Answered step by step

Verified Expert Solution

Question

1 Approved Answer

heeelp Cost of Goods Sold is typically the single cost of merchandise companies, and comprises the value of merchandise which generated revenue in a period.

heeelp

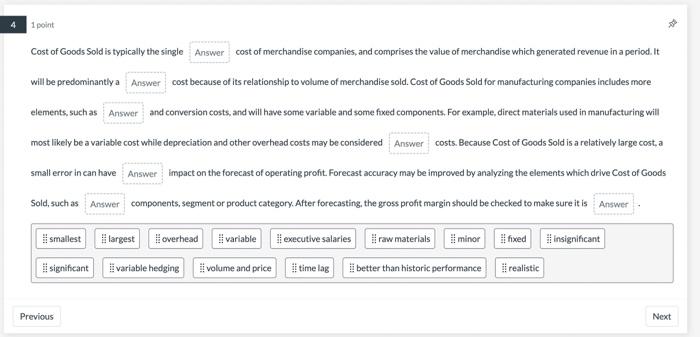

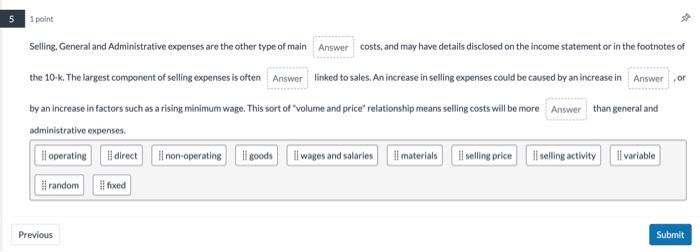

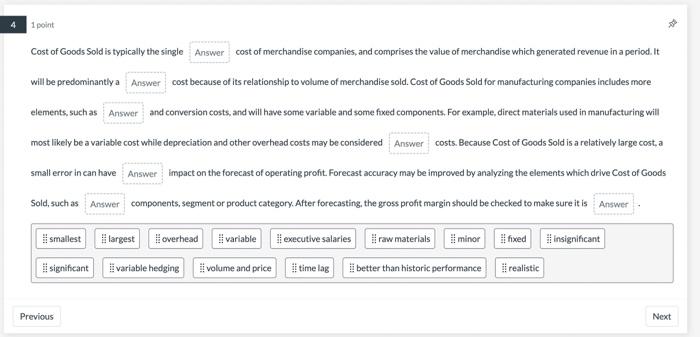

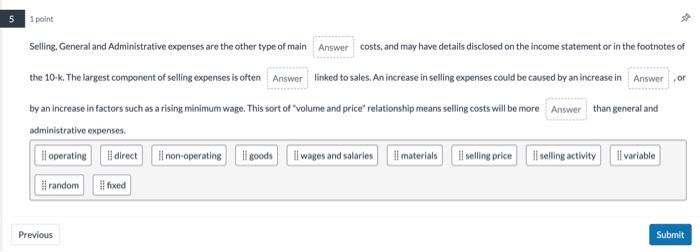

Cost of Goods Sold is typically the single cost of merchandise companies, and comprises the value of merchandise which generated revenue in a period. It will be predominantly a cost because of its relationship to volume of merchandise sold. Cost of Goods Sold for manufacturing companies includes more elements, suchas and conversion costs, and will have some variable and some foxed components. For example, direct materials used in manufacturing will most likely be a variable cost while depreciation and other overhead costs may be considered costs. Because Cost of Goods Sold is a relatively large cost, a small error in can have impact on the forecast of operating profit. Forecast accuracy may be improved by analyzing the elements which drive Cost of Goods Sold, such as components, segment or product category. After forecasting, the gross profit margin should be checked to make sure it is Selling, General and Administrative expenses are the other type of main costs, and may have details disclosed on the income statement or in the footnotes of the 10k. The largest component of selling expenses is often linked to sales. An increase in selling expenses could be caused by an increase in , or by an increase in factors such as a rising minimum wage. This sort of "volume and price" relationship means selling costs will be more than general and administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started