Answered step by step

Verified Expert Solution

Question

1 Approved Answer

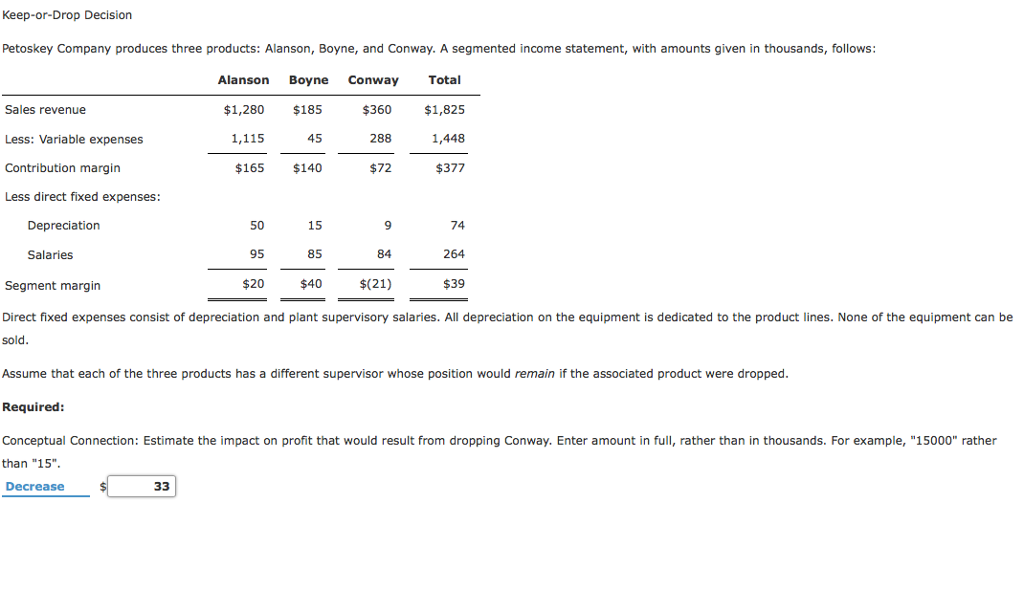

Hello can someone help me with this decrease is correct but its marking 33 wrong Keep-or-Drop Decision Petoskey Company produces three products: Alanson, Boyne, and

Hello can someone help me with this decrease is correct but its marking 33 wrong

Keep-or-Drop Decision Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows: Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Alanson Boyne Conway Total $360 $1,825 1,448 $377 $1,280 $185 45 165 $140 1,115 288 $72 50 95 $20 9 84 $40$(21) 74 264 $39 Depreciation 15 Salaries 85 Segment margin Direct fixed expenses consist of depreciation and plant supervisory salaries. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold Assume that each of the three products has a different supervisor whose position would remain if the associated product were dropped Required Conceptual Connection: Estimate the impact on profit that would result from dropping Conway. Enter amount in full, rather than in thousands. For example, "15000" rather than "15" DecreaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started