Question

Heather McIntosh of Watertown, South Dakota, recently purchased a home for $170,000. She put $25,000 down and took out a 25-year loan at 7.5 percent

Heather McIntosh of Watertown, South Dakota, recently purchased a home for $170,000. She put $25,000 down and took out a 25-year loan at 7.5 percent interest. Round your answers to the nearest cent.

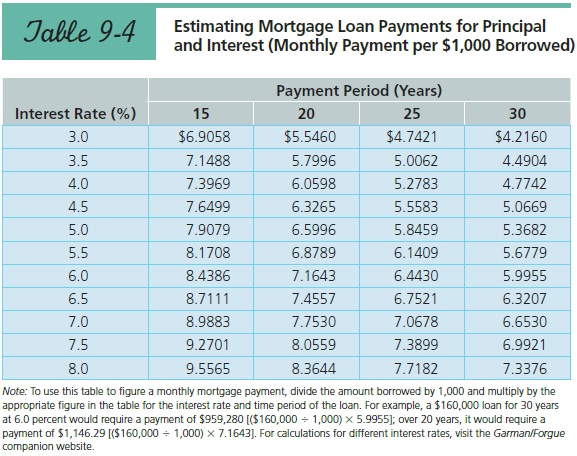

Use Table 9-4 to determine her monthly payment. Round Estimating Mortgage Loan Payments for Principal and Interest in your intermediate calculations to four decimal places.

$

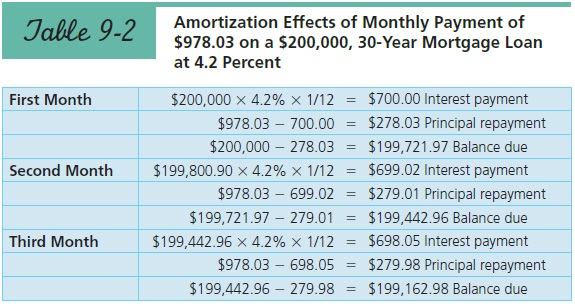

How much of her first payment will go toward interest and principal? Interest will be

$

Principal will be

$

How much will she owe after that first month? (Hint: Use the logic of Table 9-2.)

$

How much will she owe after three months? Do not round intermediate calculations. (Hint: Use the logic of Table 9-2.)

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started