Heliski Adventures Inc. is a HST registrant. The company provides ski lessons and custom ski trips to clients. The company also sells equipment and clothing to customers who need them and provide skiing lessons. The business is located at 15 Back Street, Haliburton, Ontario.

Their BN number is BN#865432183. CRA assigned them a quarterly reporting period.

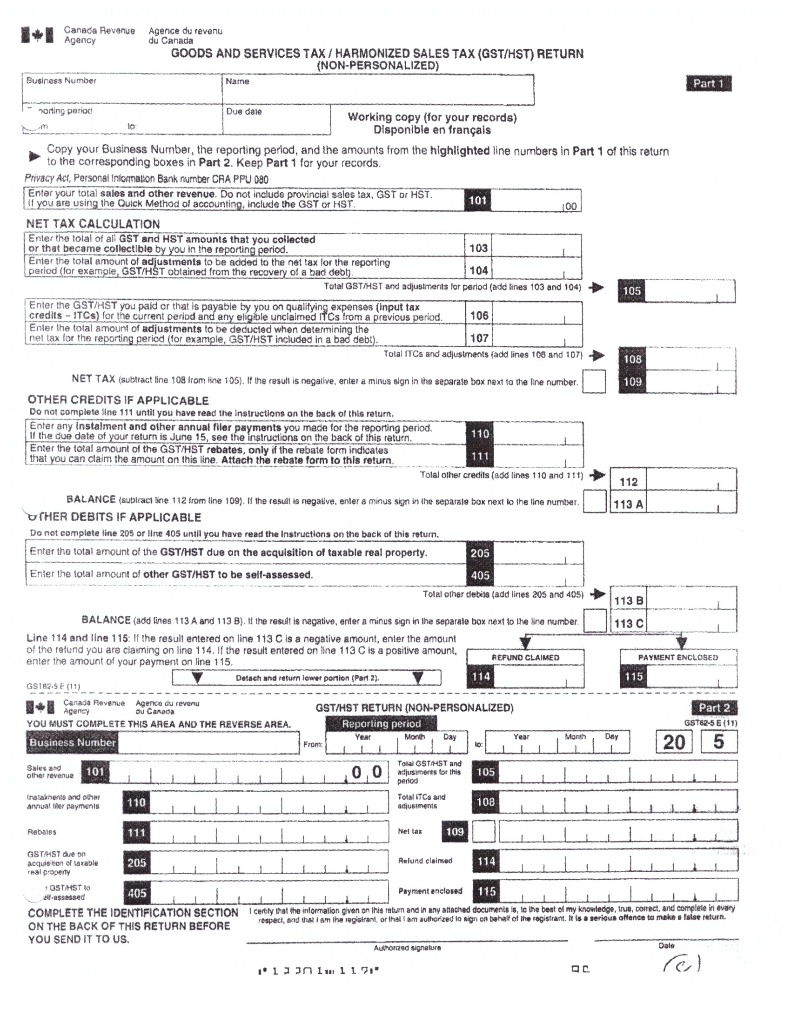

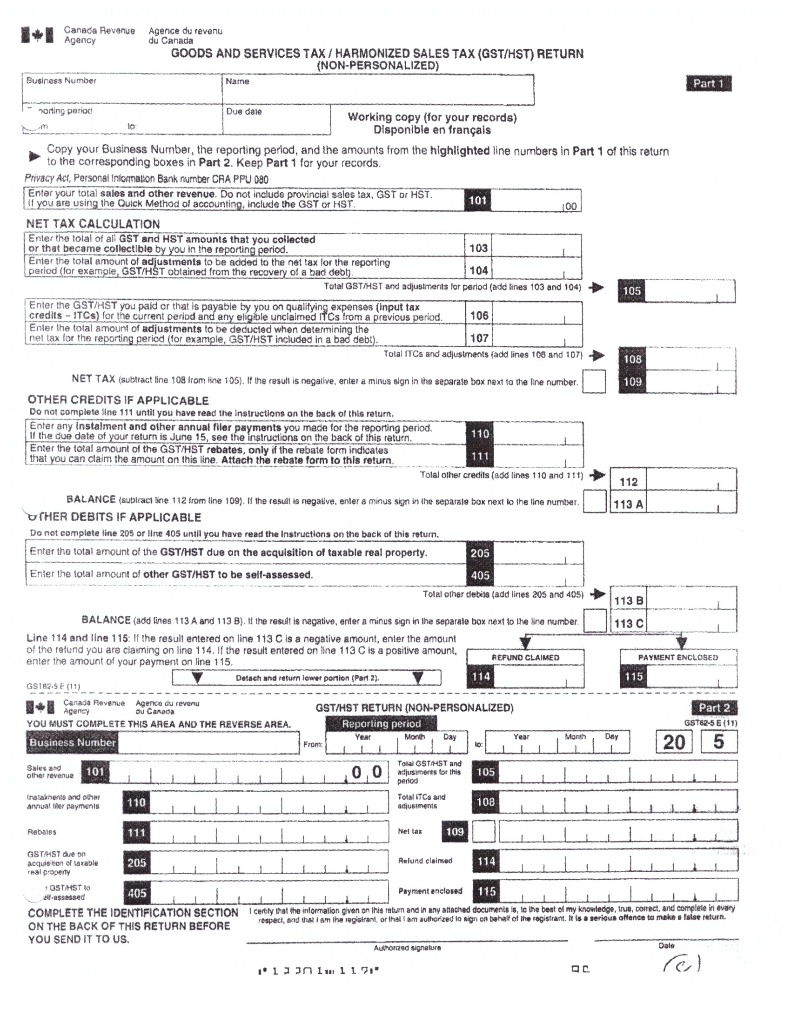

The HST/GST return is due on March 31, 2019 for reporting period Dec.1, 2018 to Feb. 28, 2019.

As their accountant you are to prepare the required GST/HST return.

Required: Round all answers to the nearest DOLLAR. COMPLETE and HAND IN the ATTACHED WORKSHEETS

Prepare the GST/HST Return for the quarter ending Feb. 28, 2019

Sales information: Invoice amount Includes all applicable taxes, unless otherwise stated. Assume customers are in Ontario unless otherwise noted.

Invoice Date Invoice # Customer Name Invoice Amount

Dec. 4, 2018 11100 Stephen Conway Ski Lessons $ 1,130

Dec. 6, 2018 11200 Michigan University Ski Team (USA) 3,300

Dec.19,2018 11300 Mississauga Community Centre--Clothing, net of 10% volume discount 2,260

Jan. 2, 2019 11400 High Park Ski Clubskis 3,390

Jan. 8, 2019 11500 North Toronto Ski Club - lessons 2,260

Jan. 13, 2019 11600 Haliburton WAWA tribe (Aboriginal)snow shoes

Delivered to reservation 5,300

Jan. 20, 2019 11700 University of Ottawaski trip 6,780

Jan. 27, 2019 - Recovery of Bad debt--Retail sale to local customer 791

Feb. 2, 2019 11800 YWCA in Waterloohelmets, ski boots 3,955

Feb. 10, 2019 11900 Sale to Neiman Markup in New York, USA 8,900

Feb. 15/19 Bad debtretail customer sale 452

Purchase information: Invoice amount Includes all applicable taxes, unless otherwise stated. Assume customers are in Ontario unless otherwise noted.

