Answered step by step

Verified Expert Solution

Question

1 Approved Answer

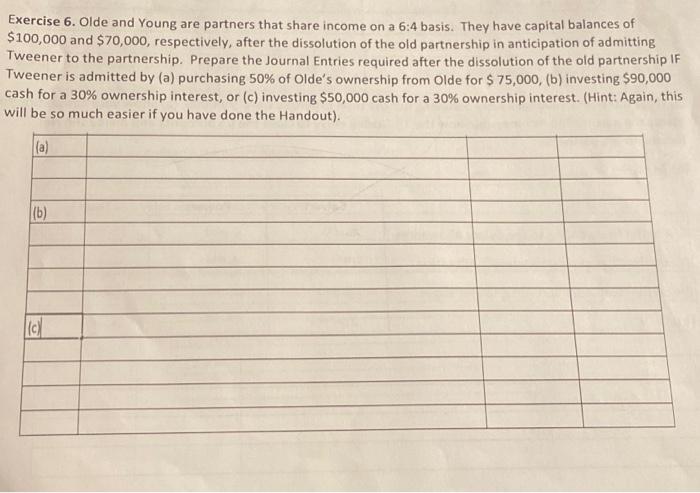

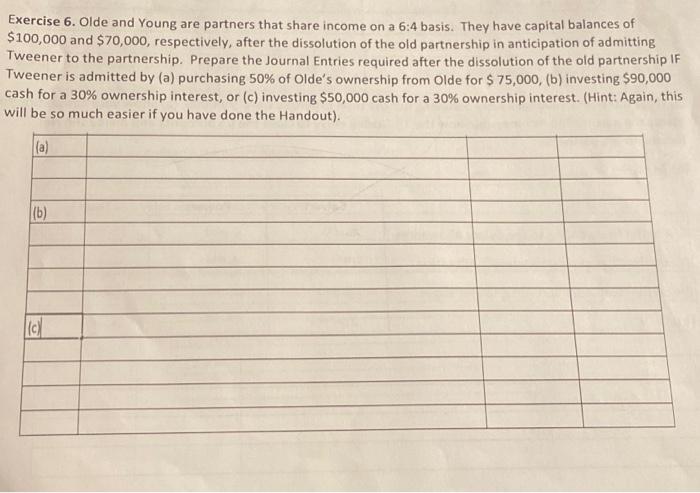

HELLLPPP!!! ASAPPP Exercise 6. Olde and Young are partners that share income on a 6:4 basis. They have capital balances of $100,000 and $70,000, respectively,

HELLLPPP!!! ASAPPP

Exercise 6. Olde and Young are partners that share income on a 6:4 basis. They have capital balances of $100,000 and $70,000, respectively, after the dissolution of the old partnership in anticipation of admitting Tweener to the partnership. Prepare the Journal Entries required after the dissolution of the old partnership IF Tweener is admitted by (a) purchasing 50% of Olde's ownership from Olde for $75,000, (b) investing $90,000 cash for a 30% ownership interest, or (c) investing $50,000 cash for a 30% ownership interest. (Hint: Again, this will be so much easier if you have done the Handout)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started