Answered step by step

Verified Expert Solution

Question

1 Approved Answer

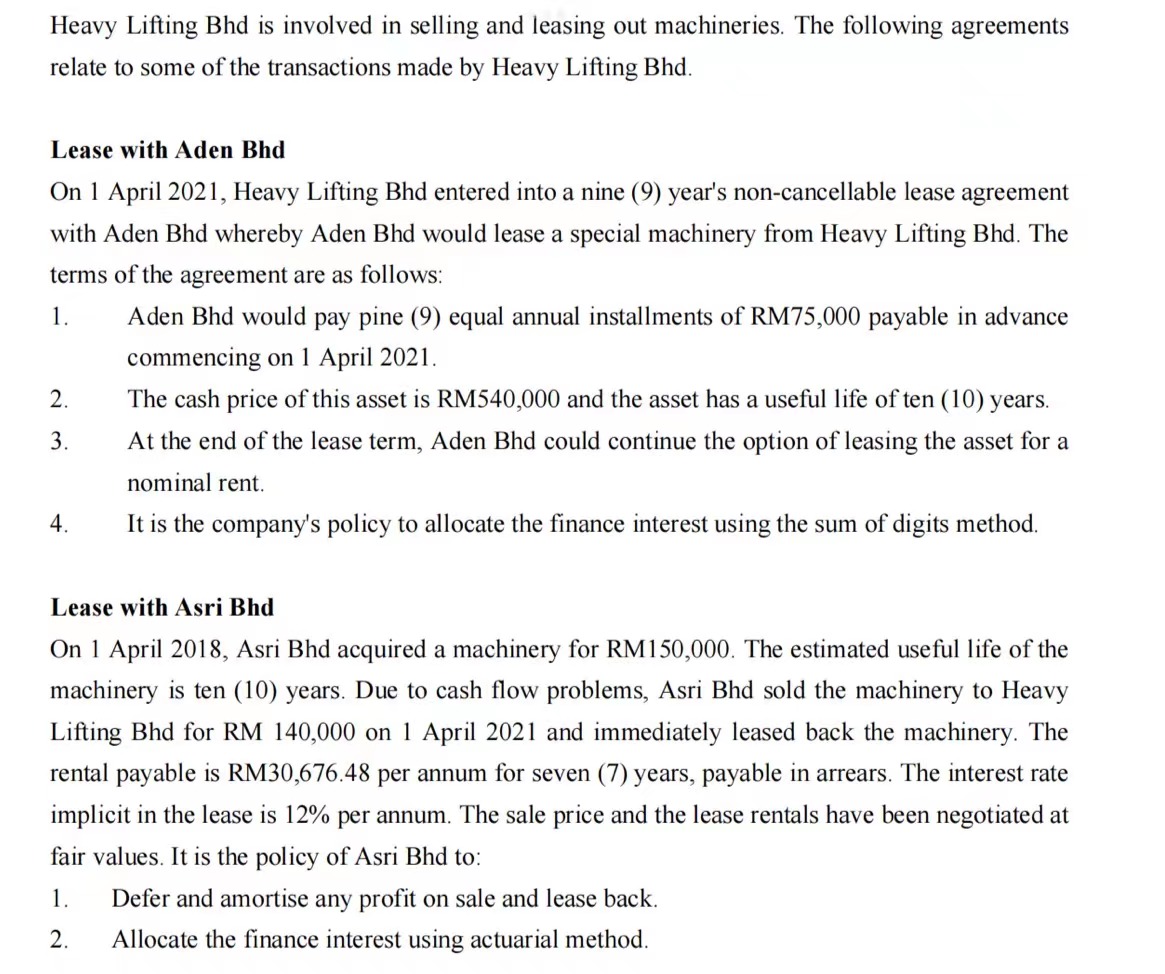

Heavy Lifting Bhd is involved in selling and leasing out machineries. The following agreements relate to some of the transactions made by Heavy Lifting Bhd.

Heavy Lifting Bhd is involved in selling and leasing out machineries. The following agreements relate to some of the transactions made by Heavy Lifting Bhd. Lease with Aden Bhd On 1 April 2021, Heavy Lifting Bhd entered into a nine (9) year's non-cancellable lease agreement with Aden Bhd whereby Aden Bhd would lease a special machinery from Heavy Lifting Bhd. The terms of the agreement are as follows: 1. Aden Bhd would pay pine (9) equal annual installments of RM75,000 payable in advance commencing on 1 April 2021. 2. The cash price of this asset is RM540,000 and the asset has a useful life of ten (10) years. 3. At the end of the lease term, Aden Bhd could continue the option of leasing the asset for a nominal rent. 4. It is the company's policy to allocate the finance interest using the sum of digits method. Lease with Asri Bhd On 1 April 2018, Asri Bhd acquired a machinery for RM150,000. The estimated useful life of the machinery is ten (10) years. Due to cash flow problems, Asri Bhd sold the machinery to Heavy Lifting Bhd for RM 140,000 on 1 April 2021 and immediately leased back the machinery. The rental payable is RM30,676.48 per annum for seven (7) years, payable in arrears. The interest rate implicit in the lease is 12% per annum. The sale price and the lease rentals have been negotiated at fair values. It is the policy of Asri Bhd to: 1. Defer and amortise any profit on sale and lease back. 2. Allocate the finance interest using actuarial method. Prepare the statement of comprehensive inome (extract) for the year ended 31 March 2022 and the statement of financial position (extract) as at that date in the books of Aden Bhd. Show the notes to the accounts in relation to the lease

Heavy Lifting Bhd is involved in selling and leasing out machineries. The following agreements relate to some of the transactions made by Heavy Lifting Bhd. Lease with Aden Bhd On 1 April 2021, Heavy Lifting Bhd entered into a nine (9) year's non-cancellable lease agreement with Aden Bhd whereby Aden Bhd would lease a special machinery from Heavy Lifting Bhd. The terms of the agreement are as follows: 1. Aden Bhd would pay pine (9) equal annual installments of RM75,000 payable in advance commencing on 1 April 2021. 2. The cash price of this asset is RM540,000 and the asset has a useful life of ten (10) years. 3. At the end of the lease term, Aden Bhd could continue the option of leasing the asset for a nominal rent. 4. It is the company's policy to allocate the finance interest using the sum of digits method. Lease with Asri Bhd On 1 April 2018, Asri Bhd acquired a machinery for RM150,000. The estimated useful life of the machinery is ten (10) years. Due to cash flow problems, Asri Bhd sold the machinery to Heavy Lifting Bhd for RM 140,000 on 1 April 2021 and immediately leased back the machinery. The rental payable is RM30,676.48 per annum for seven (7) years, payable in arrears. The interest rate implicit in the lease is 12% per annum. The sale price and the lease rentals have been negotiated at fair values. It is the policy of Asri Bhd to: 1. Defer and amortise any profit on sale and lease back. 2. Allocate the finance interest using actuarial method. Prepare the statement of comprehensive inome (extract) for the year ended 31 March 2022 and the statement of financial position (extract) as at that date in the books of Aden Bhd. Show the notes to the accounts in relation to the lease Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started