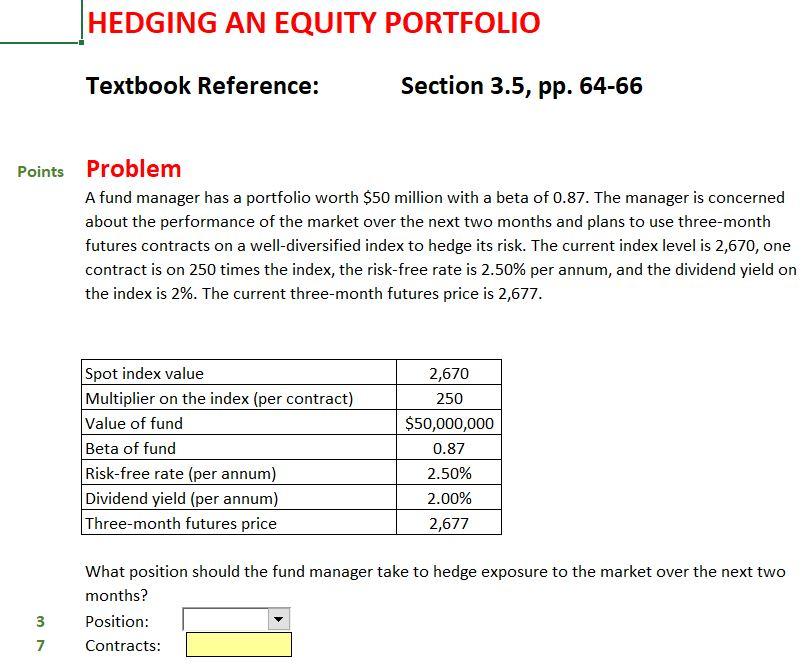

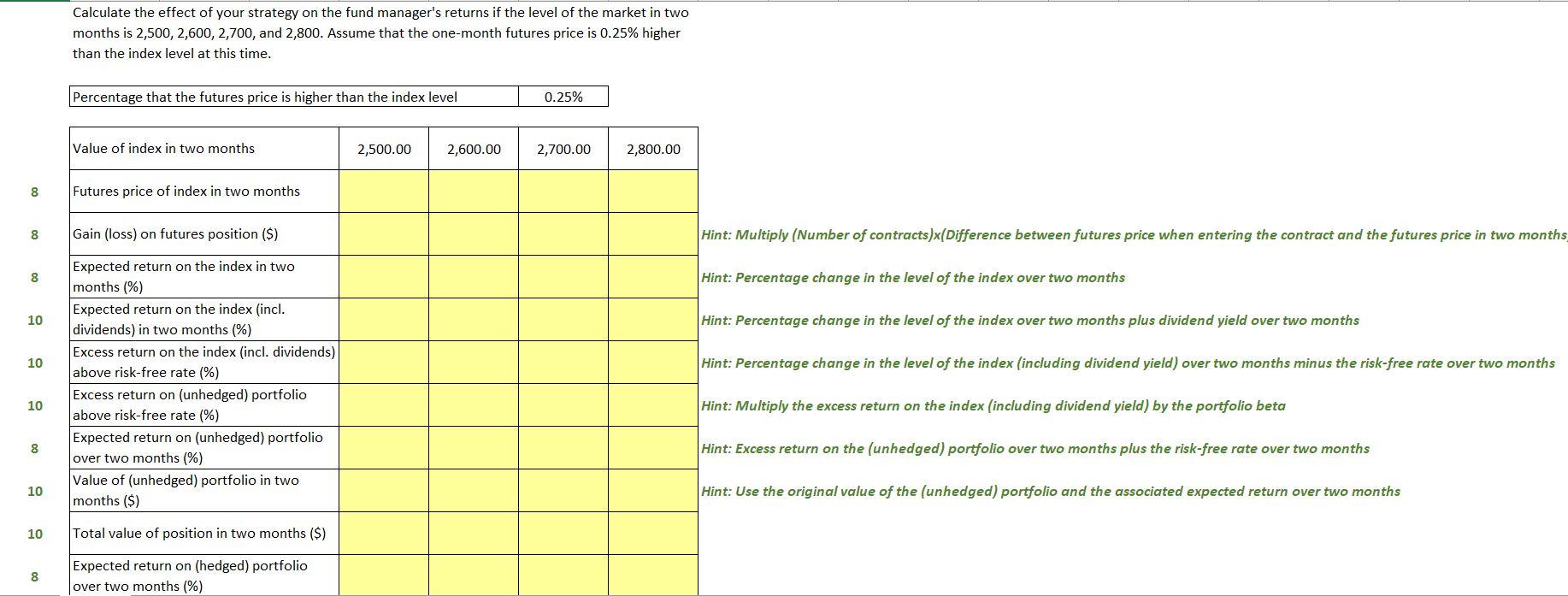

HEDGING AN EQUITY PORTFOLIO Textbook Reference: : Section 3.5, pp. 64-66 Points Problem A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures contracts on a well-diversified index to hedge its risk. The current index level is 2,670, one contract is on 250 times the index, the risk-free rate is 2.50% per annum, and the dividend yield on the index is 2%. The current three-month futures price is 2,677. Spot index value Multiplier on the index (per contract) Value of fund Beta of fund Risk-free rate (per annum) Dividend yield (per annum) Three-month futures price 2,670 250 $50,000,000 0.87 2.50% 2.00% 2,677 What position should the fund manager take to hedge exposure to the market over the next two months? Position: Contracts: 3 7 Calculate the effect of your strategy on the fund manager's returns if the level of the market in two months is 2,500, 2,600, 2,700, and 2,800. Assume that the one-month futures price is 0.25% higher than the index level at this time. Percentage that the futures price is higher than the index level 0.25% Value of index in two months 2,500.00 2,600.00 2,700.00 2,800.00 8 Futures price of index in two months 8 Gain (loss) on futures position ($) Hint: Multiply (Number of contracts)x(Difference between futures price when entering the contract and the futures price in two months 8 Hint: Percentage change in the level of the index over two months 10 Hint: Percentage change in the level of the index over two months plus dividend yield over two months 10 Hint: Percentage change in the level of the index (including dividend yield) over two months minus the risk-free rate over two months Expected return on the index in two months (%) Expected return on the index (incl. dividends) in two months (%) Excess return on the index (incl. dividends) above risk-free rate (%) Exces (unhedged) portfolio above risk-free rate (%) Expected return on (unhedged) portfolio over two months (%) Value of (unhedged) portfolio in two months ($) 10 Hint: Multiply the excess return on the index (including dividend yield) by the portfolio beta 00 Hint: Excess return on the (unhedged) portfolio over two months plus the risk-free rate over two months 10 Hint: Use the original value of the (unhedged) portfolio and the associated expected return over two months 10 Total value of position in two months ($) 8 Expected return on (hedged) portfolio over two months (%) HEDGING AN EQUITY PORTFOLIO