Hello can I have your attention? Sorry for disturbing but can you answer this please ?.

Im badly needed right now. Thank you so much. Please help me to answer this

Answer must have (given, formula used and solution)

Answer only (1-5) if you want just answer this please ?

Thank you so much!.

For other references kindly see this link:

https://bit.ly/30Tinwp

https://bit .ly/30Tinwp

https://bit. ly/30Tinwp

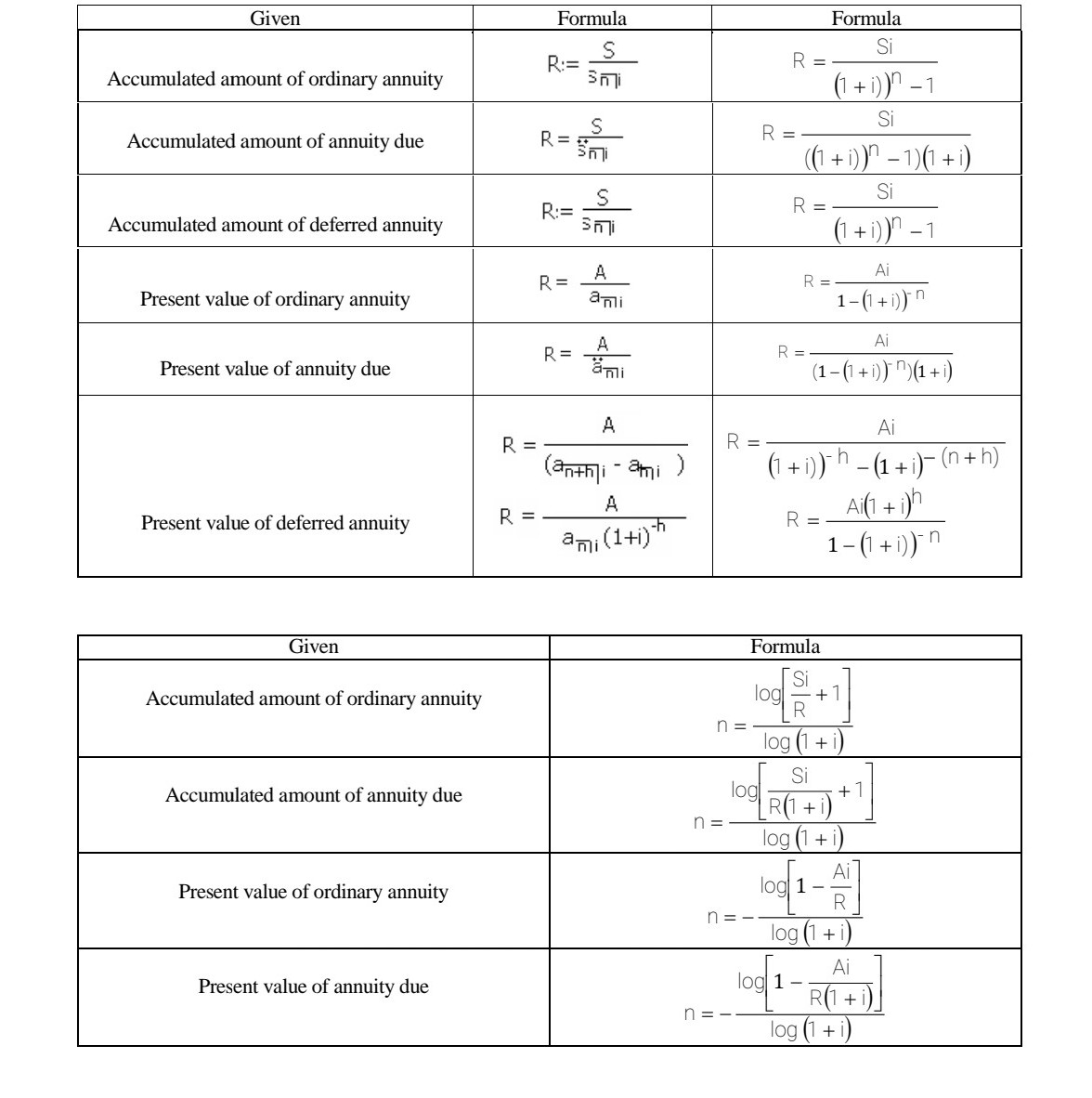

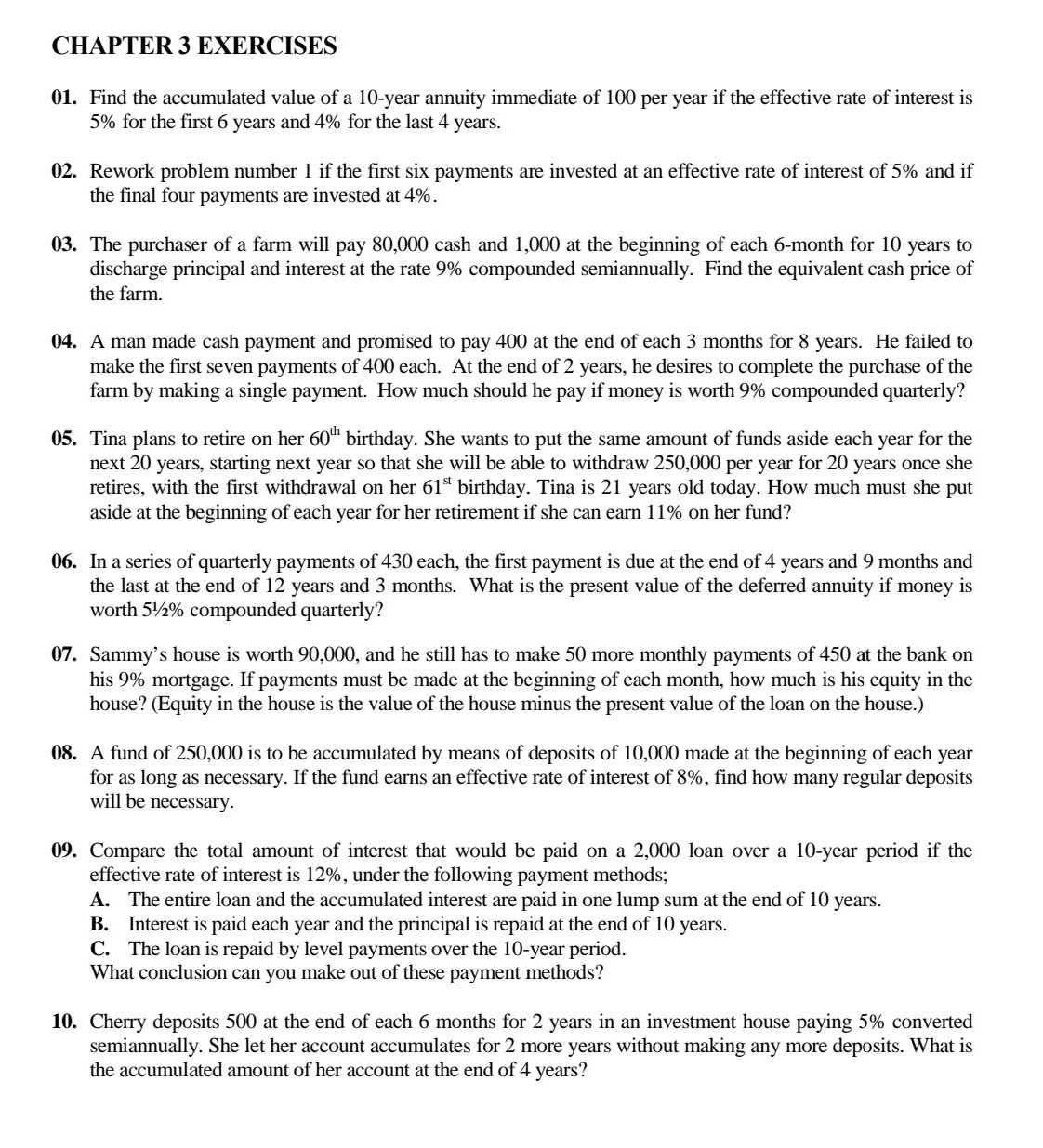

Given Formula Formula R = Si R:= = S Accumulated amount of ordinary annuity Smi (1 + i) )" - 1 Accumulated amount of annuity due S R= Smi R = Si (1 + 1) ) " - 1) (1 + 1 ) R:= = S R = - Si Accumulated amount of deferred annuity Smi (1 + 1) )n - 1 A R = - Ai R= Present value of ordinary annuity ami 1 - ( 1 + 1 ) )n A Ai R =. R = Present value of annuity due ami (1 - (1 +1)) ) (1+i) A Ai R = R = (anthi - ami ) (1 + 1))h - (1 +i)- (n+h) A Ai(1 + i)h Present value of deferred annuity R = R = - ani (1+i)h 1 - ( 1 + i ) )n Given Formula Si Accumulated amount of ordinary annuity og R n= og (1 + i) Si Accumulated amount of annuity due log R (1 + i ) n = - log (1 + i 1 1 Ai Present value of ordinary annuity R n = - log (1 + i) Ai Present value of annuity due log 1 R(1 + i) n = - og (1 + iSUMMARY OF FORMULAS 1. Ordinary annuity 2. Annuity due Alternative formulas S = R.