Answered step by step

Verified Expert Solution

Question

1 Approved Answer

helllp please The estimated betas for AOL Time Warner, J.P. Morgan Chase & Company, and Boeing Company are 2.25,1.55, and 0.75, respectively. The risk-free rate

helllp please

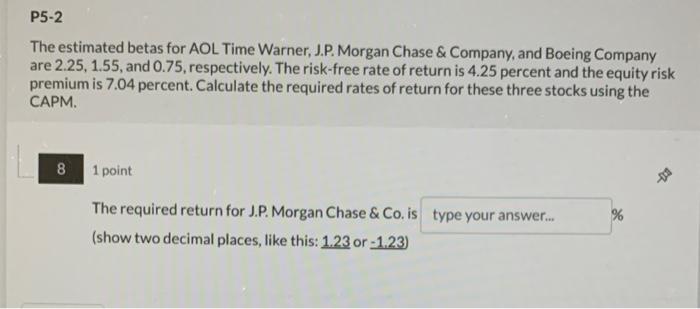

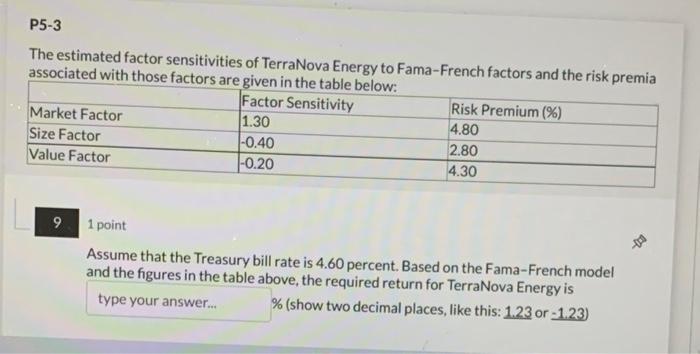

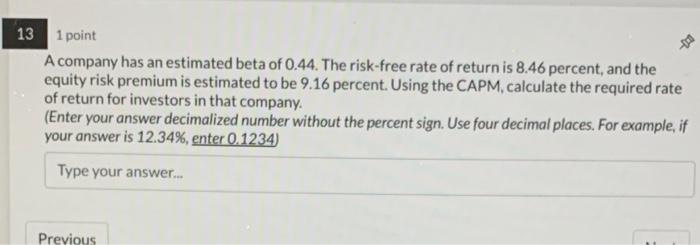

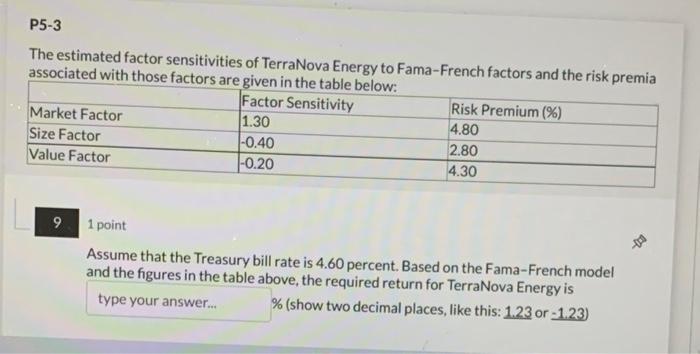

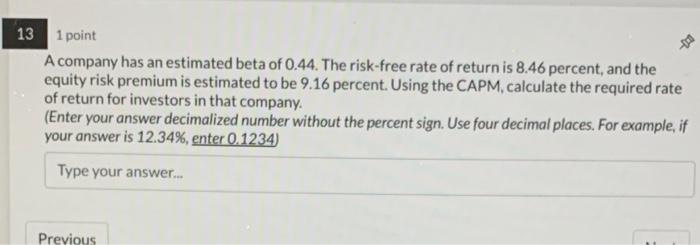

The estimated betas for AOL Time Warner, J.P. Morgan Chase \& Company, and Boeing Company are 2.25,1.55, and 0.75, respectively. The risk-free rate of return is 4.25 percent and the equity risk premium is 7.04 percent. Calculate the required rates of return for these three stocks using the CAPM. 8 point The required return for J.P. Morgan Chase & Co. is (show two decimal places, like this: 1.23 or 1.23 ) The estimated factor sensitivities of TerraNova Energy to Fama-French factors and the risk premia associated with those factors are given in tha tahin hain... 9 1 point Assume that the Treasury bill rate is 4.60 percent. Based on the Fama-French model and the figures in the table ahove, the required return for TerraNova Energy is % (show two decimal places, like this: 1.23 or 1.23 ) 1 point A company has an estimated beta of 0.44. The risk-free rate of return is 8.46 percent, and the equity risk premium is estimated to be 9.16 percent. Using the CAPM, calculate the required rate of return for investors in that company. (Enter your answer decimalized number without the percent sign. Use four decimal places. For example, if your answer is 12.34%, enter 0.1234 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started