Textbook Reference: : Section 3.5, pp. 64-66 Points Problem A fund manager has a portfolio worth $50 million with a beta of 0.87. The manager is concerned about the performance of the market over the next two months and plans to use three-month futures contracts on a well-diversified index to hedge its risk. The current index level is 2,670, one contract is on 250 times the index, the risk-free rate is 2.50% per annum, and the dividend yield on the index is 2%. The current three-month futures price is 2,677. Spot index value Multiplier on the index (per contract) Value of fund Beta of fund Risk-free rate (per annum) Dividend yield (per annum) Three-month futures price 2,670 250 $50,000,000 0.87 2.50% 2.00% 2,677 What position should the fund manager take to hedge exposure to the market over the next two months? Position: Contracts: 3 7 Calculate the effect of your strategy on the fund manager's returns if the level of the market in two months is 2,500, 2,600, 2,700, and 2,800. Assume that the one-month futures price is 0.25% higher than the index level at this time. Percentage that the futures price is higher than the index level 0.25% Value of index in two months 2,500.00 2,600.00 2,700.00 2,800.00 8 Futures price of index in two months 8 Gain (loss) on futures position ($) Hint: Multiply (Number of contracts)x(Difference between futures price when entering the contract and the futures price in two months 8 Hint: Percentage change in the level of the index over two months 10 Hint: Percentage change in the level of the index over two months plus dividend yield over two months 10 Hint: Percentage change in the level of the index (including dividend yield) over two months minus the risk-free rate over two months Expected return on the index in two months (%) Expected return on the index (incl. dividends) in two months (%) Excess return on the index (incl. dividends) above risk-free rate (%) Exces (unhedged) portfolio above risk-free rate (%) Expected return on (unhedged) portfolio over two months (%) Value of (unhedged) portfolio in two months ($) 10 Hint: Multiply the excess return on the index (including dividend yield) by the portfolio beta 00 Hint: Excess return on the (unhedged) portfolio over two months plus the risk-free rate over two months 10 Hint: Use the original value of the (unhedged) portfolio and the associated expected return over two months 10 Total value of position in two months ($) 8 Expected return on (hedged) portfolio over two months (%)