Hello, can someone help me with my ratio assignment for accounting? There are two companies' income statement and statement of financial position. I have answered some of the questions but I am not entirely sure if I got the right answers to some of them. Thank you for the help!

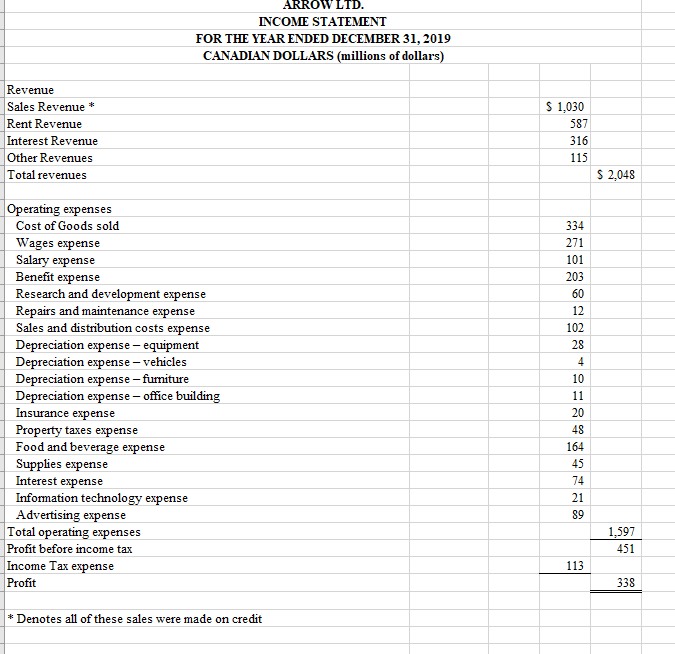

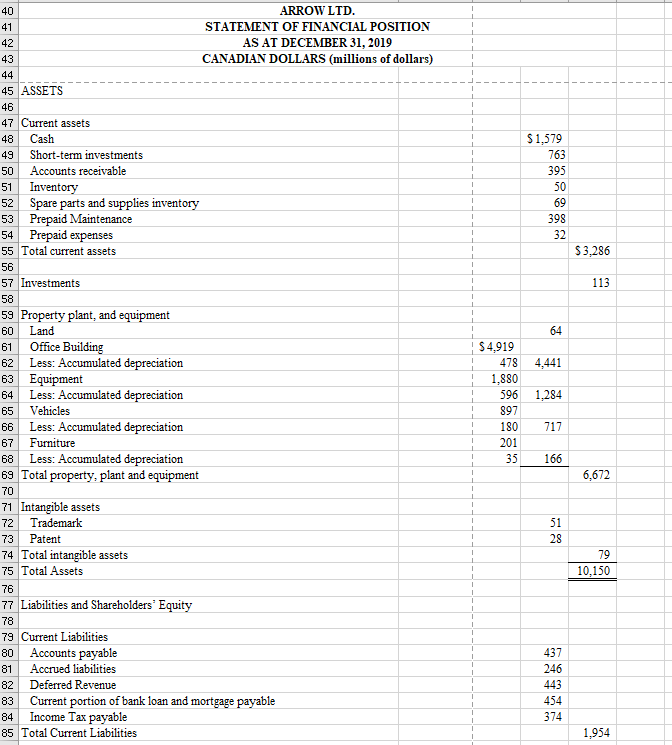

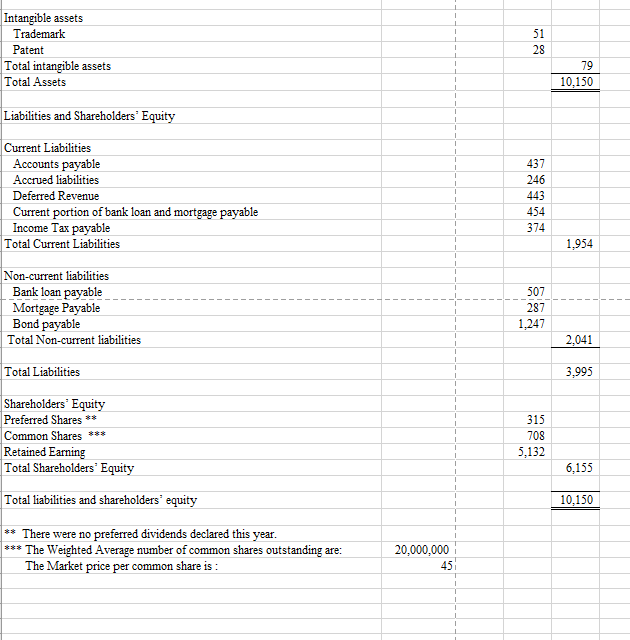

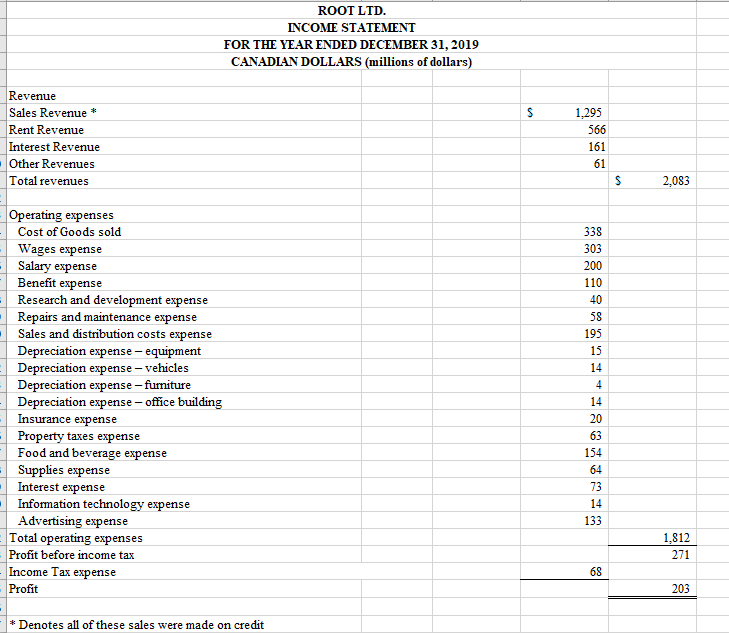

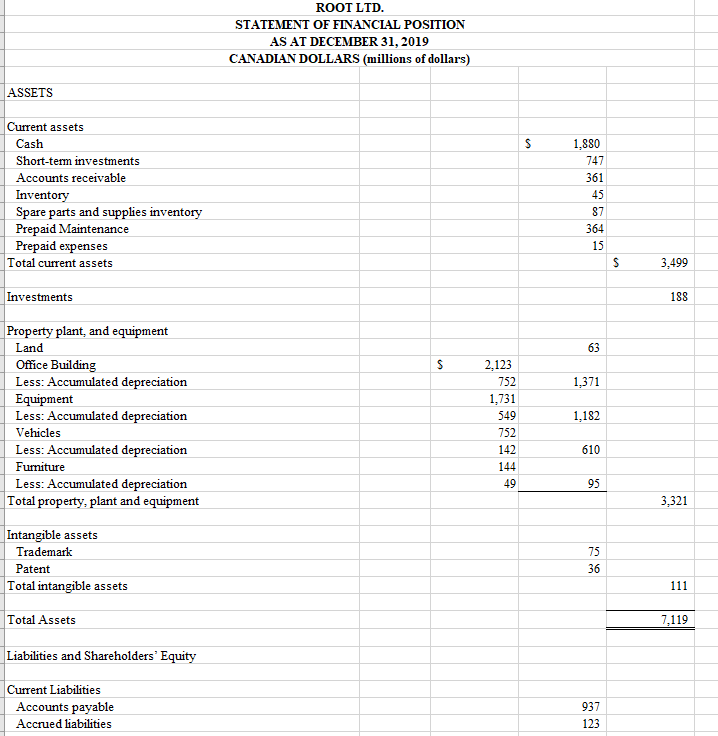

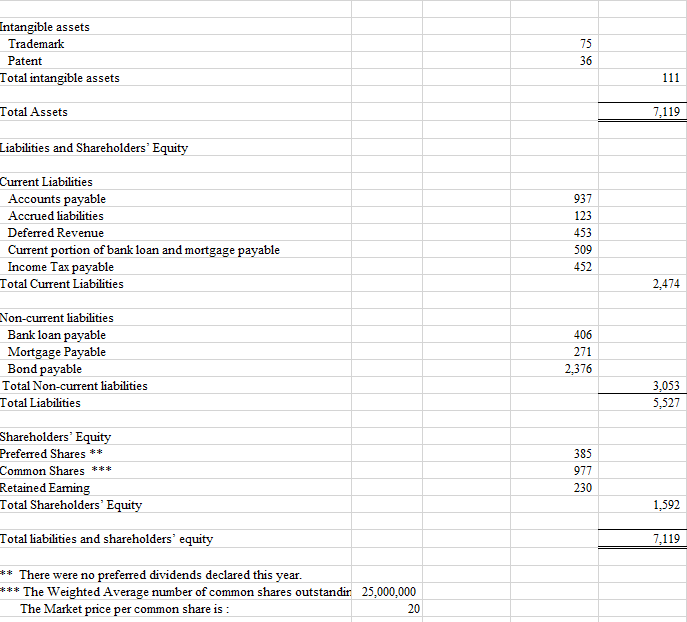

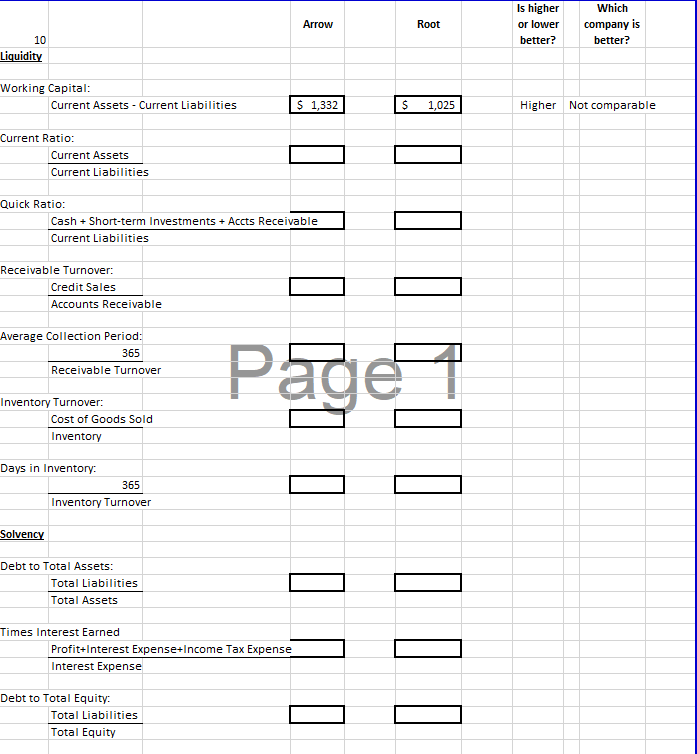

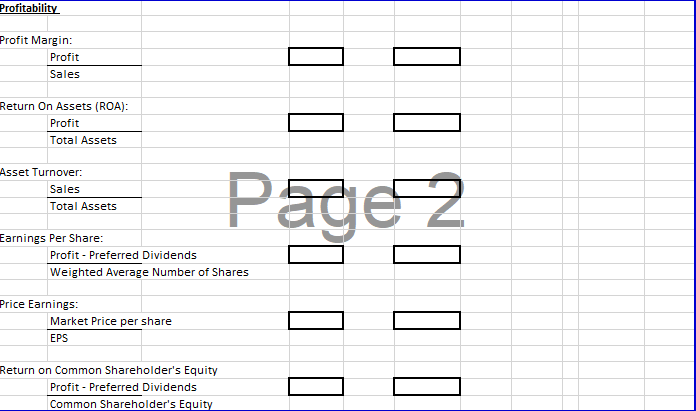

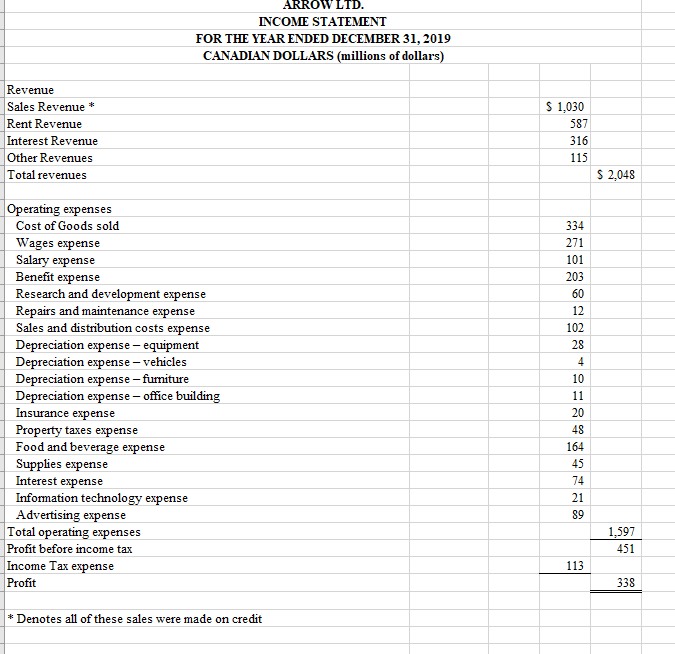

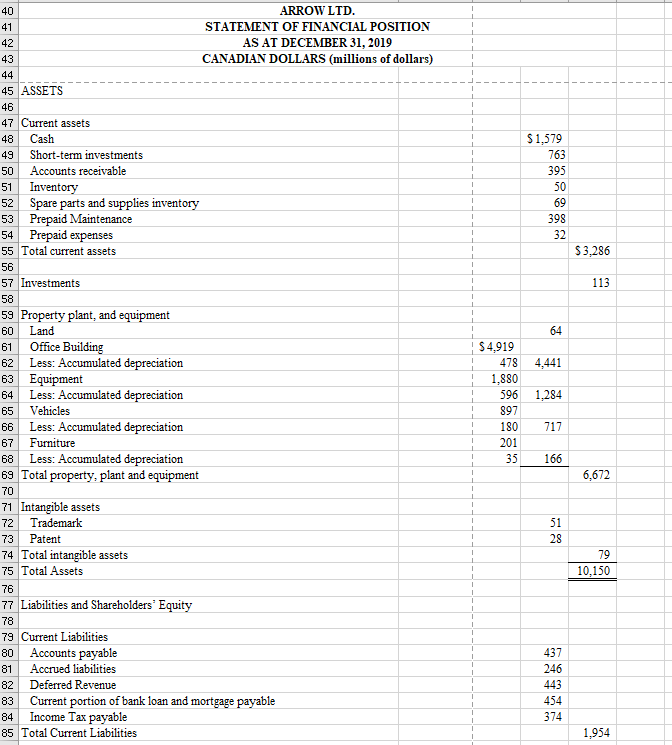

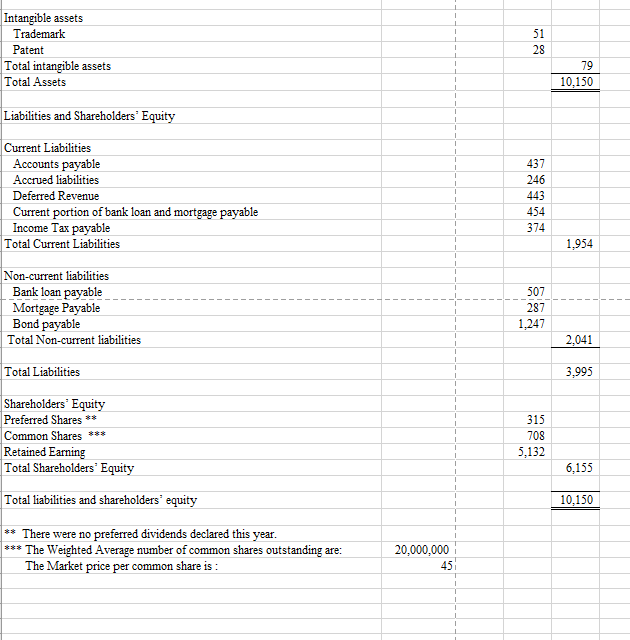

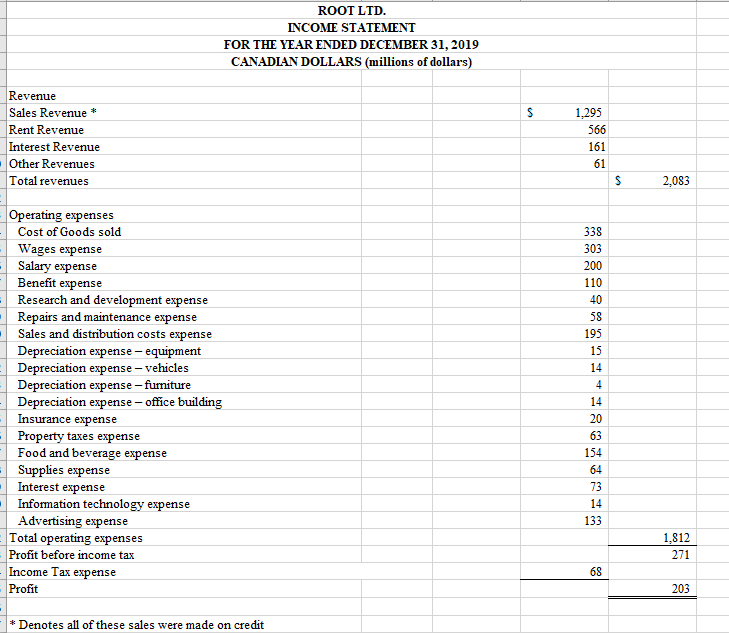

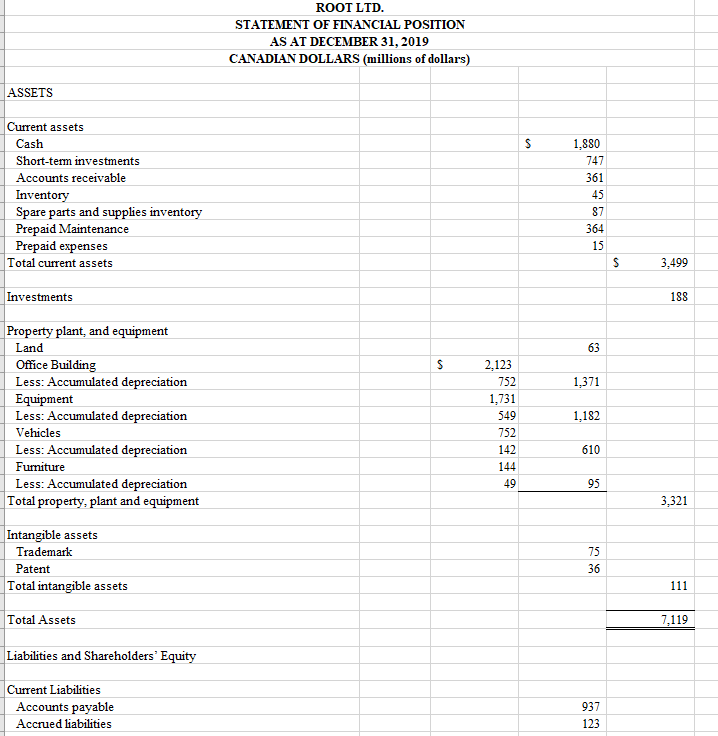

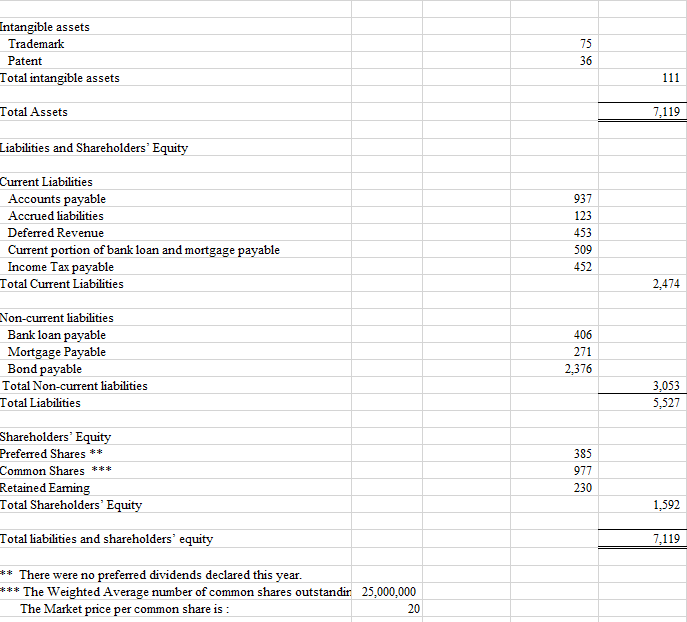

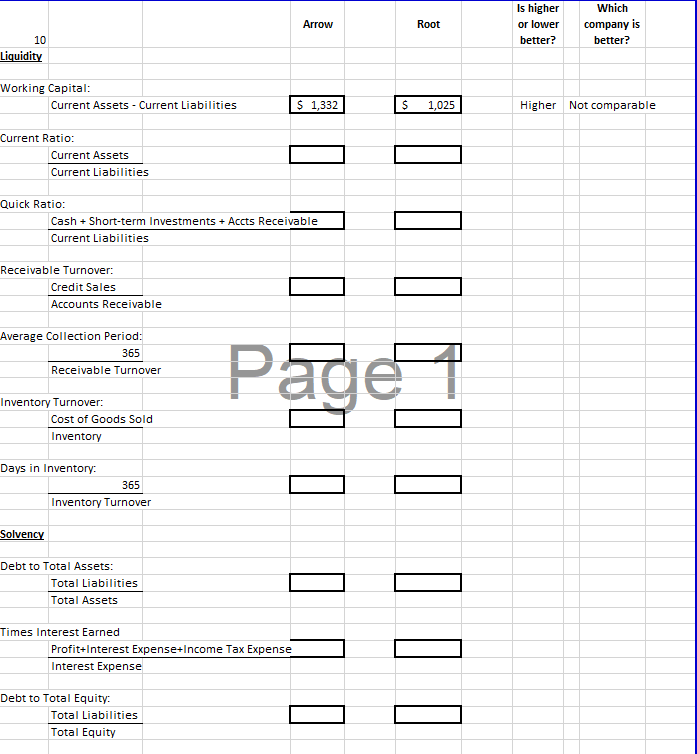

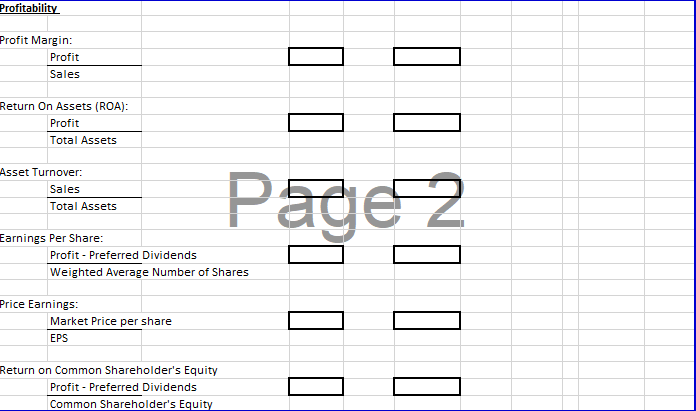

