Hello! Can someone help

me solve these financial/real estate questions? If you could also show your work or include methodology, that would be really helpful. Thank you!

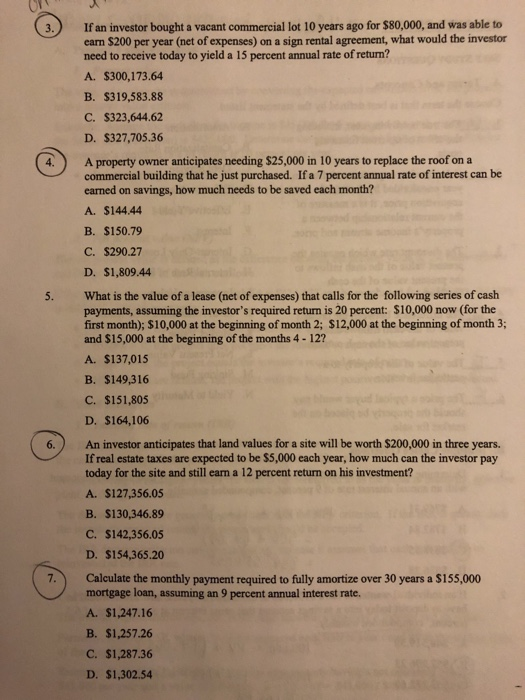

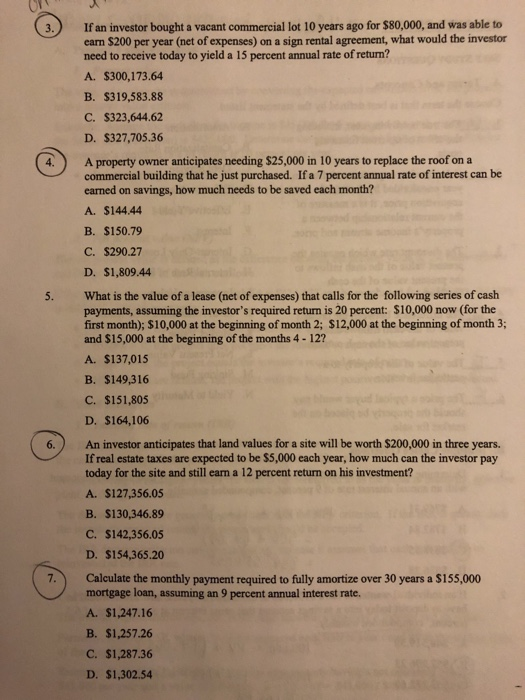

If an investor bought a vacant commercial lot 10 years ago for $80,000, and was able to carn $200 per year (net of expenses) on a sign rental agreement, what would the investor need to receive today to yield a 15 percent annual rate of return? A. $300,173.64 B. $319,583.88 C. $323,644.62 D. $327,705.36 A property owner anticipates needing $25,000 in 10 years to replace the roof on a commercial building that he just purchased. If a 7 percent annual rate of interest can be earned on savings, how much needs to be saved each month? A. $144.44 B. $150.79 C. $290.27 D. $1,809.44 What is the value of a lease (net of expenses) that calls for the following series of cash payments, assuming the investor's required return is 20 percent: $10,000 now (for the first month); $10,000 at the beginning of month 2; $12,000 at the beginning of month 3; and $15,000 at the beginning of the months 4 - 12? A. $137,015 B. $149,316 C. $151,805 D. $164,106 An investor anticipates that land values for a site will be worth $200,000 in three years. If real estate taxes are expected to be $5,000 each year, how much can the investor pay today for the site and still earn a 12 percent return on his investment? A. S127,356.05 B. $130,346.89 C. $142,356.05 D. $154,365.20 Calculate the monthly payment required to fully amortize over 30 years a $155,000 mortgage loan, assuming an 9 percent annual interest rate. A. $1,247.16 B. $1,257.26 c. $1,287.36 D. $1,302.54 10. Determine the quarterly payment required to fully amortize a 10-year, S1 million loan at 8 percent annual interest (compounded quarterly). A. $12,132.76 B. $29,350.58 C. $36,555.75 D. $37,257.37 What is the value of an account at the end of 5 years, if $500 is deposited at the end of each month in an investment account that eams 12 percent annually during the period? A. $30,176.42 B. $33,600.00 C. $38,117.08 D. $40,834.83 An income-producing property can be acquired for $5,250,000 and is expected to generate the following annual after-tax cash flows (assume they are received at the end of the year): Year 1: $400,000; Year 2: $450,000; Year 3: $450,000; Year 4: $500,000; and Year 5: $7,000,000. Would an investor with a required rate of return (after-tax) of 12 percent be wise to invest at the current price? A. No, the NPV is -$1,674,072.O d B. No, the NPV is-S535,929. gada que n C. Yes, the NPV is $75.928. D. Yes, the NPV is $715,040. An income-producing property can be acquired for $4,500,000 and is expected to generate the following after-tax cash flows: Year 1: $500,000; Year 2: $550,000; Year 3: $600,000; and Year 4: $6,000,000. Calculate the annual IRR for this investment opportunity. A. 10.28 percent B. 12.65 percent C. 14.86 percent D. 16.28 percent What is the annual rate of return to the lender offering an $115,000, 30-year mortgage loan with monthly payments of $860.72? A. 8.21 percent B. 8.23 percent C. 8.34 percent D. 8.55 percent 12