Invoice Date Purchase Description Invoice Amount

Dec. 10, 2018 Advertising 1,356.00

Dec. 19, 2018 Courier charge for delivery 135.60

Jan. 5, 2019 Purchase various inventory 20,340.00

Jan. 21, 2019 Purchase of packaging equipment from a local supplier 6,554.00

Jan. 30 , 2019 Insurance policy for fire and theft 1,700.00

Feb.2, 2019 Business Entertainmentclient event (not employee reimbursement) 3,616.00

Feb.5, 2019 Birthday present to presidents daughter 840.00

Feb.8, 2019 Reimbursement to employee (using Method 1) for expenses used 560.00

100% in the companys commercial activities - inclusive of taxes

Feb.16, 2019 Purchase of goods (for re-sale), from Denver Colorado, USA 1,380.00

(Assessed Canadian Equivalent is= $1,600)

Additional information--$1,400 HST installment was paid to the CRA for this quarter (Hintline 110)

Canada Revenue Agence du revenu du Canada GOODS AND SERVICES TAX/HARMONIZED SALES TAX (GST/HST) RETURN (NON-PERSONALIZED) Business Number Name Part 1 orting perio Due da Working copy (for your records) Disponible en franais Copy your Business Number, the reporting perlod, and the amounts from the highlighted line numbers in Part 1 of this return to the corresponding boxes in Part 2. Keep Part 1 for your records Privacy Act, Personal Iniomation Bank number CRA PPU 080 Enter your total sales and other revenue. Do not include provincial sales tax, GST or HS are using the Quick Method of accounting, include the GST or HST NET TAX CALCULATION Enter the tolal of alil GST and HST amounsthat you collected or that became collectible by you in the reporting period Enter the total amount of adjustments to be added to the ne! tax lor the reporting 103 riod (for example, GSTAHST obtained from the of a bad deb Total GST/HST and adjustments for period (add lines 103 and 104) Enter the GSTIHST you paid or that is payable by you on qualitying expenses (input tax credits-ITCs) for the current period and any eligible unclaimed ITCs from a previous Enler Ihe total amount of adjustments to be deducted when determining the nel tax for the r riod (for example, GST/HST included in a bad debt 107 Tolal ITCs and adjusiments fadd lines 10 and 107 NET TAX (subtract line 108 from kne 105). It the result is negalive, enter a minus sign in the separate box next to the ine number OTHER CREDITS IF APPLICABLE Do not complete ine 111 until you have read the instructions on the back of this return Enter any instalment and other annual filer ts you made for the reporting period if the due date of Enter the total amount of the GSTHST rebates, only the rebate form indicates that you can claim the amount on this line. Attach the rebate form to this return return is June 15, see the ons on the back of this return Talal olher credits (add linns 110 and 111) BALANCE (sublract hne 112 from line 109) H the resul is negaive, enter a minus sign is the separale box next lo the line number 113 A 'U(HER DEBITS IF APPLICABLE Do not complete line 205 or ine 405 until you have read the Instructions on the back of this return Enter tho total amount of the GSTHST due on the acquisition of taxable real property Enter the lotal arnount of other GST/HST to be self-assessed Tolai olher debis (add lines 205 and 405) 113 B BALANCE (add lines 113 A and 113 8). the resut is nagative, enter a minus sign in Ihe separale box next to the ine number 113 Line 114 and line 1 15:the resuit entered on line 113 C is a negative amount, enter the amount of the reund you are claiming on line 114. If the resuit entered on line 113 C is a positive amounl, enter the amount of your payment on line 115. REFUND CLAIMED PAYMENT ENCLOSED Detach and return lower portion (Part 2) GS182.S E (11) Canada evenue Agence du revenu Part 2 GST62-5 E11 205 ou Caneda GST/HST RETURN (NON-PERSONALIZED) YOU MUST COMPLETE THIS AREA AND THE REVERSE AREA. Reporting period Yest MonthDay MorthDay Business Number Fromr Sales nd olher revenue Tolal GSTHST and djusiments tor this nstainenis and othar annuat ther paymenis Tolal ITCs and RebaiBs 109 GSTMST dre on 205 