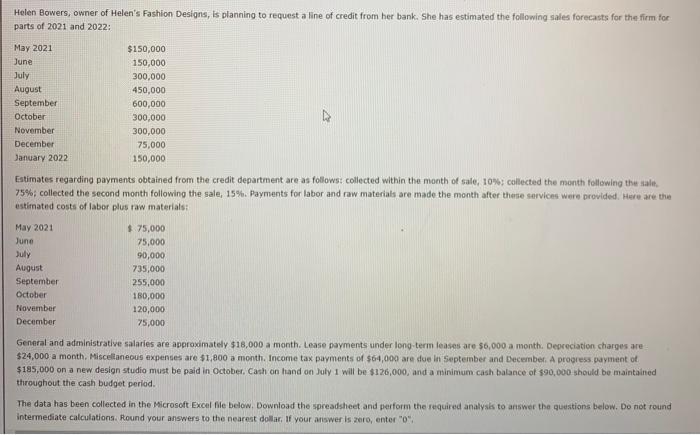

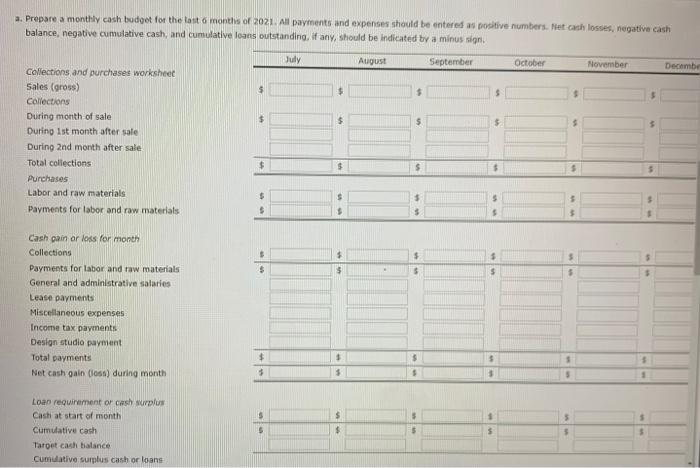

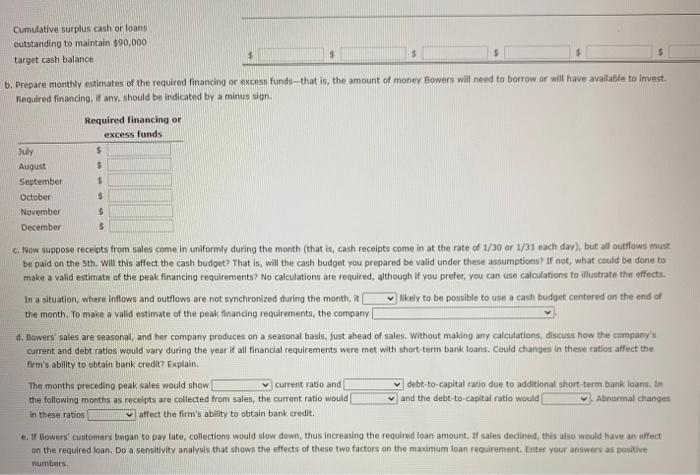

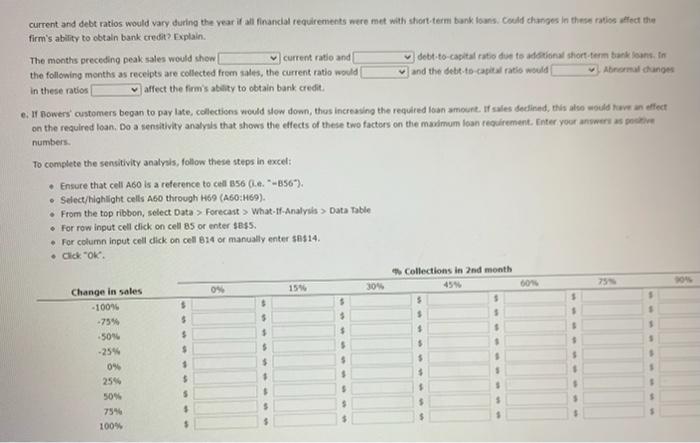

Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the flem for parts of 2021 and 2022: May 2021 June July August September October November December January 2022 $150,000 150,000 300,000 450,000 600,000 300,000 300,000 75,000 150,000 Estimates regarding payments obtained from the credit department are as follows collected within the month of sale, 10%: collected the month following the sale, 75% collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2021 June July August September October November December $ 75,000 75,000 90,000 735,000 255,000 180,000 120,000 75,000 General and administrative salaries are approximately $18,000 a month. Lease payments under long term leases are $6,000 a month. Depreciation charges are $24,000 a month. Miscellaneous expenses are $1,800 a month. Income tax payments of $64,000 are due in September and December. A progress payment of $185,000 on a new design studio must be paid in October, Cash on hand on July 1 will be $126,000, and a minimum cash balance of $90,000 should be maintained throughout the cash budget period. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to the nearest dollar. If your answer is 2010, enter"0" a. Prepare a monthly cash budget for the last 6 months of 2021. All payments and expenses should be entered as positive numbers. Net cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, if any, should be indicated by a minus sign July August September October November Decembe $ $ $ Collections and purchases worksheet Sales (gros) Collections During month of sale During ist month after sale During and month after sale Total collections Purchases Labor and raw materials Payments for labor and raw materials $ $ $ $ $ $ $ $ $ $ $ $ 5 $ $ $ $ $ Cash gain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (s) during month $ $ $ 5 3 5 3 5 S Loan requirement or cash surplus Cashi at start of month Cumulative cash Target cash balance Cumulative surplus cash or loans $ $ Cumulative surplus cash or loans outstanding to maintain $90,000 target cash balance $ b. Prepare monthly estimates of the required financing or excess funds that is, the amount of money Bowers will need to borrow or will have available to invest. Required financing, if any, should be indicated by a minus sign $ $ $ $ $ Required financing or excess funds Buly $ August September October November December 6. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 or 1/31 each day), but will outflows must be paid on the Sth. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although If you prefer, you can use calculations to illustrate the effects. a In a situation, where inflows and outflows are not synchronized during the month, it kely to be possible to use a cash budget centered on the end of the month. To make a valid estimate of the peak financing requirements, the company d. Bowers' sales are seasonal and her company produces on a seasonal basis, Just ahead of sales. Without making any calculations, discuss how the company's current and debt ratios would vary during the vear if all financial requirements were met with short term bank loans. Could changes in these ratios affect the firm's ability to obtain bank credit? Explain. The months preceding peak sales would show current ratio and debt-to-capital ratio due to additional short-term bank loans. In the following months as receipts are collected from sales, the current ratio would and the debt-to-capital ratio would Abrormal changes In these ratios vaffect the firm's ability to obtain bank credit. . 