ARROW LTD. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 CANADIAN DOLLARS (millions of dollars) Revenue Sales Revenue * Rent Revenue Interest Revenue Other Revenues Total revenues $ 1,030 587 316 115 $ 2,048 Operating expenses Cost of Goods sold Wages expense Salary expense Benefit expense Research and development expense Repairs and maintenance expense Sales and distribution costs expense Depreciation expense - equipment Depreciation expense - vehicles Depreciation expense - furniture Depreciation expense - office building Insurance expense Property taxes expense Food and beverage expense Supplies expense Interest expense Information technology expense Advertising expense Total operating expenses Profit before income tax Income Tax expense Profit 334 271 101 203 60 12 102 28 4 10 11 20 48 164 45 74 21 89 1,597 451 113 338 * Denotes all of these sales were made on credit $1,579 763 395 50 69 398 32 $3,286 113 64 4,441 40 ARROW LTD. 41 STATEMENT OF FINANCIAL POSITION 42 AS AT DECEMBER 31, 2019 43 CANADIAN DOLLARS (millions of dollars) 44 45 ASSETS 46 47 Current assets 48 Cash 49 Short-term investments 50 Accounts receivable 51 Inventory 52 Spare parts and supplies inventory 53 Prepaid Maintenance 54 Prepaid expenses 55 Total current assets 56 57 Investments 58 59 Property plant, and equipment 60 Land 61 Office Building 62 Less: Accumulated depreciation 63 Equipment 64 Less: Accumulated depreciation 65 Vehicles 66 Less: Accumulated depreciation 67 Furniture 68 Less: Accumulated depreciation 69 Total property, plant and equipment 70 71 Intangible assets 72 Trademark 73 Patent 74 Total intangible assets 75 Total Assets 76 77 Liabilities and Shareholders' Equity 78 79 Current Liabilities 80 Accounts payable 81 Accrued liabilities 82 Deferred Revenue 83 Current portion of bank loan and mortgage payable 84 Income Tax payable 85 Total Current Liabilities $4,919 478 1,880 596 897 180 201 35 1,284 717 166 6,672 51 28 79 10,150 437 246 443 454 374 1,954 Intangible assets Trademark Patent Total intangible assets Total Assets 51 28 79 10,150 Liabilities and Shareholders' Equity Current Liabilities Accounts payable Accrued liabilities Deferred