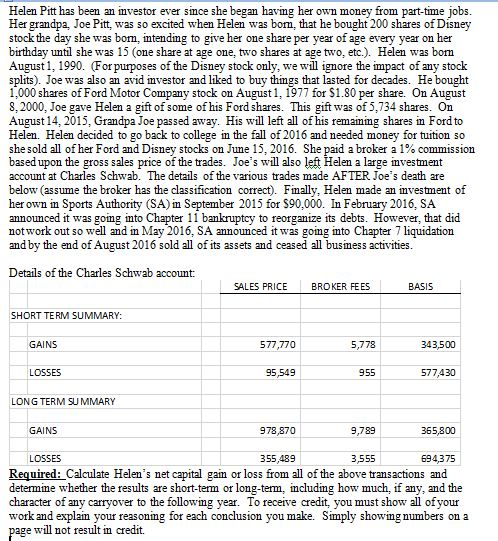

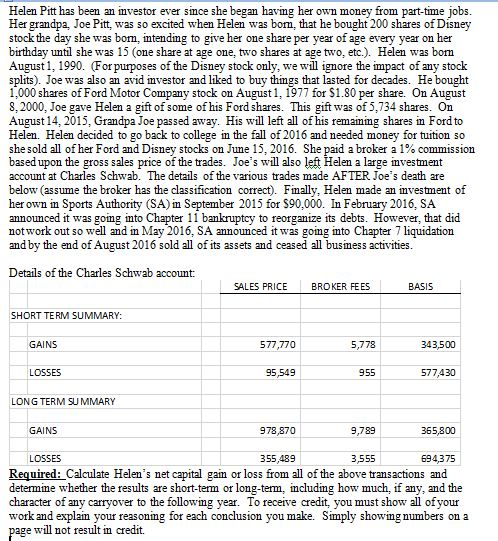

Helen Pitt has been an investor ever since she began havng her own money from part-time jobs Her grandpa, Joe Pitt, was so excited when Helen was bom, that he bought 200 shares of Disney stock the day she was bom, imtendimg to give her one share per year of age every year on her birthday untl she was 15 (one share at age one, two shares at age two, etc.). Helen was borm August1, 1990. (Forpurposes of the Disney stock only, we will ignore the impact of any stock splits). Joe was also an avid imvestor and liked to buy thimgs that lasted for decades. He bought 1,000 shares of Ford Motor Company stock on August 1, 1977 for S1.80 per share. On August 8, 2000, Joe gave Helen a gift of some of his Ford shares. This gift was of 5,734 shares. On August 14, 2015, Grandpa Joe passed away. His will left all of his remainng shares in Ford to Helen. Helen decided to go back to college in the fall of 2016 and needed money for tuition so she sold all of her Ford and Disney stocks on June 15, 2016. She paid a broker a 1% commission based upon the gross sales price of the trades. Joe's will also left Helen a large investment account at Charles Schwab. The details of the various trades made AF TER Joe's death are below (assume the broker has the classification correct). Fimally, Helen made an investment of her own in Sports Authority (SA) n September 2015 for S90,000. In February 2016, SA announced it was goimg imto Chapter 11 bankruptey to reorganize its debts. However, that did notwork out so well and in May 2016, SA annoumced it was going into Chapter 7 liquidation and by the end of August 2016 sold all of its assets and ceased all busmess activities Details of the Charles Schwab account: SALES PRICE BROKER FEES BASIS SHORT TERM SUMMARY GAINS 577,770 5,778 343,500 LOSSES 95,549 955 577,430 LONG TERM SU MMARY GAINS 978,870 9,789 365800 LOSSES 355,489 3,555 694,375 Required: Calculate Helen's net capital gan or loss from all of the above transactions and determine whether the results are short-term or long-term, includimg how much, if any, and the character of any carryover to the following year. To receive credit, you must show all ofyour work and explam your reasoning for each conclusion you make. Simply showing numbers on a age will not result im credit. Helen Pitt has been an investor ever since she began havng her own money from part-time jobs Her grandpa, Joe Pitt, was so excited when Helen was bom, that he bought 200 shares of Disney stock the day she was bom, imtendimg to give her one share per year of age every year on her birthday untl she was 15 (one share at age one, two shares at age two, etc.). Helen was borm August1, 1990. (Forpurposes of the Disney stock only, we will ignore the impact of any stock splits). Joe was also an avid imvestor and liked to buy thimgs that lasted for decades. He bought 1,000 shares of Ford Motor Company stock on August 1, 1977 for S1.80 per share. On August 8, 2000, Joe gave Helen a gift of some of his Ford shares. This gift was of 5,734 shares. On August 14, 2015, Grandpa Joe passed away. His will left all of his remainng shares in Ford to Helen. Helen decided to go back to college in the fall of 2016 and needed money for tuition so she sold all of her Ford and Disney stocks on June 15, 2016. She paid a broker a 1% commission based upon the gross sales price of the trades. Joe's will also left Helen a large investment account at Charles Schwab. The details of the various trades made AF TER Joe's death are below (assume the broker has the classification correct). Fimally, Helen made an investment of her own in Sports Authority (SA) n September 2015 for S90,000. In February 2016, SA announced it was goimg imto Chapter 11 bankruptey to reorganize its debts. However, that did notwork out so well and in May 2016, SA annoumced it was going into Chapter 7 liquidation and by the end of August 2016 sold all of its assets and ceased all busmess activities Details of the Charles Schwab account: SALES PRICE BROKER FEES BASIS SHORT TERM SUMMARY GAINS 577,770 5,778 343,500 LOSSES 95,549 955 577,430 LONG TERM SU MMARY GAINS 978,870 9,789 365800 LOSSES 355,489 3,555 694,375 Required: Calculate Helen's net capital gan or loss from all of the above transactions and determine whether the results are short-term or long-term, includimg how much, if any, and the character of any carryover to the following year. To receive credit, you must show all ofyour work and explam your reasoning for each conclusion you make. Simply showing numbers on a age will not result im credit