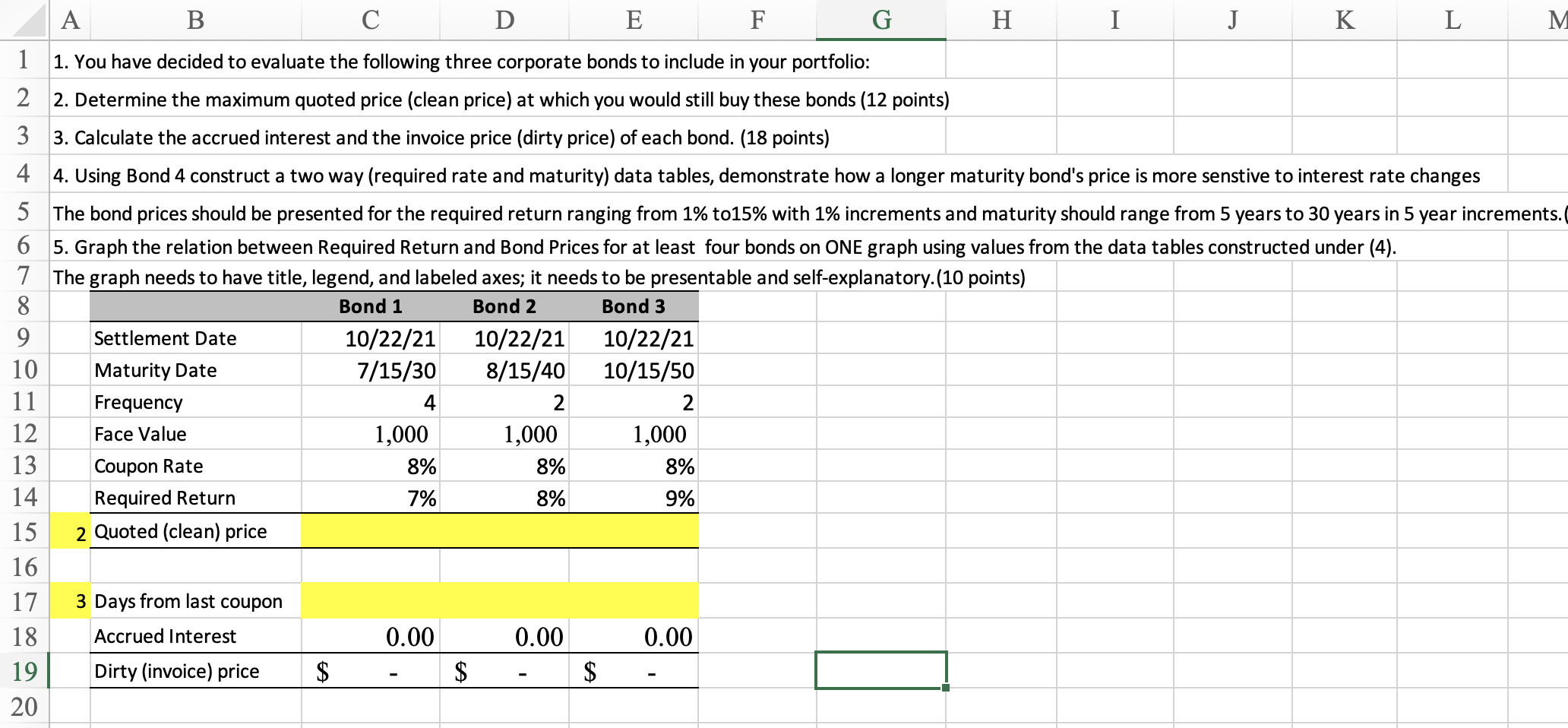

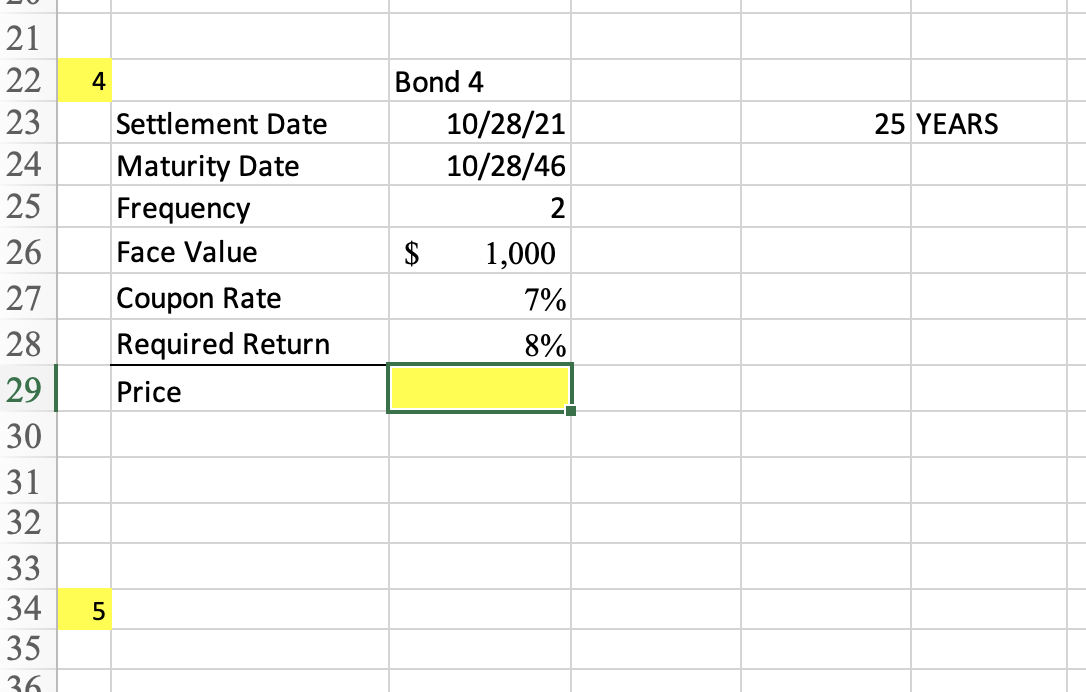

A B D E F G H 1 I J K L M 1 1. You have decided to evaluate the following three corporate bonds to include in your portfolio: 2 2. Determine the maximum quoted price (clean price) at which you would still buy these bonds (12 points) 3 3. Calculate the accrued interest and the invoice price (dirty price) of each bond. (18 points) 4 4. Using Bond 4 construct a two way (required rate and maturity) data tables, demonstrate how a longer maturity bond's price is more senstive to interest rate changes 5 The bond prices should be presented for the required return ranging from 1% to15% with 1% increments and maturity should range from 5 years to 30 years in 5 year increments. 6 5. Graph the relation between Required Return and Bond Prices for at least four bonds on ONE graph using values from the data tables constructed under (4). 7 The graph needs to have title, legend, and labeled axes; it needs to be presentable and self-explanatory. (10 points) 8 Bond 1 Bond 2 Bond 3 9 Settlement Date 10/22/21 10/22/21 10/22/21 10 Maturity Date 7/15/30 8/15/40 10/15/50 11 Frequency 4 2 2 12 Face Value 1,000 1,000 1,000 13 Coupon Rate 8% 8% 8% 14 Required Return 7% 8% 9% 15 2 Quoted (clean) price 16 17 3 Days from last coupon 18 Accrued Interest 0.00 0.00 0.00 19 Dirty (invoice) price $ $ $ 20 21 22 4 25 YEARS 23 24 25 26 27 Settlement Date Maturity Date Frequency Face Value Coupon Rate Required Return Price Bond 4 10/28/21 10/28/46 2 $ 1,000 7% 8% 28 29 30 31 32 33 34 35 5 36 A B D E F G H 1 I J K L M 1 1. You have decided to evaluate the following three corporate bonds to include in your portfolio: 2 2. Determine the maximum quoted price (clean price) at which you would still buy these bonds (12 points) 3 3. Calculate the accrued interest and the invoice price (dirty price) of each bond. (18 points) 4 4. Using Bond 4 construct a two way (required rate and maturity) data tables, demonstrate how a longer maturity bond's price is more senstive to interest rate changes 5 The bond prices should be presented for the required return ranging from 1% to15% with 1% increments and maturity should range from 5 years to 30 years in 5 year increments. 6 5. Graph the relation between Required Return and Bond Prices for at least four bonds on ONE graph using values from the data tables constructed under (4). 7 The graph needs to have title, legend, and labeled axes; it needs to be presentable and self-explanatory. (10 points) 8 Bond 1 Bond 2 Bond 3 9 Settlement Date 10/22/21 10/22/21 10/22/21 10 Maturity Date 7/15/30 8/15/40 10/15/50 11 Frequency 4 2 2 12 Face Value 1,000 1,000 1,000 13 Coupon Rate 8% 8% 8% 14 Required Return 7% 8% 9% 15 2 Quoted (clean) price 16 17 3 Days from last coupon 18 Accrued Interest 0.00 0.00 0.00 19 Dirty (invoice) price $ $ $ 20 21 22 4 25 YEARS 23 24 25 26 27 Settlement Date Maturity Date Frequency Face Value Coupon Rate Required Return Price Bond 4 10/28/21 10/28/46 2 $ 1,000 7% 8% 28 29 30 31 32 33 34 35 5 36