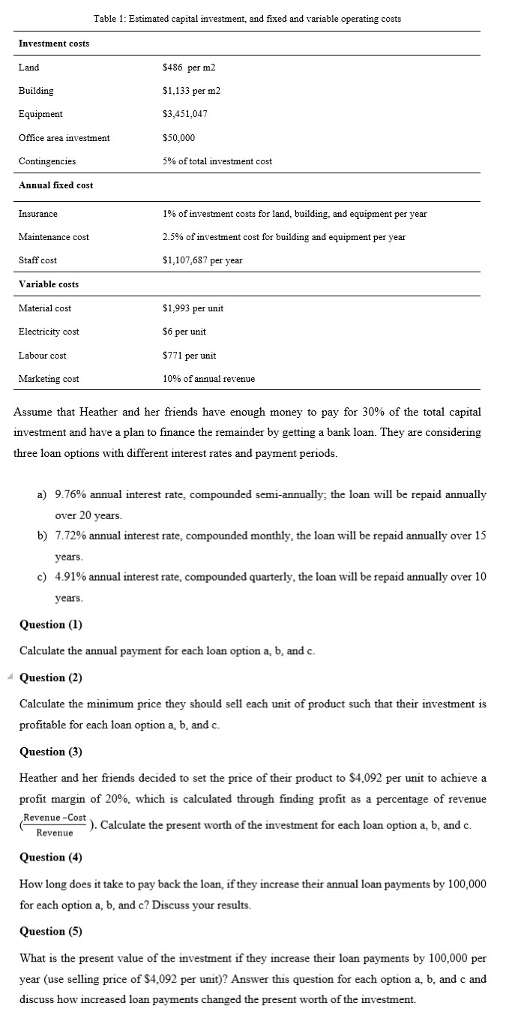

Heather and her friends are proposing to start a manufacturing company to produce high quality office desks and they are investigating the profitability of this investment. Heather and her friends use an annual interest rate of 12% for their investigation. They have gathered the financial data for a production facility with a capacity of 3,570 desk units per year and estimated that this facility will need 6,400 m2 of land and 3,525 m2 of building. Table 1 shows the financial data they have gathered for economic assessment of the project over its service life, which is 20 years.

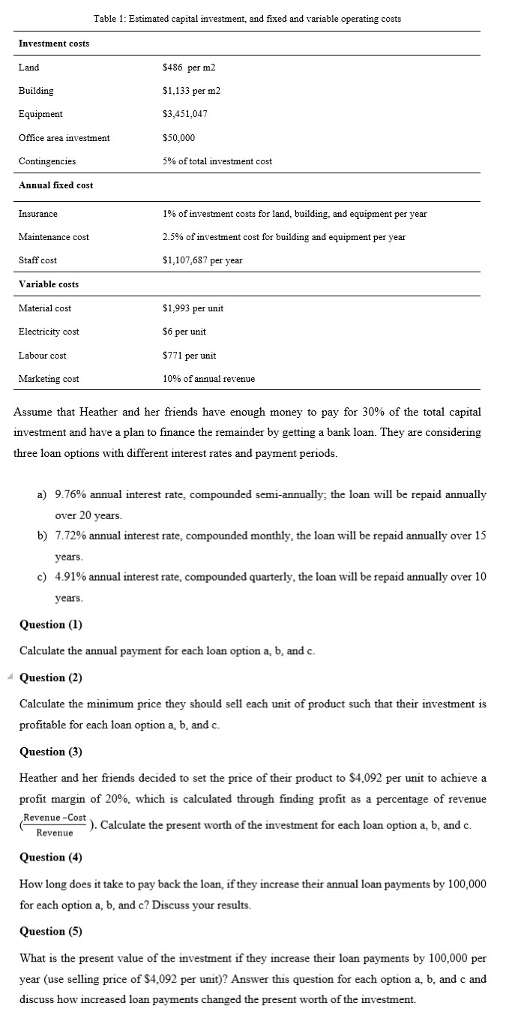

Table 1: Estimated capital ineatment, and fixed and variable operating coots Investment costs Land Building Equipment Office area investment $486 perm2 S1,133 per m2 $3,451.047 $50,000 5% of total investnent cost Annual fired cost 1% of investment costs for land, building, and equipment per year 2.5% of investment cost for building d equipment per year $1,107,637 per year Maintenance cost Staff cost Variable costs Material cost Electricity cost Labour cost Marketing coat S1,993 per unit $6 per unit $771 per unit 10% of annual revenue Assume that Heather and her friends have enough money to pay for 30% of the total capital investment and have a plan to finance the remainder by getting a bank loan. They are considering three loan options with different interest rates and payment periods. a) 9.76% annual interest rate, c semi-annually; the loan will be repaid annually over 20 years. b) 7.72% annual interest rate, c monthly, the loan will be repaid annually over 15 years c) 4.91% annual interest rate, compounded quarterly, the loan will be repaid annually over 10 years. Question (1) Calculate the annual payment for each loan option a, b, and c. Question (2) Calculate the minimum price they should sell each unit of product such that their investment is profitable for each loan option a, b, and c. Question (3) Heather and her friends decided to set the price of their product to S4,092 per un to achieve a profit margin of 20%, which is calculated through finding profit as a percentage of revenue Revenue -Cost . Calculate the present worth of the investment for each loan option a, b, and c. Revenue Question (4) How long does it take to pay back the loan, if they increase their annual loan payments by 100,000 for each option a, b, and c? Discuss your results. Question (5) What is the present value of the investment if they increase their loan payments by 100,000 per year (use selling price of $4,092 per unit)? Answer this question for each option a, b, and c and discuss how increased loan payments changed the present worth of the investment