Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hedging Commodity Price Risk: Forecasted Future Transaction Finally, we consider a different kind of hedging commonly used in operations to miti- gate commodity price

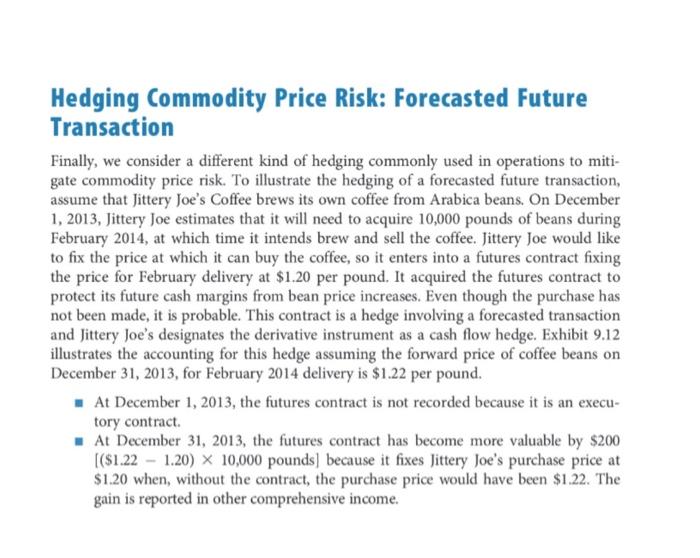

Hedging Commodity Price Risk: Forecasted Future Transaction Finally, we consider a different kind of hedging commonly used in operations to miti- gate commodity price risk. To illustrate the hedging of a forecasted future transaction, assume that Jittery Joe's Coffee brews its own coffee from Arabica beans. On December 1, 2013, Jittery Joe estimates that it will need to acquire 10,000 pounds of beans during February 2014, at which time it intends brew and sell the coffee. Jittery Joe would like to fix the price at which it can buy the coffee, so it enters into a futures contract fixing the price for February delivery at $1.20 per pound. It acquired the futures contract to protect its future cash margins from bean price increases. Even though the purchase has not been made, it is probable. This contract is a hedge involving a forecasted transaction and Jittery Joe's designates the derivative instrument as a cash flow hedge. Exhibit 9.12 illustrates the accounting for this hedge assuming the forward price of coffee beans on December 31, 2013, for February 2014 delivery is $1.22 per pound. At December 1, 2013, the futures contract is not recorded because it is an execu- tory contract. At December 31, 2013, the futures contract has become more valuable by $200 [($1.22 1.20) x 10,000 pounds] because it fixes Jittery Joe's purchase price at $1.20 when, without the contract, the purchase price would have been $1.22. The gain is reported in other comprehensive income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started