Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Helena Products plc is a manufacturer of office furniture. In January 2019 the company carried out a strategic review and decided to target as

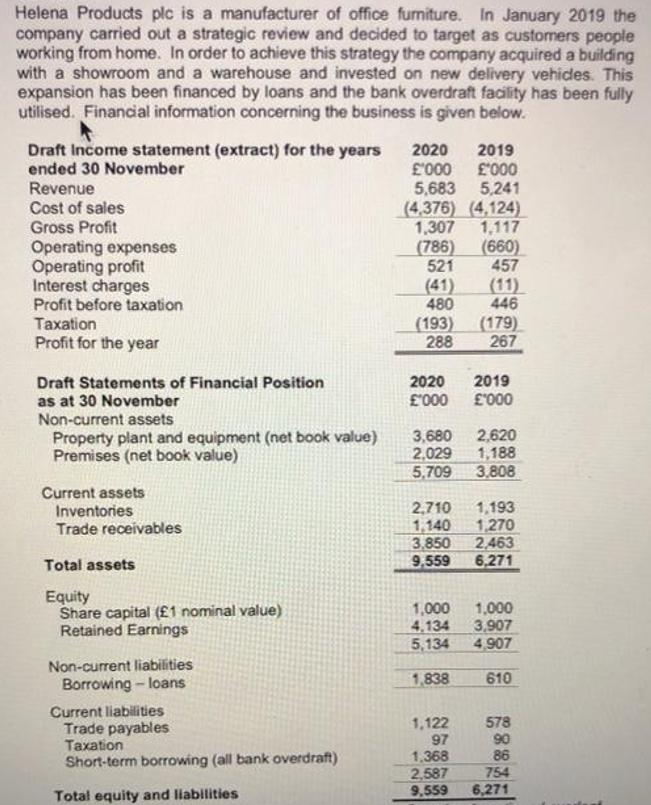

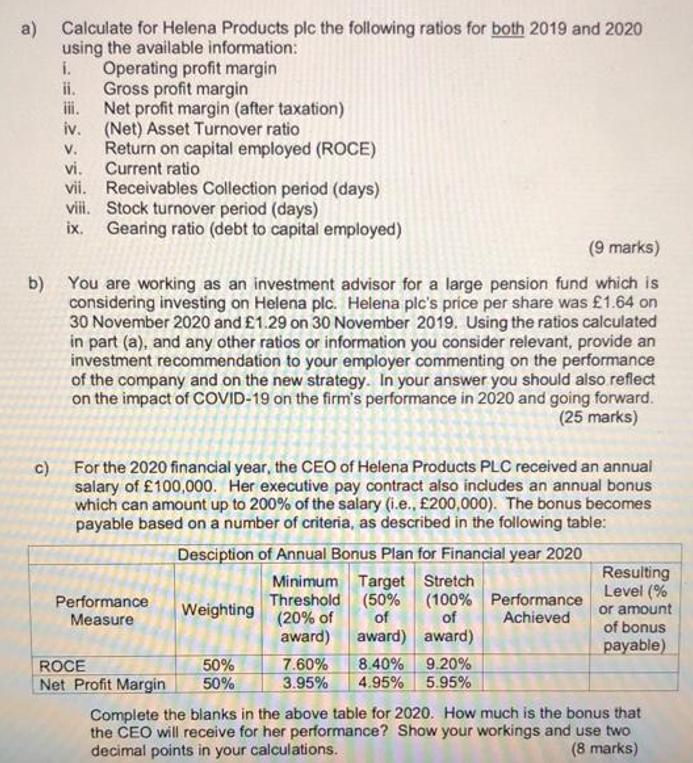

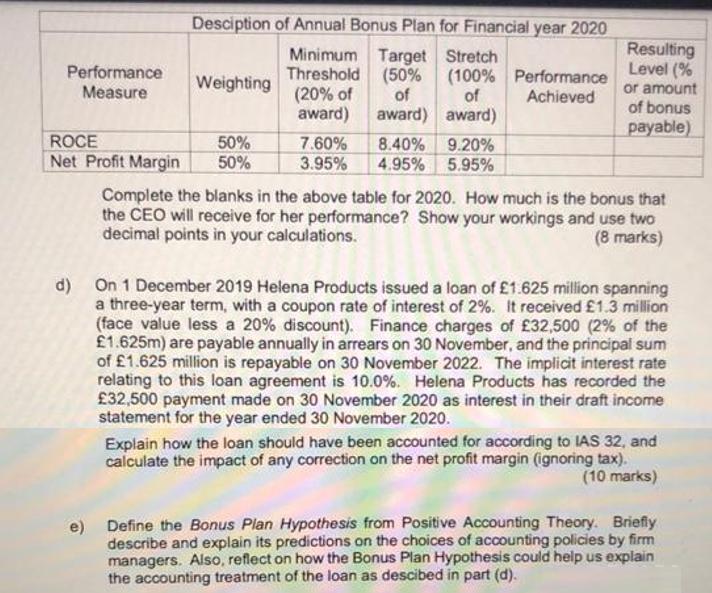

Helena Products plc is a manufacturer of office furniture. In January 2019 the company carried out a strategic review and decided to target as customers people working from home. In order to achieve this strategy the company acquired a building with a showroom and a warehouse and invested on new delivery vehicles. This expansion has been financed by loans and the bank overdraft facility has been fully utilised. Financial information concerning the business is given below. Draft Income statement (extract) for the years ended 30 November Revenue Cost of sales Gross Profit Operating expenses Operating profit Interest charges Profit before taxation Taxation Profit for the year Draft Statements of Financial Position as at 30 November Non-current assets Property plant and equipment (net book value) Premises (net book value) Current assets Inventories Trade receivables Total assets Equity Share capital (1 nominal value) Retained Earnings Non-current liabilities Borrowing-loans Current liabilities Trade payables Taxation Short-term borrowing (all bank overdraft) Total equity and liabilities 2020 2019 '000 000 5,683 5,241 (4,376) (4,124) 1,307 1,117 (786) (660) 521 457 480 (193) 288 2020 '000 3,680 2,029 5,709 2,710 1,140 1,000 4.134 5,134 1,838 1,193 1,270 3,850 2,463 9,559 6,271 1,122 97 (11) 446 1,368 2,587 9,559 (179) 267 2019 '000 2,620 1,188 3,808 1,000 3,907 4,907 610 578 90 86 754 6,271 a) Calculate for Helena Products plc the following ratios for both 2019 and 2020 using the available information: Operating profit margin Gross profit margin Net profit margin (after taxation) iv. (Net) Asset Turnover ratio V. vi. vii. vili. i. ii. Return on capital employed (ROCE) Current ratio Receivables Collection period (days) Stock turnover period (days) Gearing ratio (debt to capital employed) (9 marks) b) You are working as an investment advisor for a large pension fund which is considering investing on Helena plc. Helena plc's price per share was 1.64 on 30 November 2020 and 1.29 on 30 November 2019. Using the ratios calculated in part (a), and any other ratios or information you consider relevant, provide an investment recommendation to your employer commenting on the performance of the company and on the new strategy. In your answer you should also reflect on the impact of COVID-19 on the firm's performance in 2020 and going