1 Bowers customers began to pay tate, collections would low down, thus increasing the required loan amount. If sales declined, this also would have an affect on the required loan. Do a sensitivity analysis that shows the effects of these two factors on the mandmum loan requirement. Enter your answers as positive numbers, current and debt ratios would vary during the year ifall financial requirements were met with short term bank loans. Could changes in these ratios alted the firm's ability to obtain bank credit? Explain. The months preceding peak sales would show ] current ratio and debt-to-capital ratio due todotional short term bankans. In the following months as receipts are collected from sales, the current ratio would and the debt-to-capital ratio would Abnormal changes in these ratios affect the firm's ability to obtain bank credit e. Il Bowers customers began to pay late, collections would stow down, thus increasing the required loan amount of sales dediad, this also would have an effect on the required loan. Doa sensitivity analysis that shows the effects of these two factors on the maximum loan requirement. Enter your answers numbers To complete the sensitivity analysis, follow these steps in excel: Ensure that cell A60 is a reference to call 856 (.e. --B56"). Select/highlight cells A60 through HGO (A60:H69). . From the top ribbon, select Data > Forecast > What-If-Analysis > Data Table Forrow input cell click on cell 85 or enter $B$5. For column input cell click on cell 874 or manually enter $0$14. . Click "OK. Collections in and month 75% 604 04 155 09 30 $ $ $ $ $ $ $ $ $ $ $ 5 $ $ $ $ $ 1 $ Change in sales -100% -75% -50% -25% 0% 254 50% 754 100% $ $ $ $ $ . . $ $ 1 $ $ 5 $ $ 5 5 $ $ Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the flem for parts of 2021 and 2022: May 2021 June July August September October November December January 2022 $150,000 150,000 300,000 450,000 600,000 300,000 300,000 75,000 150,000 Estimates regarding payments obtained from the credit department are as follows collected within the month of sale, 10%: collected the month following the sale, 75% collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2021 June July August September October November December $ 75,000 75,000 90,000 735,000 255,000 180,000 120,000 75,000 General and administrative salaries are approximately $18,000 a month. Lease payments under long term leases are $6,000 a month. Depreciation charges are $24,000 a month. Miscellaneous expenses are $1,800 a month. Income tax payments of $64,000 are due in September and December. A progress payment of $185,000 on a new design studio must be paid in October, Cash on hand on July 1 will be $126,000, and a minimum cash balance of $90,000 should be maintained throughout the cash budget period. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to the nearest dollar. If your answer is 2010, enter"0" a. Prepare a monthly cash budget for the last 6 months of 2021. All payments and expenses should be entered as positive numbers. Net cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, if any, should be indicated by a minus sign July August September October November Decembe $ $ $ Collections and purchases worksheet Sales (gros) Collections During month of sale During ist month after sale During and month after sale Total collections Purchases Labor and raw materials Payments for labor and raw materials $ $ $ $ $ $ $ $ $ $ $ $ 5 $ $ $ $ $ Cash gain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (s) during month $ $ $ 5 3 5 3 5 S Loan requirement or cash surplus Cashi at start of month Cumulative cash Target cash balance Cumulative surplus cash or loans $ $ Cumulative surplus cash or loans outstanding to maintain $90,000 target cash balance $ b. Prepare monthly estimates of the required financing or excess funds that is, the amount of money Bowers will need to borrow or will have available to invest. Required financing, if any, should be indicated by a minus sign $ $ $ $ $ Required financing or excess funds Buly $ August September October November December 6. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 or 1/31 each day), but will outflows must be paid on the Sth. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although If you prefer, you can use calculations to illustrate the effects. a In a situation, where inflows and outflows are not synchronized during the month, it kely to be possible to use a cash budget centered on the end of the month. To make a valid estimate of the peak financing requirements, the company d. Bowers' sales are seasonal and her company produces on a seasonal basis, Just ahead of sales. Without making any calculations, discuss how the company's current and debt ratios would vary during the vear if all financial requirements were met with short term bank loans. Could changes in these ratios affect the firm's ability to obtain bank credit? Explain. The months preceding peak sales would show current ratio and debt-to-capital ratio due to additional short-term bank loans. In the following months as receipts are collected from sales, the current ratio would and the debt-to-capital ratio would Abrormal changes In these ratios vaffect the firm's ability to obtain bank credit. . 1 Bowers customers began to pay tate, collections would low down, thus increasing the required loan amount. If sales declined, this also would have an affect on the required loan. Do a sensitivity analysis that shows the effects of these two factors on the mandmum loan requirement. Enter your answers as positive numbers, current and debt ratios would vary during the year ifall financial requirements were met with short term bank loans. Could changes in these ratios alted the firm's ability to obtain bank credit? Explain. The months preceding peak sales would show ] current ratio and debt-to-capital ratio due todotional short term bankans. In the following months as receipts are collected from sales, the current ratio would and the debt-to-capital ratio would Abnormal changes in these ratios affect the firm's ability to obtain bank credit e. Il Bowers customers began to pay late, collections would stow down, thus increasing the required loan amount of sales dediad, this also would have an effect on the required loan. Doa sensitivity analysis that shows the effects of these two factors on the maximum loan requirement. Enter your answers numbers To complete the sensitivity analysis, follow these steps in excel: Ensure that cell A60 is a reference to call 856 (.e. --B56"). Select/highlight cells A60 through HGO (A60:H69). . From the top ribbon, select Data > Forecast > What-If-Analysis > Data Table Forrow input cell click on cell 85 or enter $B$5. For column input cell click on cell 874 or manually enter $0$14. . Click "OK. Collections in and month 75% 604 04 155 09 30 $ $ $ $ $ $ $ $ $ $ $ 5 $ $ $ $ $ 1 $ Change in sales -100% -75% -50% -25% 0% 254 50% 754 100% $ $ $ $ $ . . $ $ 1 $ $ 5 $ $ 5 5 $ $