rata to its shareholders. 1. How is the February 1" distribution taxed to Heath, Jetta, and Ashley? Please use the table below. February 1" Distribution Reduction in Basis Capital Gain Percent Dividend Dividend Ownership from throm current E&P) accumulated E6P 60% 20% 208 Heath Jetta Ashley 2. How is the sune 1 distribution taned to Heath? Please use the table below. Also, why doesn't IR.C. 5 2026 (1) or 5 302012) apply to her redemption? June 19 Dividend Dividend Reduction in Capital Gain Distribution from from Basis current E5P) xccumulated EL.P) Heath 3. How is the September 1* distribution taxed to Heath, Jetta, Petra, and Ashley? Please use the table below. September 1" Percent Dividend Distribution Ownership from Dividend from Reduction in Capital Gain Basis current E&P) accumulated ESP) Heath Jetta Ashley Petra 4. How is the October 1" distribution taxed to Heath (please indicate amount of taxable income and how it is taxed)? Please use the table below. Also, why doesn't I.R.C. 9 302(b)(1) or 302(b)(2) apply to her redemption? October 1" Dividend Dividend Reduction in Capital Gain Distribution (from current (from Basis E&P) accumulated E&P) Heath 5. What is Petra's gain realized and gain recognized upon the contribution of the automobile in exchange for 10 shares of Lux Corp.? Does non-recognition treatment under 1.R.C.5 351 apply? Does Lux Corp. realize or recognize any gain upon the issuance of 10 shares to Petra? What is the relevant Code section which sets forth the rule? 6. What is Lux's Corp gain (or loss) realized and gain (or loss) recognized upon (1) the sale of the automobile; and (ii) the distribution of the condo? 7. How is the November 1" distribution taxed to Jetta? Please use the table below. Also, why doesn't I.R.C. $ 302(b)(1) or $ 302(b)(2) apply to her redemption? November 1" Dividend Dividend Reduction in Capital Gain Distribution (from current (from Basis E&P) accumulated E&P) Jetta a 8. Is the 2016 merger between Prowess Corp. and Lux Corp. a "tax-free" reorganization under LR.C. S 368? Why/Why not