Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hector is in the 32 tax bracket. He acquired 10,000 shares of stock in Eclipse Corporation three years ago at a cost of ( $

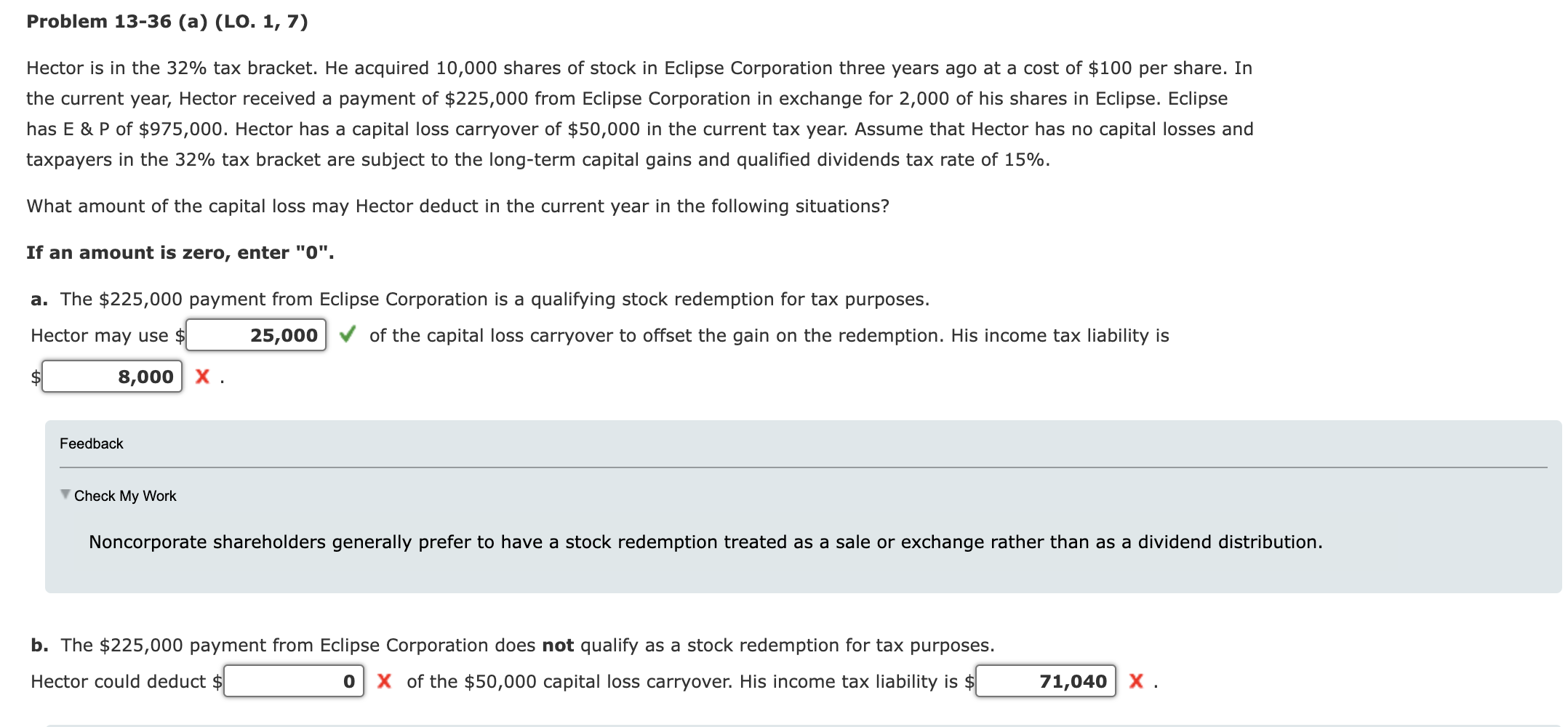

Hector is in the \32 tax bracket. He acquired 10,000 shares of stock in Eclipse Corporation three years ago at a cost of \\( \\$ 100 \\) per share. In the current year, Hector received a payment of \\( \\$ 225,000 \\) from Eclipse Corporation in exchange for 2,000 of his shares in Eclipse. Eclipse has \\( E \\& P \\) of \\( \\$ 975,000 \\). Hector has a capital loss carryover of \\( \\$ 50,000 \\) in the current tax year. Assume that Hector has no capital losses and taxpayers in the \32 tax bracket are subject to the long-term capital gains and qualified dividends tax rate of \15. What amount of the capital loss may Hector deduct in the current year in the following situations? If an amount is zero, enter \"0\". a. The \\( \\$ 225,000 \\) payment from Eclipse Corporation is a qualifying stock redemption for tax purposes. Hector may use \\( \\$ \\) of the capital loss carryover to offset the gain on the redemption. His income tax liability is \\( \\$ \\) \\( \\mathbf{X} \\). Feedback Check My Work Noncorporate shareholders generally prefer to have a stock redemption treated as a sale or exchange rather than as a dividend distribu b. The \\( \\$ 225,000 \\) payment from Eclipse Corporation does not qualify as a stock redemption for tax purposes. Hector could deduct \\( \\$ \\) \\( \\mathbf{X} \\) of the \\( \\$ 50,000 \\) capital loss carryover. His income tax liability is \\( \\$ \\) \\( \\mathbf{X} \\)

Hector is in the \32 tax bracket. He acquired 10,000 shares of stock in Eclipse Corporation three years ago at a cost of \\( \\$ 100 \\) per share. In the current year, Hector received a payment of \\( \\$ 225,000 \\) from Eclipse Corporation in exchange for 2,000 of his shares in Eclipse. Eclipse has \\( E \\& P \\) of \\( \\$ 975,000 \\). Hector has a capital loss carryover of \\( \\$ 50,000 \\) in the current tax year. Assume that Hector has no capital losses and taxpayers in the \32 tax bracket are subject to the long-term capital gains and qualified dividends tax rate of \15. What amount of the capital loss may Hector deduct in the current year in the following situations? If an amount is zero, enter \"0\". a. The \\( \\$ 225,000 \\) payment from Eclipse Corporation is a qualifying stock redemption for tax purposes. Hector may use \\( \\$ \\) of the capital loss carryover to offset the gain on the redemption. His income tax liability is \\( \\$ \\) \\( \\mathbf{X} \\). Feedback Check My Work Noncorporate shareholders generally prefer to have a stock redemption treated as a sale or exchange rather than as a dividend distribu b. The \\( \\$ 225,000 \\) payment from Eclipse Corporation does not qualify as a stock redemption for tax purposes. Hector could deduct \\( \\$ \\) \\( \\mathbf{X} \\) of the \\( \\$ 50,000 \\) capital loss carryover. His income tax liability is \\( \\$ \\) \\( \\mathbf{X} \\) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started