Answered step by step

Verified Expert Solution

Question

1 Approved Answer

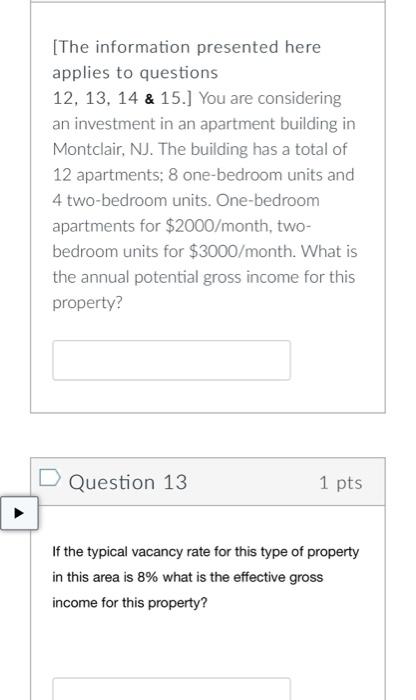

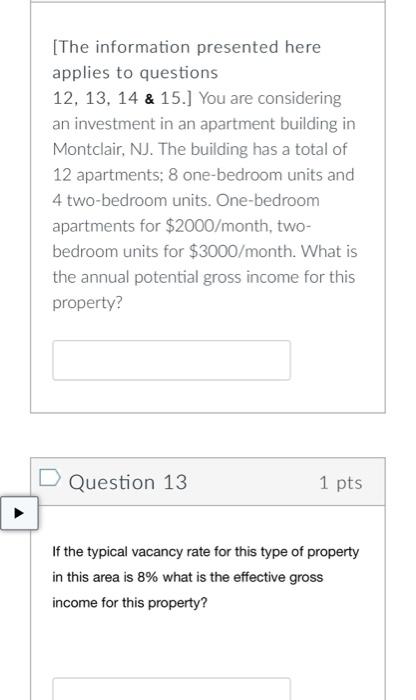

Hello can someone help me solve those questions please [The information presented here applies to questions 12,13,14 & 15.] You are considering an investment in

Hello can someone help me solve those questions please

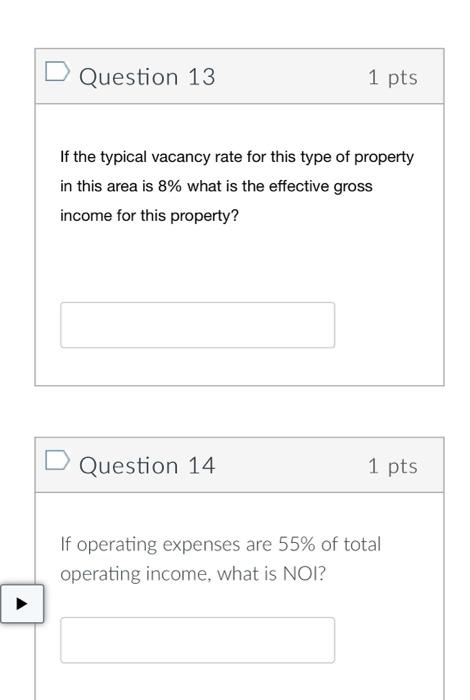

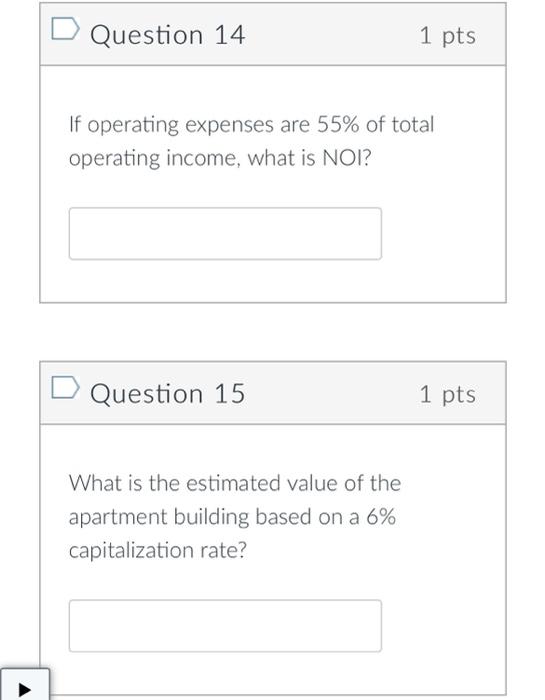

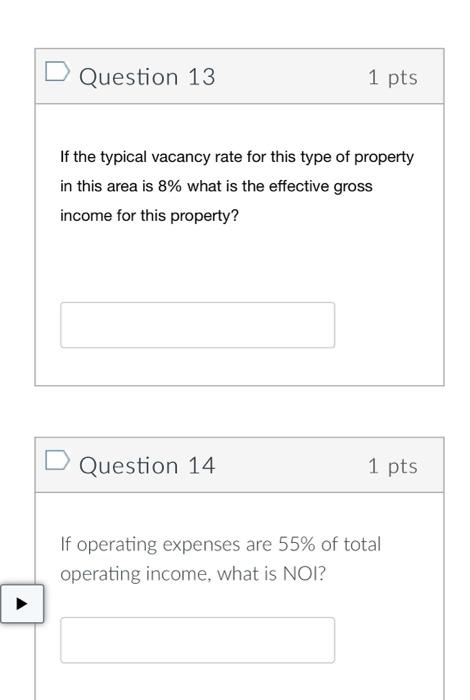

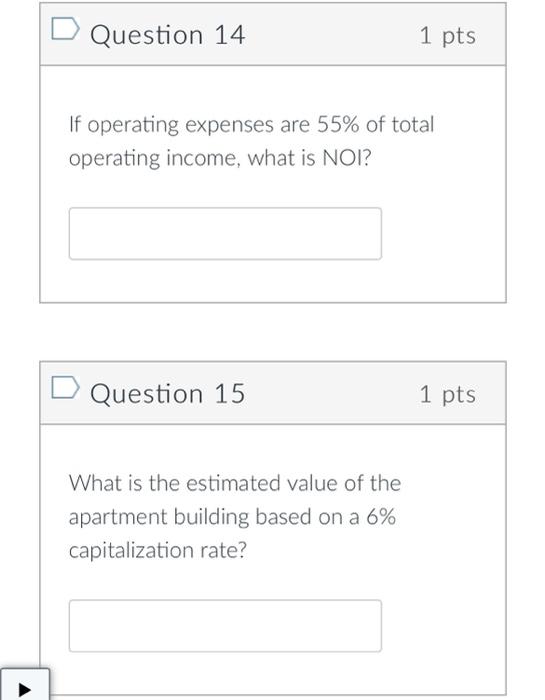

[The information presented here applies to questions 12,13,14 \& 15.] You are considering an investment in an apartment building in Montclair, NJ. The building has a total of 12 apartments; 8 one-bedroom units and 4 two-bedroom units. One-bedroom apartments for $2000 /month, twobedroom units for $3000/ month. What is the annual potential gross income for this property? Question 13 1 pts If the typical vacancy rate for this type of property in this area is 8% what is the effective gross income for this property? If the typical vacancy rate for this type of property in this area is 8% what is the effective gross income for this property? Question 14 1 pts If operating expenses are 55% of total operating income, what is NOI ? Question 14 If operating expenses are 55% of total operating income, what is NOI ? Question 15 What is the estimated value of the apartment building based on a 6\% capitalization rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started