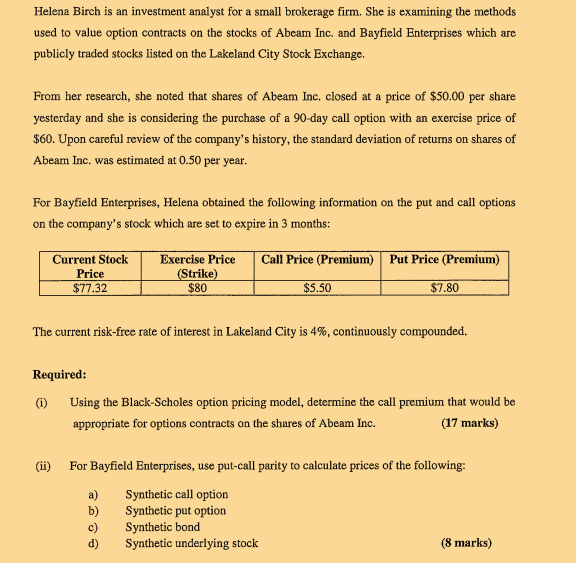

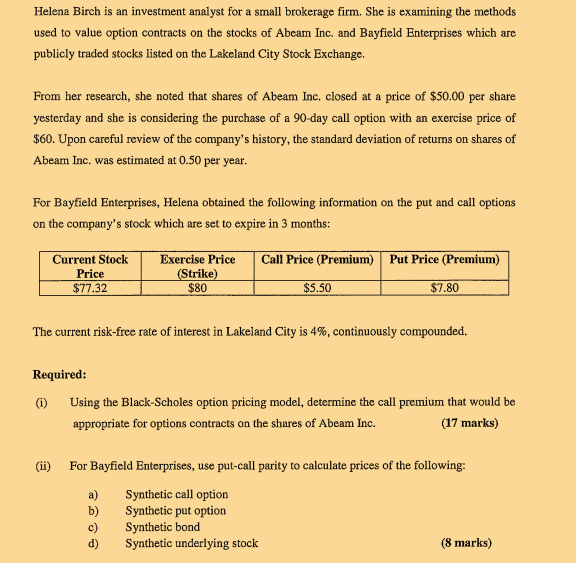

Helena Birch is an investment analyst for a small brokerage firm. She is examining the methods used to value option contracts on the stocks of Abcam Inc. and Bayfield Enterprises which are publicly traded stocks listed on the Lakeland City Stock Exchange. From her research, she noted that shares of Abeam Inc. closed at a price of $50.00 per share yesterday and she is considering the purchase of a 90-day call option with an exercise price of $60. Upon careful review of the company's history, the standard deviation of returns on shares of Abeam Inc. was estimated at 0.50 per year. For Bayfield Enterprises, Helena obtained the following information on the put and call options on the company's stock which are set to expire in 3 months: Call Price (Premium) Put Price (Premium) Current Stock Price $77.32 Exercise Price (Strike) $80 $5.50 $7.80 The current risk-free rate of interest in Lakeland City is 4%, continuously compounded. Required: (1) Using the Black-Scholes option pricing model, determine the call premium that would be appropriate for options contracts on the shares of Abeam Inc. (17 marks) (ii) For Bayfield Enterprises, use put-call parity to calculate prices of the following: a) b) c) d) Synthetic call option Synthetic put option Synthetic bond Synthetic underlying stock (8 marks) Helena Birch is an investment analyst for a small brokerage firm. She is examining the methods used to value option contracts on the stocks of Abcam Inc. and Bayfield Enterprises which are publicly traded stocks listed on the Lakeland City Stock Exchange. From her research, she noted that shares of Abeam Inc. closed at a price of $50.00 per share yesterday and she is considering the purchase of a 90-day call option with an exercise price of $60. Upon careful review of the company's history, the standard deviation of returns on shares of Abeam Inc. was estimated at 0.50 per year. For Bayfield Enterprises, Helena obtained the following information on the put and call options on the company's stock which are set to expire in 3 months: Call Price (Premium) Put Price (Premium) Current Stock Price $77.32 Exercise Price (Strike) $80 $5.50 $7.80 The current risk-free rate of interest in Lakeland City is 4%, continuously compounded. Required: (1) Using the Black-Scholes option pricing model, determine the call premium that would be appropriate for options contracts on the shares of Abeam Inc. (17 marks) (ii) For Bayfield Enterprises, use put-call parity to calculate prices of the following: a) b) c) d) Synthetic call option Synthetic put option Synthetic bond Synthetic underlying stock (8 marks)