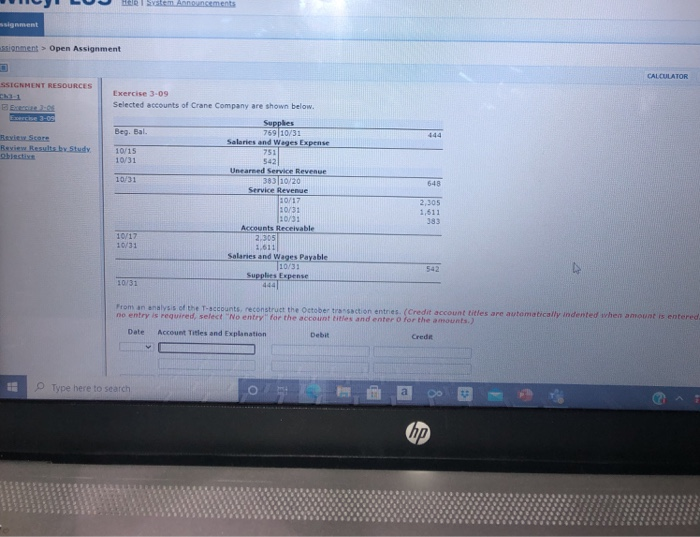

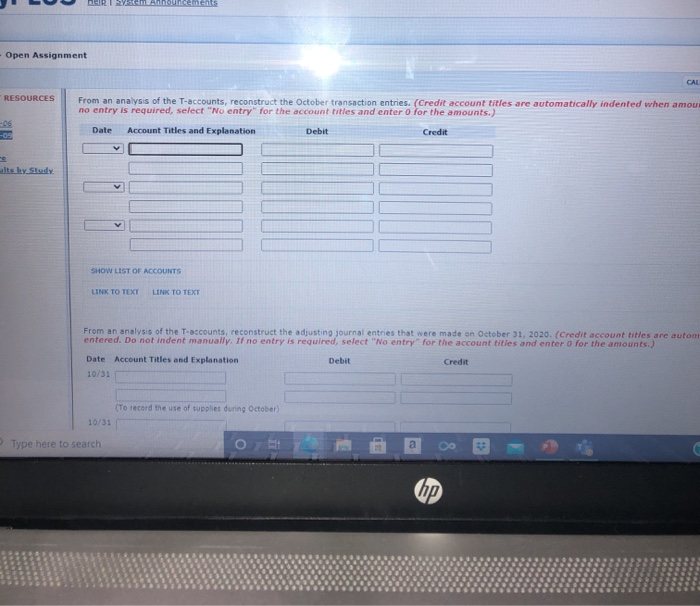

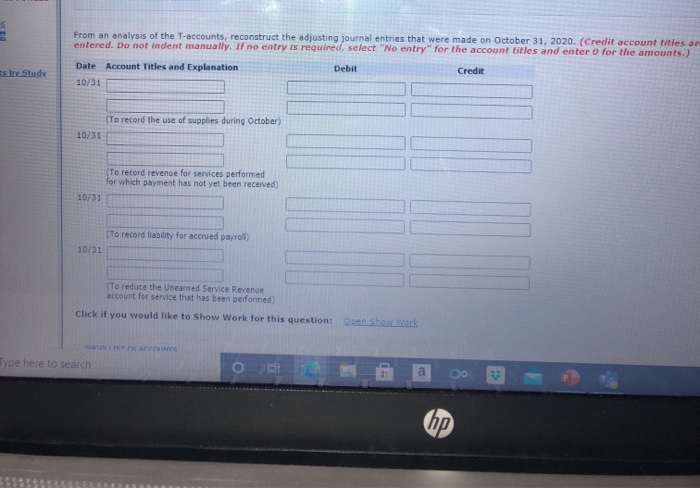

Hele System Announcements ssignment assignment > Open Assignment CALCULATOR SSIGNMENT RESOURCES Beg. Bal. 444 Review Score Review Results by Study Obiective 648 Exercise 3-09 Selected accounts of Crane Company are shown below. Supplies 769 10/31 Salaries and Wages Expense 10/15 751 10/31 542 Unearned Service Revenue 10/31 383 10/20 Service Revenue 10/17 10/31 10/31 Accounts Receivable 10/17 2.305 10/31 1.611 Salaries and Wages Payable 10/30 Supplies Expense 10/31 444 2,305 1,511 383 542 From an analysis of the accounts reconstruct the October transaction entries. (Credit account titles are automatically indented when amount is entered. no entry is required, select "No entry for the accountitles and enterolor the amounts) Date Account Titles and Explanation Debit Crede Type here to search a BIR 2C Announcements Open Assignment CAL RESOURCES From an analysis of the T-accounts, reconstruct the October transaction entries. (Credit account titles are automatically indented when amous no entry is required, select "No entry for the account titles and enter o for the amounts.) -OS Date Account Titles and Explanation Debit Credit alts by Study SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT From an analysis of the T-accounts, reconstruct the adjusting journal entries that were made on October 31, 2020. (Credit account titles are autom entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 10/31 (To record the use of supplies during October 10/31 Type here to search OG a From an analysis of the T-accounts, reconstruct the adjusting journal entries that were made on October 31, 2020. (Credit account ttles ar entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) ts by Study Date Account Titles and Explanation 10/31 Debit Credit (To record the use of supplies during October) 10/31 (To record revenue for services performed for which payment has not yet been received) 10/31 (To record liability for accrued payroll) 10/31 (To reduce the Uneamed Service Revenue account for service that has been performed) Click if you would like to Show Work for this question: Open Show Work Type here to search a hp