Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Helios Industries uses FIFO process costing in accounting for its production activities. Materials are added at the beginning of the process and conversion costs

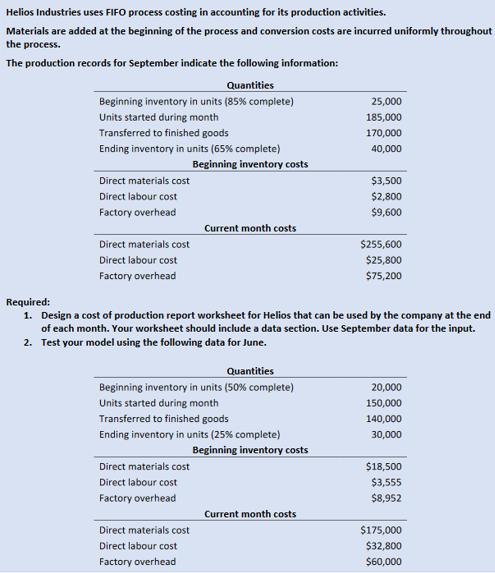

Helios Industries uses FIFO process costing in accounting for its production activities. Materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. The production records for September indicate the following information: Quantities Beginning inventory in units (85% complete) 25,000 Units started during month 185,000 Transferred to finished goods 170,000 Ending inventory in units (65% complete) 40,000 Beginning inventory costs Direct materials cost $3,500 Direct labour cost $2,800 Factory overhead $9,600 Current month costs Direct materials cost $255,600 Direct labour cost $25,800 Factory overhead $75,200 Required: 1. Design a cost of production report worksheet for Helios that can be used by the company at the end of each month. Your worksheet should include a data section. Use September data for the input. 2. Test your model using the following data for June. Quantities Beginning inventory in units (50% complete) Units started during month 20,000 150,000 Transferred to finished goods 140,000 Ending inventory in units (25% complete) 30,000 Beginning inventory costs Direct materials cost $18,500 Direct labour cost $3,555 Factory overhead $8,952 Current month costs Direct materials cost $175,000 Direct labour cost $32,800 Factory overhead $60,000

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The production cost report prepared under the FIFO method for process consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started