Answered step by step

Verified Expert Solution

Question

1 Approved Answer

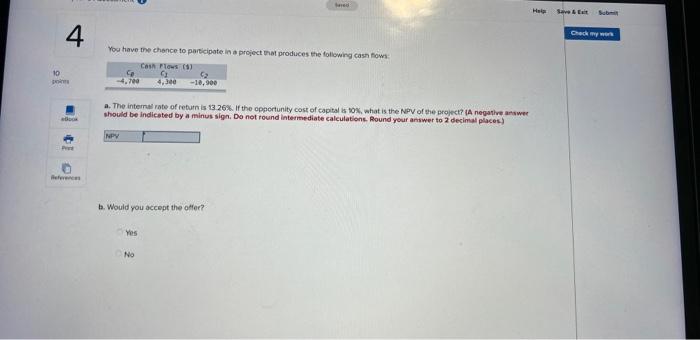

Hello can someone explain me how to do this question in the financial calculator ? Yos have the chance to participote in a project that

Hello can someone explain me how to do this question in the financial calculator ?

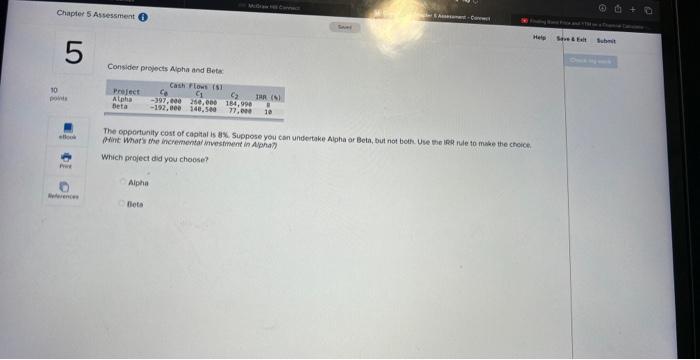

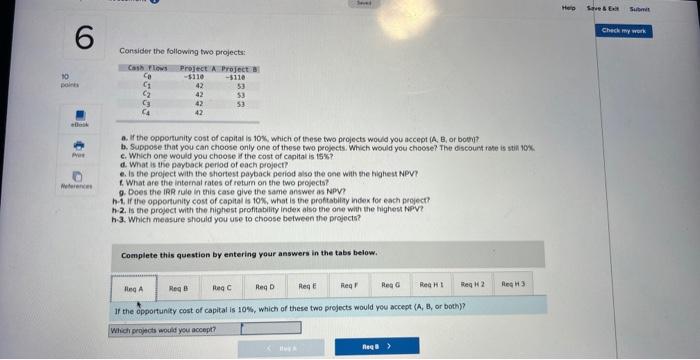

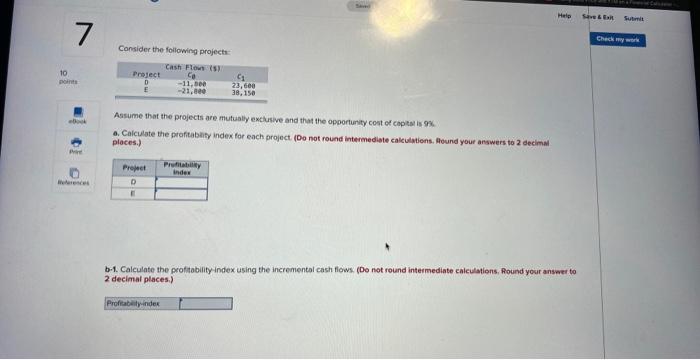

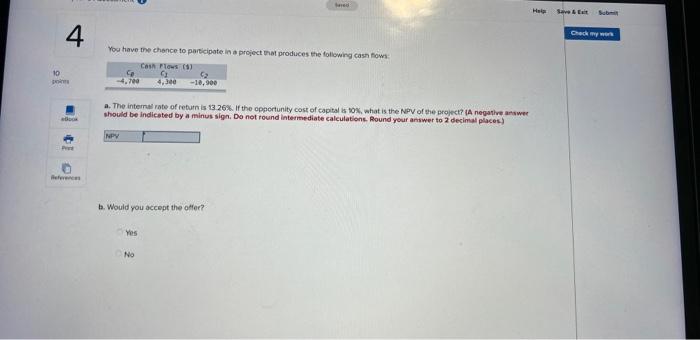

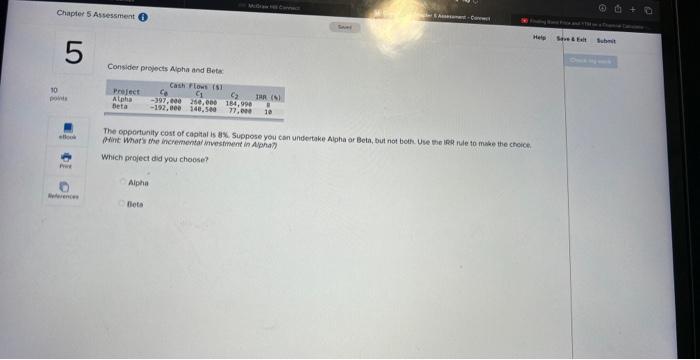

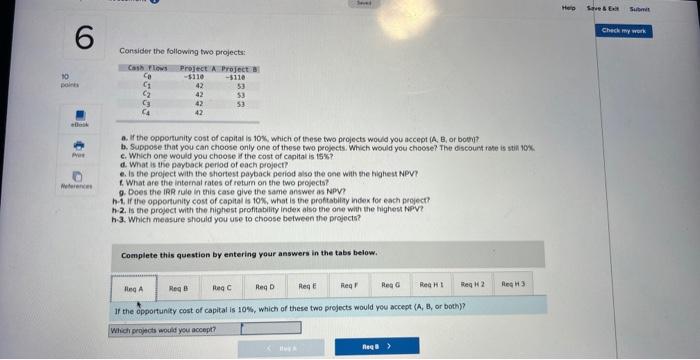

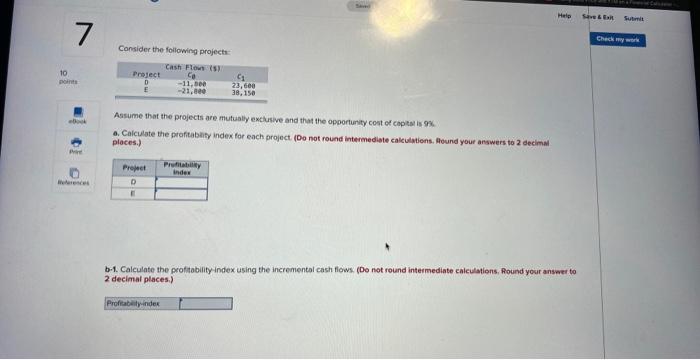

Yos have the chance to participote in a project that produces the following cash fows: a. The intemal rate of return is 13.26%. If the oppertunity cost of capital is 50%, what is the NFV of the project? (A negathe arawee should be indicated by a minus sign. Do not round intermediate calculatiens. Round your answer to 2 decimal places) b. Would you accept the oHer? Yes Consider projects Alpha and Beta: The opportunity cost of capltal is bx suppose you can undertake Alpha ar Beta, but not both. Use the ira nie to make the choice. Phint: Whatis bhe incrementad investiment in Ayenady. Which project did yeu choose? Aipha llete Consider the following two projects: a. If the opportunity cest of capital is 10%, which of these two projects would you accept (A,B, or bothi)? b. Suppose that you can choose only one of these two propects. Which would you choose? The discount rote is stin 10. c. Which one would you choose if the cost of cagital is 15% ? d. What is the puyback penod of each project? e. Is the project with the shortest payback period also the one with the highest NPV? 6. What are the internal rates of return on the two projects? 9. Does the IRR rule in this case give the same answer as NpV? h-t. If the opportunity cost of capital is 10%, what is the profitabliaty index for each pegect? h-2. Is the project with the highest profitability index aiso the one with the highest NPV? h-3. Which measure should you use to choose between the projects? Complete this question by entering your answers in the tabs below. If the opportunity cost of capital is 10%, which of these two projects would you accept (A,B, or both)? Consider the following projects Assume that the projects are mutualy exclusive and that the opertunity cost ef coptar is 9x. a. Calculate the prafitabity index for each project (Do not round intermediate calculations. Aound your answers to 2 decimal places.) b-1. Calculate the profitability index using the incremiental cash flows. (Do not round intermediate caiculations, found your anser to 2 decimal places.) BAII Plus is TEXAS INSTRUMENTS ns. Round your : I intermediate calculati Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started