(Sn+lli - 1) A = R(1+ andi ) S = RSmi S = RSmi S A = Rami A = Rami R. =- S S (Snelli - 1) R:= = R = 501 Smi A A R = A R = RE (1 + andi ) anli ami 2. Deferred annuity A = R(anthi - ami ) A R = (anthi - ami ) A A = Rani (1+i) R = - ami (1+i)h where and 1 - (1+i)n (1+i)" - 1 ani= Sali = 1 - (1+i) (1+i)" - 1 ani = Shli = d d [1 - (1+i) " ] (1+1) [1 - (1+1)" ] (1+1) ani = Sni =CHAPTER 3 EXERCISES 01. 02. 03. 10. Find the accumulated value of a l0year annuity immediate of 100 per year if the effective rate of interest is 5% for the rst 6 years and 4% for the last 4 years. Rework problem number 1 if the rst six payments are invested at an e'ective rate of interest of 5% and if the nal four payments are invested at 4%. The purchaser of a farm will pay 30,000 cash and 1,000 at the beginning of each 6-month for 10 years to discharge principal and interest at the rate 9% compounded semiannually. Find the equivalent cash price of the farm. A man made cash payment and promised to pay 400 at the end of each 3 months for 8 years. He failed to make the rst seven payments of 400 each. At the end of 2 years, he desires to complete the purchase of the farm by making a single payment. How much should he pay if money is worth 9% compounded quarterly? Tina plans to retire on her (50lil birthday. She wants to put the same amount of flmds aside each year for the next 20 years, starting next year so that she will be able to withdraw 250,000 per year for 20 years once she retires, with the rst withdrawal on her 61st birthday. Tina is 21 years old today. How much must she put aside at the beginning of each year for her retirement if she can earn 11% on her fund? In a series of quarterly payments of 430 each, the rst payment is due at the end of 4 years and 9 months and the last at the end of 12 years and 3 months. What is the present value of the deferred annuity if money is worth 5%% compounded quarterly? Sammy's house is worth 90,000, and he still has to make 50 more monthly payments of 450 at the bank on his 9% mortgage. If payments must be made at the beginning of each month, how much is his equity in the house? (Equity in the house is the value of the house minus the present value of the loan on the house.) A fund of 250,000 is to be accumulated by means of deposits of 10,000 made at the beginning of each year for as long as necessary. If the fund earns an effective rate of interest of 8%, nd how many regular deposits will be necessary. Compare the total amount of interest that would be paid on a 2,000 loan over a 10-year period if the effective rate of interest is 12%, under the following payment methods; A. The entire loan and the accumulated interest are paid in one lump sum at the end of 10 years. B. Interest is paid each year and the principal is repaid at the end of 10 years. C. The loan is repaid by level payments over the lO-year period. What conclusion can you make out of these payment methods? Cherry deposits 500 at the end of each 6 months for 2 years in an investment house paying 5% converted semiannually. She let her account accumulates for 2 more years without making any more deposits. What is the accumulated amount of her account at the end of 4 years