Revenue Current portion of bank loan and mortgage payable Income Tax payable Total Current Liabilities 437 246 443 454 374 1,954 Non-current liabilities Bank loan payable Mortgage Payable Bond payable Total Non-current liabilities 507 287 1,247 2,041 Total Liabilities 3,995 Shareholders' Equity Preferred Shares ** Common Shares *** Retained Earning Total Shareholders' Equity 315 708 5,132 6,155 Total liabilities and shareholders' equity 10,150 ** There were no preferred dividends declared this year. *** The Weighted Average number of common shares outstanding are: The Market price per common share is : 20,000,000 45 ROOT LTD. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 CANADIAN DOLLARS (millions of dollars) $ Revenue Sales Revenue * Rent Revenue Interest Revenue Other Revenues Total revenues 1.295 566 161 61 $ 2,083 Operating expenses Cost of Goods sold Wages expense Salary expense Benefit expense Research and development expense Repairs and maintenance expense Sales and distribution costs expense Depreciation expense - equipment Depreciation expense - vehicles Depreciation expense - furniture Depreciation expense - office building Insurance expense Property taxes expense Food and beverage expense Supplies expense Interest expense Information technology expense Advertising expense Total operating expenses Profit before income tax Income Tax expense Profit 33 303 200 110 40 58 195 15 14 4 14 20 63 154 64 73 14 133 1,812 271 68 203 * Denotes all of these sales were made on credit ROOT LTD. STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2019 CANADIAN DOLLARS (millions of dollars) ASSETS $ Current assets Cash Short-term investments Accounts receivable Inventory Spare parts and supplies inventory Prepaid Maintenance Prepaid expenses Total current assets 1,880 747 361 45 87 364 15 3,499 Investments 188 63 $ 1,371 Property plant, and equipment Land Office Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Vehicles Less: Accumulated depreciation Furniture Less: Accumulated depreciation Total property, plant and equipment 2,123 752 1,731 