Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! Can I get the answer for this please The birth of the Internet in the 1990s led to the creation of a new industry

Hello! Can I get the answer for this please

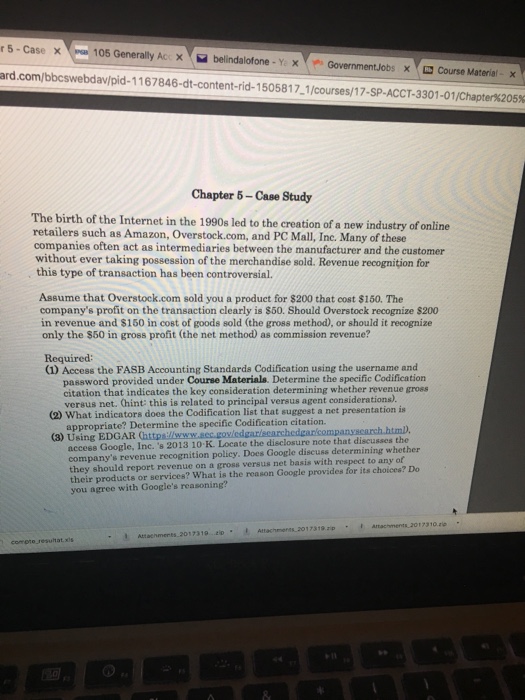

The birth of the Internet in the 1990s led to the creation of a new industry of online retailers such as Amazon, Overstock.com, and PC Mall. Inc. Many of these companies often act as intermediaries between the manufacturer and the customer without ever taking possession of the merchandise sold. Revenue recognition for this type of transaction has been controversial. Assume that Overstock.com sold you a product for $200 that cost $150. The company's profit on the transaction dearly is $50. Should Overstock recognize $200 in revenue and $160 in cost of goods sold (the gross method), or should it recognize only the $50 in gross profit (the net method) as commission revenue. Access the FASB Accounting Standards Codification using the username and password provided under Course Materials. Determine the specific Codification citation that indicates the key consideration determining whether revenue gross versus net. What indicators does the Codification list that suggest a net presentation is appropriate? Determine the specific Codification citation. Using EDGAR (https://www.sec.gov/edgar/searchedgar/companysearch.html), across Google, Inc.'s 2013 10 middot K. Locate the company's revenue recognition policy. Does Google discuss determining whether they should report revenue on a versus net basis with respect to any of their products or services? What is the reason Google provides for its choices? Do you agree with Google's reasoning? The birth of the Internet in the 1990s led to the creation of a new industry of online retailers such as Amazon, Overstock.com, and PC Mall. Inc. Many of these companies often act as intermediaries between the manufacturer and the customer without ever taking possession of the merchandise sold. Revenue recognition for this type of transaction has been controversial. Assume that Overstock.com sold you a product for $200 that cost $150. The company's profit on the transaction dearly is $50. Should Overstock recognize $200 in revenue and $160 in cost of goods sold (the gross method), or should it recognize only the $50 in gross profit (the net method) as commission revenue. Access the FASB Accounting Standards Codification using the username and password provided under Course Materials. Determine the specific Codification citation that indicates the key consideration determining whether revenue gross versus net. What indicators does the Codification list that suggest a net presentation is appropriate? Determine the specific Codification citation. Using EDGAR (https://www.sec.gov/edgar/searchedgar/companysearch.html), across Google, Inc.'s 2013 10 middot K. Locate the company's revenue recognition policy. Does Google discuss determining whether they should report revenue on a versus net basis with respect to any of their products or services? What is the reason Google provides for its choices? Do you agree with Google's reasoning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started