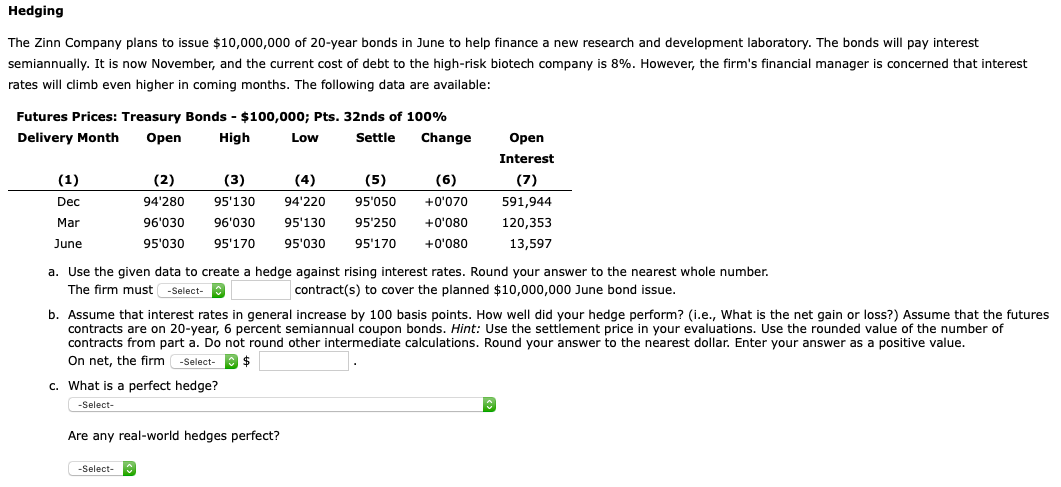

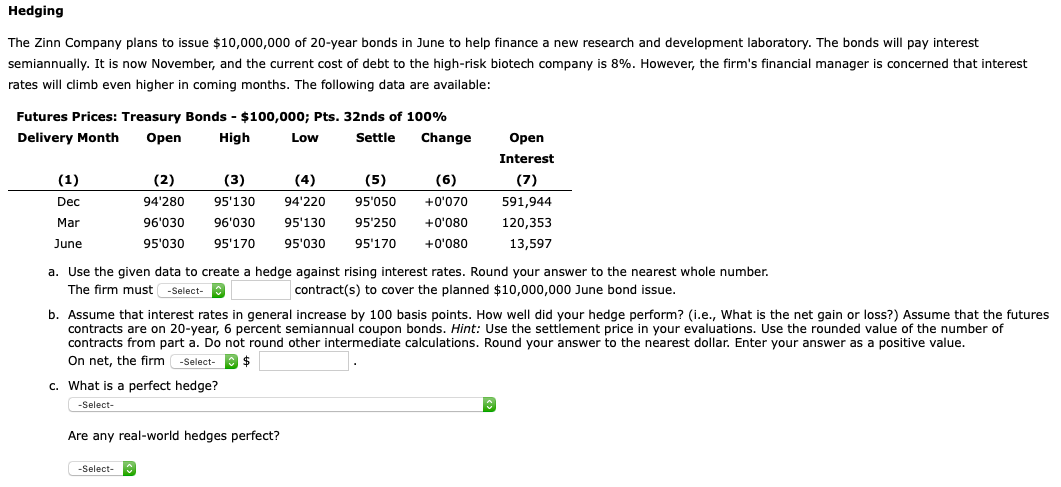

Hedging The Zinn Company plans to issue $10,000,000 of 20-year bonds in June to help finance a new research and development laboratory. The bonds will pay interest semiannually. It is now November, and the current cost of debt to the high-risk biotech company is 8%. However, the firm's financial manager is concerned that interest rates will climb even higher in coming months. The following data are available: Futures Prices: Treasury Bonds - $100,000; Pts. 32nds of 100% Delivery Month Open High Low Settle Change (1) Dec Mar (6) +0'070 (2) 94'280 96'030 95'030 (3) 95'130 96'030 95'170 Open Interest (7) 591,944 120,353 13,597 (5) 95'050 95'250 95'170 94'220 95'130 95'030 +0'080 +0'080 June a. Use the given data to create a hedge against rising interest rates. Round your answer to the nearest whole number. The firm must -Select- contract(s) to cover the planned $10,000,000 June bond issue. b. Assume that interest rates in general increase by 100 basis points. How well did your hedge perform? (i.e., What is the net gain or loss?) Assume that the futures contracts are on 20-year, 6 percent semiannual coupon bonds. Hint: Use the settlement price in your evaluations. Use the rounded value of the number of contracts from part a. Do not round other intermediate calculations. Round your answer to the nearest dollar. Enter your answer as a positive value. On net, the firm -Select- $ c. What is a perfect hedge? -Select- Are any real-world hedges perfect? -Select- Hedging The Zinn Company plans to issue $10,000,000 of 20-year bonds in June to help finance a new research and development laboratory. The bonds will pay interest semiannually. It is now November, and the current cost of debt to the high-risk biotech company is 8%. However, the firm's financial manager is concerned that interest rates will climb even higher in coming months. The following data are available: Futures Prices: Treasury Bonds - $100,000; Pts. 32nds of 100% Delivery Month Open High Low Settle Change (1) Dec Mar (6) +0'070 (2) 94'280 96'030 95'030 (3) 95'130 96'030 95'170 Open Interest (7) 591,944 120,353 13,597 (5) 95'050 95'250 95'170 94'220 95'130 95'030 +0'080 +0'080 June a. Use the given data to create a hedge against rising interest rates. Round your answer to the nearest whole number. The firm must -Select- contract(s) to cover the planned $10,000,000 June bond issue. b. Assume that interest rates in general increase by 100 basis points. How well did your hedge perform? (i.e., What is the net gain or loss?) Assume that the futures contracts are on 20-year, 6 percent semiannual coupon bonds. Hint: Use the settlement price in your evaluations. Use the rounded value of the number of contracts from part a. Do not round other intermediate calculations. Round your answer to the nearest dollar. Enter your answer as a positive value. On net, the firm -Select- $ c. What is a perfect hedge? -Select- Are any real-world hedges perfect? -Select