Relund elaised OSTHST Payment enclosed t assessed COMPLETE THE IDENTIFICATION SECTION I cery hat the intormation given on ihis rebun and in any attached documenis is, io Uhe beat el my knowledge, true, coect, and compieie in evany ON THE BACK OF THIS RETURN BEFORE YOU SEND IT TO US. seriGUB ONenoe to maka . false return. respect, and tw i Mmlhe iegstrat orths: am authorced io egn co behar et the registrant. It is Dale Canada Revenue Agence du revenu du Canada GOODS AND SERVICES TAX/HARMONIZED SALES TAX (GST/HST) RETURN (NON-PERSONALIZED) Business Number Name Part 1 orting perio Due da Working copy (for your records) Disponible en franais Copy your Business Number, the reporting perlod, and the amounts from the highlighted line numbers in Part 1 of this return to the corresponding boxes in Part 2. Keep Part 1 for your records Privacy Act, Personal Iniomation Bank number CRA PPU 080 Enter your total sales and other revenue. Do not include provincial sales tax, GST or HS are using the Quick Method of accounting, include the GST or HST NET TAX CALCULATION Enter the tolal of alil GST and HST amounsthat you collected or that became collectible by you in the reporting period Enter the total amount of adjustments to be added to the ne! tax lor the reporting 103 riod (for example, GSTAHST obtained from the of a bad deb Total GST/HST and adjustments for period (add lines 103 and 104) Enter the GSTIHST you paid or that is payable by you on qualitying expenses (input tax credits-ITCs) for the current period and any eligible unclaimed ITCs from a previous Enler Ihe total amount of adjustments to be deducted when determining the nel tax for the r riod (for example, GST/HST included in a bad debt 107 Tolal ITCs and adjusiments fadd lines 10 and 107 NET TAX (subtract line 108 from kne 105). It the result is negalive, enter a minus sign in the separate box next to the ine number OTHER CREDITS IF APPLICABLE Do not complete ine 111 until you have read the instructions on the back of this return Enter any instalment and other annual filer ts you made for the reporting period if the due date of Enter the total amount of the GSTHST rebates, only the rebate form indicates that you can claim the amount on this line. Attach the rebate form to this return return is June 15, see the ons on the back of this return Talal olher credits (add linns 110 and 111) BALANCE (sublract hne 112 from line 109) H the resul is negaive, enter a minus sign is the separale box next lo the line number 113 A 'U(HER DEBITS IF APPLICABLE Do not complete line 205 or ine 405 until you have read the Instructions on the back of this return Enter tho total amount of the GSTHST due on the acquisition of taxable real property Enter the lotal arnount of other GST/HST to be self-assessed Tolai olher debis (add lines 205 and 405) 113 B BALANCE (add lines 113 A and 113 8). the resut is nagative, enter a minus sign in Ihe separale box next to the ine number 113 Line 114 and line 1 15:the resuit entered on line 113 C is a negative amount, enter the amount of the reund you are claiming on line 114. If the resuit entered on line 113 C is a positive amounl, enter the amount of your payment on line 115. REFUND CLAIMED PAYMENT ENCLOSED Detach and return lower portion (Part 2) GS182.S E (11) Canada evenue Agence du revenu Part 2 GST62-5 E11 205 ou Caneda GST/HST RETURN (NON-PERSONALIZED) YOU MUST COMPLETE THIS AREA AND THE REVERSE AREA. Reporting period Yest MonthDay MorthDay Business Number Fromr Sales nd olher revenue Tolal GSTHST and djusiments tor this nstainenis and othar annuat ther paymenis Tolal ITCs and RebaiBs 109 GSTMST dre on 205 Relund elaised OSTHST Payment enclosed t assessed COMPLETE THE IDENTIFICATION SECTION I cery hat the intormation given on ihis rebun and in any attached documenis is, io Uhe beat el my knowledge, true, coect, and compieie in evany ON THE BACK OF THIS RETURN BEFORE YOU SEND IT TO US. seriGUB ONenoe to maka . false return. respect, and tw i Mmlhe iegstrat orths: am authorced io egn co behar et the registrant. It is Dale