Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heeeelp An investor has $10000 then decides to construct the following portfolio Stock Position Price Number of shares A Long $100 750 B Long $75

Heeeelp

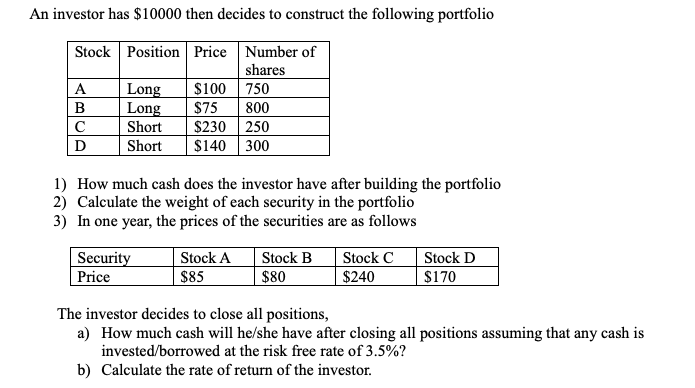

An investor has $10000 then decides to construct the following portfolio Stock Position Price Number of shares A Long $100 750 B Long $75 800 Short $230 250 D Short $140 300 1) How much cash does the investor have after building the portfolio 2) Calculate the weight of each security in the portfolio 3) In one year, the prices of the securities are as follows Security Price Stock A $85 Stock B $80 Stock C $240 Stock D $170 The investor decides to close all positions, a) How much cash will he/she have after closing all positions assuming that any cash is invested/borrowed at the risk free rate of 3.5%? b) Calculate the rate of return of the investorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started