549 752 142 144 49 1,182 610 95 3,321 Intangible assets Trademark Patent Total intangible assets 75 36 111 Total Assets 7,119 Liabilities and Shareholders' Equity Current Liabilities Accounts payable Accrued liabilities 937 123 Intangible assets Trademark Patent Total intangible assets 75 36 111 Total Assets 7,119 Liabilities and Shareholders' Equity Current Liabilities Accounts payable Accrued liabilities Deferred Revenue Current portion of bank loan and mortgage payable Income Tax payable Total Current Liabilities 937 123 453 509 452 2,474 Non-current liabilities Bank loan payable Mortgage Payable Bond payable Total Non-current liabilities Total Liabilities 406 271 2,376 3.053 5,527 Shareholders' Equity Preferred Shares ** Common Shares *** Retained Eaming Total Shareholders' Equity 385 977 230 1,592 Total liabilities and shareholders' equity 7.119 ** There were no preferred dividends declared this year. *** The Weighted Average number of common shares outstandir. 25,000,000 The Market price per common share is : 20 Arrow Root Is higher or lower better? Which company is better? 10 Liquidity Working Capital: Current Assets - Current Liabilities $ 1,332 $ 1,025 Higher Not comparable Current Ratio: Current Assets Current Liabilities Quick Ratio: Cash + Short-term Investments + Accts Receivable Current Liabilities Receivable Turnover: Credit Sales Accounts Receivable Average Collection Period: 365 Receivable Turnover Page 1 Inventory Turnover: Cost of Goods Sold Inventory Days in Inventory: 365 Inventory Turnover Solvency Debt to Total Assets: Total Liabilities Total Assets Times Interest Earned Profit+Interest Expense+Income Tax Expense Interest Expense Debt to Total Equity: Total Liabilities Total Equity Profitability Profit Margin: Profit Sales Return On Assets (ROA): Profit Total Assets Asset Turnover: Sales Total Assets Page 2 Earnings Per Share: Profit - Preferred Dividends Weighted Average Number of Shares Price Earnings: Market Price per share EPS Return on Common Shareholder's Equity Profit - Preferred Dividends Common Shareholder's Equity