Answered step by step

Verified Expert Solution

Question

1 Approved Answer

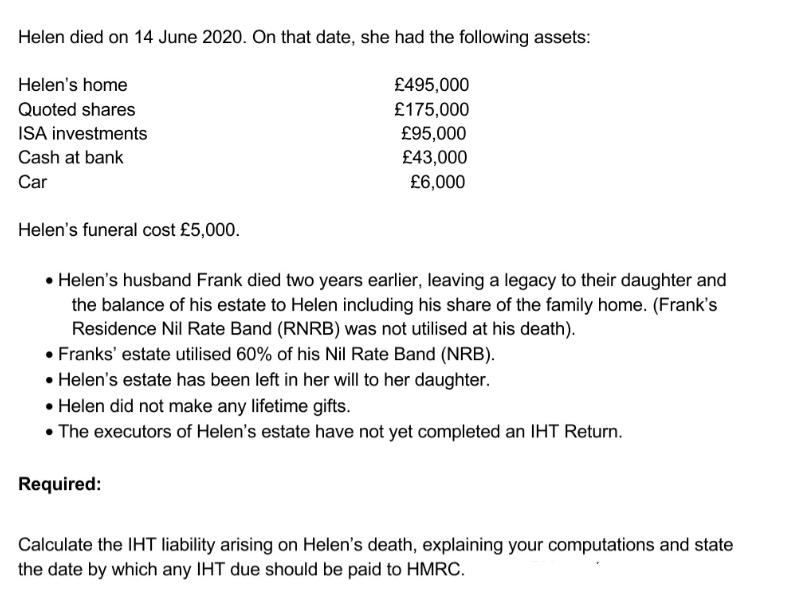

Helen died on 14 June 2020. On that date, she had the following assets: Helen's home Quoted shares ISA investments Cash at bank Car

Helen died on 14 June 2020. On that date, she had the following assets: Helen's home Quoted shares ISA investments Cash at bank Car Helen's funeral cost 5,000. 495,000 175,000 95,000 43,000 6,000 Helen's husband Frank died two years earlier, leaving a legacy to their daughter and the balance of his estate to Helen including his share of the family home. (Frank's Residence Nil Rate Band (RNRB) was not utilised at his death). Franks' estate utilised 60% of his Nil Rate Band (NRB). Helen's estate has been left in her will to her daughter. Helen did not make any lifetime gifts. The executors of Helen's estate have not yet completed an IHT Return. Required: Calculate the IHT liability arising on Helen's death, explaining your computations and state the date by which any IHT due should be paid to HMRC.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the Inheritance Tax IHT liability arising on Helens death Calculate the Estate Value Helen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started