forward. (25 marks) c) For the 2020 financial year, the CEO of Helena Products PLC received an annual salary of 100,000. Her executive pay contract also includes an annual bonus which can amount up to 200% of the salary (i.e., 200,000). The bonus becomes payable based on a number of criteria, as described in the following table: Performance Measure ROCE Net Profit Margin Desciption of Annual Bonus Plan for Financial year 2020 Minimum Target Stretch Threshold (50% (100% Performance (20% of of Achieved of award) award) award) Weighting 50% 50% 7.60% 8.40% 9.20% 3.95% 4.95% 5.95% Resulting Level (% or amount of bonus payable) Complete the blanks in the above table for 2020. How much is the bonus that the CEO will receive for her performance? Show your workings and use two decimal points in your calculations. (8 marks) Performance Measure Desciption of Annual Bonus Plan for Financial year 2020 Resulting Minimum Target Stretch Threshold (50% (100% Performance Level (% (20% of or amount of of Achieved of bonus award) award) award) payable) Weighting ROCE 50% Net Profit Margin 50% 7.60% 8.40% 9.20% 3.95% 4.95% 5.95% Complete the blanks in the above table for 2020. How much is the bonus that the CEO will receive for her performance? Show your workings and use two decimal points in your calculations. (8 marks) d) On 1 December 2019 Helena Products issued a loan of 1.625 million spanning a three-year term, with a coupon rate of interest of 2%. It received 1.3 million (face value less a 20% discount). Finance charges of 32,500 (2% of the 1.625m) are payable annually in arrears on 30 November, and the principal sum of 1.625 million is repayable on 30 November 2022. The implicit interest rate relating to this loan agreement is 10.0%. Helena Products has recorded the 32,500 payment made on 30 November 2020 as interest in their draft income statement for the year ended 30 November 2020. Explain how the loan should have been accounted for according to IAS 32, and calculate the impact of any correction on the net profit margin (ignoring tax). (10 marks) e) Define the Bonus Plan Hypothesis from Positive Accounting Theory. Briefly describe and explain its predictions on the choices of accounting policies by firm managers. Also, reflect on how the Bonus Plan Hypothesis could help us explain the accounting treatment of the loan as descibed in part (d).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In this task you have been presented with various pieces of financial information for Helena Products plc and have been asked to calculate different financial ratios provide recommendations based on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started