Hello,

Below i attached the question and my answer of the question i have been assigned to. What i need to do is to analyse the risk return for the company Bapcor Ltd (ASX:BAP).

I am having difficulties to calculate the total return to shareholder as the capital gain is negative. i am confused and have no idea how to do.

Please help me. Thank you.

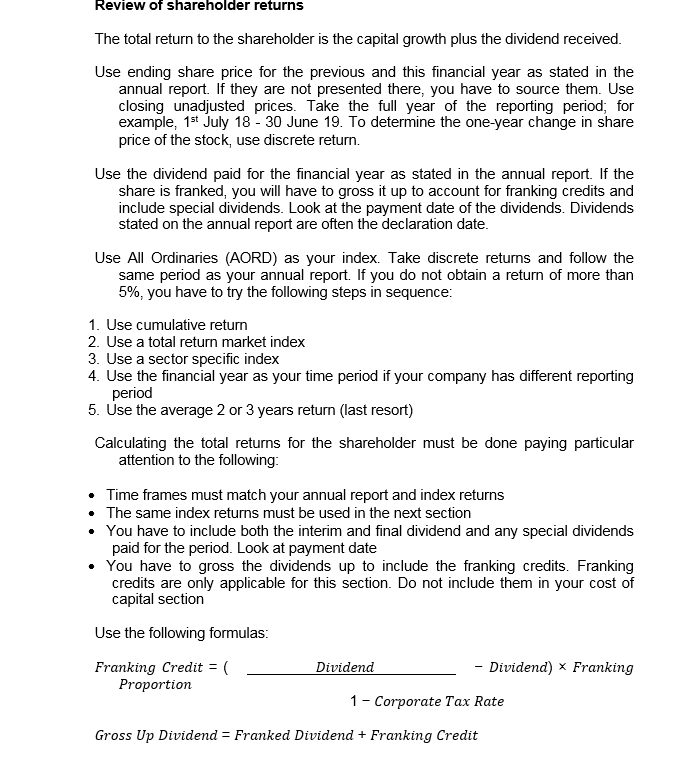

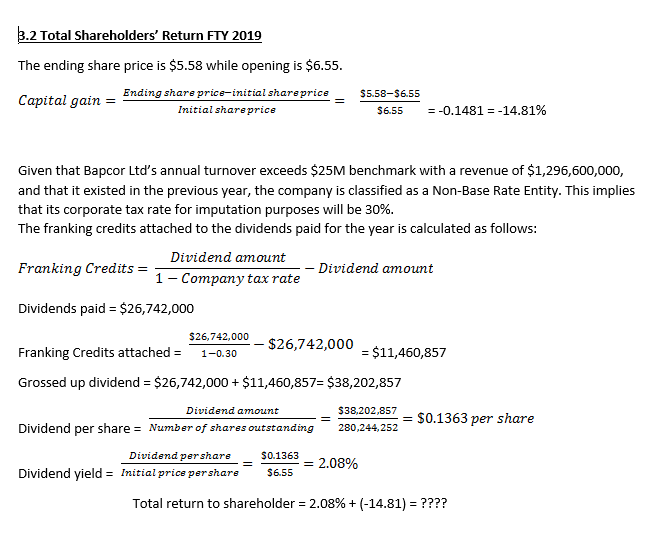

Review of shareholder returns The total return to the shareholder is the capital growth plus the dividend received. Use ending share price for the previous and this financial year as stated in the annual report. If they are not presented there, you have to source them. Use closing unadjusted prices. Take the full year of the reporting period; for example, 1st July 18 - 30 June 19. To determine the one-year change in share price of the stock, use discrete return. Use the dividend paid for the financial year as stated in the annual report. If the share is franked, you will have to gross it up to account for franking credits and include special dividends. Look at the payment date of the dividends. Dividends stated on the annual report are often the declaration date. Use All Ordinaries (AORD) as your index. Take discrete returns and follow the same period as your annual report. If you do not obtain a return of more than 5%, you have to try the following steps in sequence: 1. Use cumulative return 2. Use a total return market index 3. Use a sector specific index 4. Use the financial year as your time period if your company has different reporting period 5. Use the average 2 or 3 years return (last resort) Calculating the total returns for the shareholder must be done paying particular attention to the following: Time frames must match your annual report and index returns The same index returns must be used in the next section You have to include both the interim and final dividend and any special dividends paid for the period. Look at payment date . You have to gross the dividends up to include the franking credits. Franking credits are only applicable for this section. Do not include them in your cost of capital section Use the following formulas: Franking Credit =( Proportion Dividend - Dividend) x Franking 1 - Corporate Tax Rate Gross Up Dividend = Franked Dividend + Franking Credit 3.2 Total Shareholders' Return FTY 2019 The ending share price is $5.58 while opening is $6.55. : Capital gain = Ending share price-initial share price Initial sharsprics $5.58-$6.55 $6.55 = -0.1481 = -14.81% Given that Bapcor Ltd's annual turnover exceeds $25M benchmark with a revenue of $1,296,600,000, and that it existed in the previous year, the company is classified as a Non-Base Rate Entity. This implies that its corporate tax rate for imputation purposes will be 30%. The franking credits attached to the dividends paid for the year is calculated as follows: Dividend amount Franking Credits = 1- Company tax rate - Dividend amount Dividends paid = $26,742,000 $26.742,000 - $26,742,000 = $11,460,857 Franking Credits attached = 1-0.30 Grossed up dividend = $26,742,000+ $11,460,857= $38,202,857 Dividend amount - - $38,202,857 = $0.1363 per share Dividend per share = Number of shares outstanding 280,244,252 Dividend pershare = $0.1363 = 2.08% Dividend yield = Initial price pershare Total return to shareholder = 2.08%+ (-14.81) = ???? Review of shareholder returns The total return to the shareholder is the capital growth plus the dividend received. Use ending share price for the previous and this financial year as stated in the annual report. If they are not presented there, you have to source them. Use closing unadjusted prices. Take the full year of the reporting period; for example, 1st July 18 - 30 June 19. To determine the one-year change in share price of the stock, use discrete return. Use the dividend paid for the financial year as stated in the annual report. If the share is franked, you will have to gross it up to account for franking credits and include special dividends. Look at the payment date of the dividends. Dividends stated on the annual report are often the declaration date. Use All Ordinaries (AORD) as your index. Take discrete returns and follow the same period as your annual report. If you do not obtain a return of more than 5%, you have to try the following steps in sequence: 1. Use cumulative return 2. Use a total return market index 3. Use a sector specific index 4. Use the financial year as your time period if your company has different reporting period 5. Use the average 2 or 3 years return (last resort) Calculating the total returns for the shareholder must be done paying particular attention to the following: Time frames must match your annual report and index returns The same index returns must be used in the next section You have to include both the interim and final dividend and any special dividends paid for the period. Look at payment date . You have to gross the dividends up to include the franking credits. Franking credits are only applicable for this section. Do not include them in your cost of capital section Use the following formulas: Franking Credit =( Proportion Dividend - Dividend) x Franking 1 - Corporate Tax Rate Gross Up Dividend = Franked Dividend + Franking Credit 3.2 Total Shareholders' Return FTY 2019 The ending share price is $5.58 while opening is $6.55. : Capital gain = Ending share price-initial share price Initial sharsprics $5.58-$6.55 $6.55 = -0.1481 = -14.81% Given that Bapcor Ltd's annual turnover exceeds $25M benchmark with a revenue of $1,296,600,000, and that it existed in the previous year, the company is classified as a Non-Base Rate Entity. This implies that its corporate tax rate for imputation purposes will be 30%. The franking credits attached to the dividends paid for the year is calculated as follows: Dividend amount Franking Credits = 1- Company tax rate - Dividend amount Dividends paid = $26,742,000 $26.742,000 - $26,742,000 = $11,460,857 Franking Credits attached = 1-0.30 Grossed up dividend = $26,742,000+ $11,460,857= $38,202,857 Dividend amount - - $38,202,857 = $0.1363 per share Dividend per share = Number of shares outstanding 280,244,252 Dividend pershare = $0.1363 = 2.08% Dividend yield = Initial price pershare Total return to shareholder = 2.08%+ (-14.81) =