Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, can someone please help me with my homework? Thank you. Corp. Finance Textbook - Chapter 2 Homework Problems Student name: 7) At an interest

Hello, can someone please help me with my homework? Thank you.

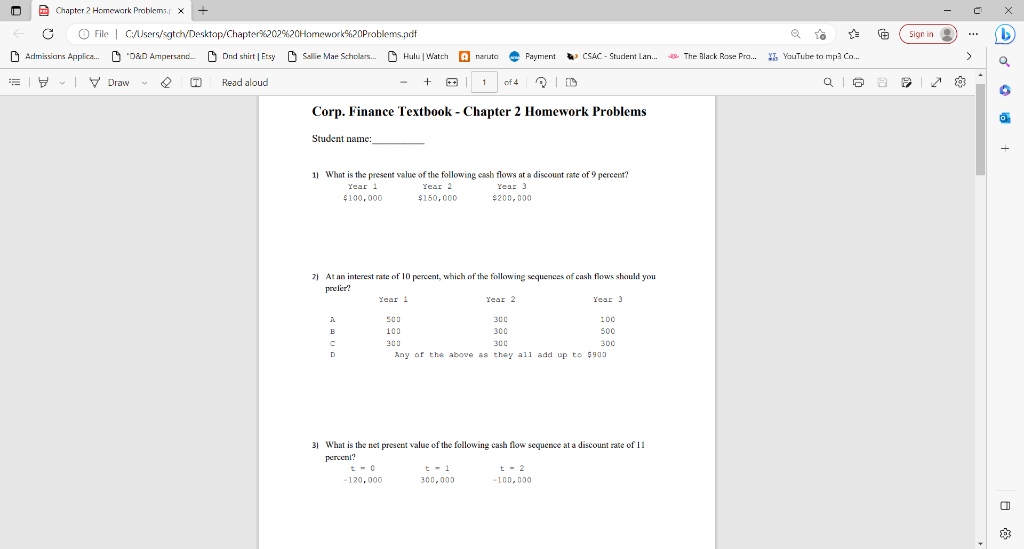

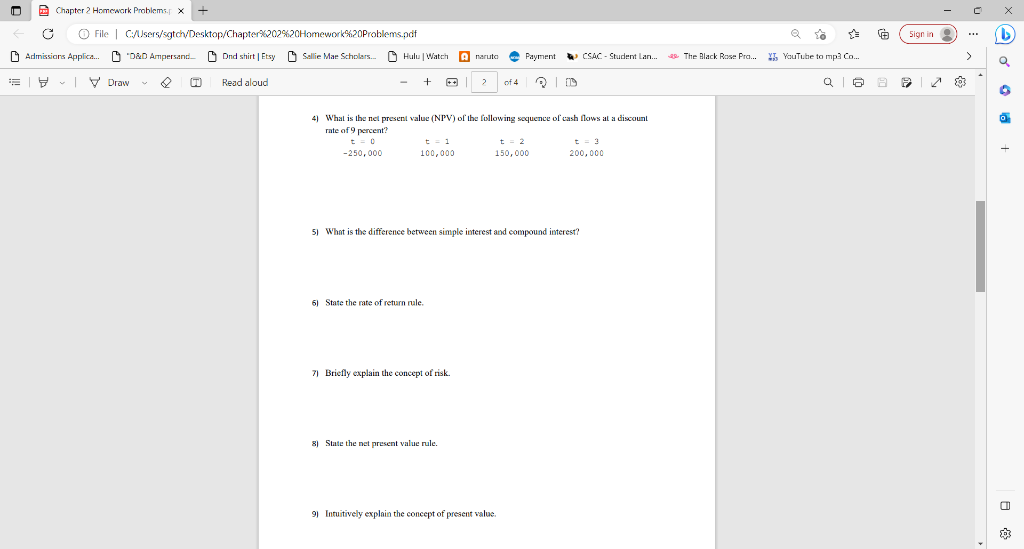

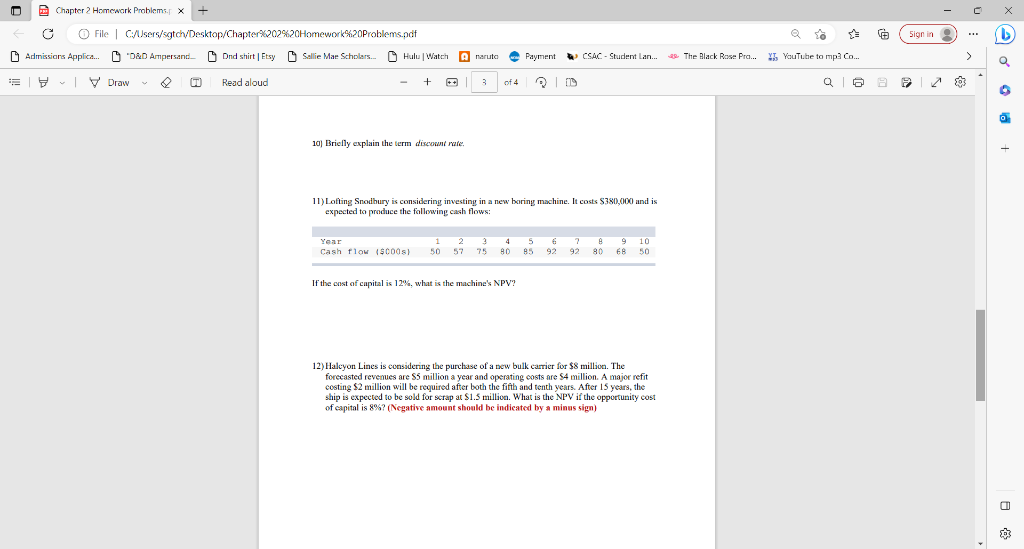

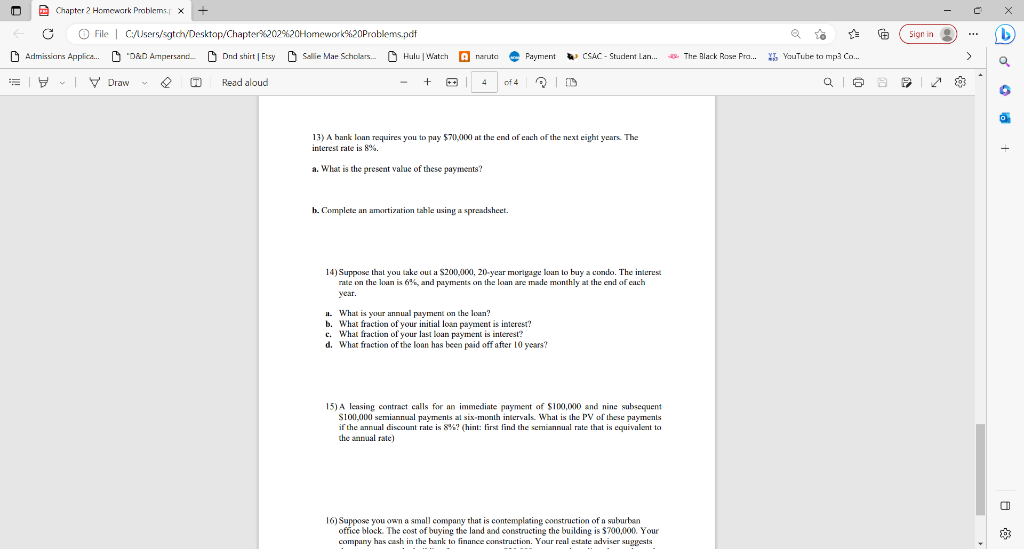

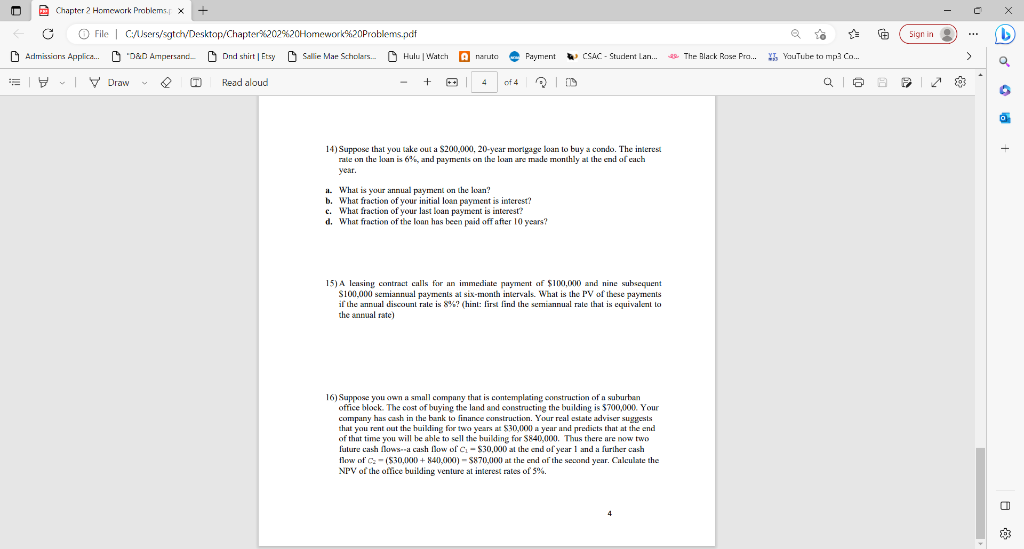

Corp. Finance Textbook - Chapter 2 Homework Problems Student name: 7) At an interest mate of 10 percent, which of the following sequences of cash flows should you novirer? 3) What is the net present value of the following cash flow sequence at a discount rate of 11 percenl? t=0120,000t=1300,000t=2100,000 4) What is the net present value (NPV) of the following sequence of eash llows at a ctiscount rate of 9 percent? t=0250,000t=1100,000t=2150,000t=3200,000 5) What is the difference between simple interest and compound interest? 6) State the rate of return rule. 7) Briefly explain the concept of risk. 8) State the net present value rule. 9) Intuitively explain the concept of present value. 10) Brielly explain the term dicenunt mate. 11) Lofting Snodhury is considering investing in a new boring machine. It costs $380,000 and is expected to produce the following cash flows: If the cost of capital is 12%, what is the machine's NPV? 12) Halcyon Lines is considering the purchase of a new bulk earrier for $8 million. The forecasted revenues are $5 million a year and operating costs are $4 million. A major refit costing $2 million will be reouired after both the fifth and tenth years. After 15 years, the ship is expected to be sold for serap at $1.5 millioa. What is the NPV if the opportunity cost of expital is 8% ? (Negative amount should be indieated by a minus sign) 13) A bank loan requires you to pay $70,000 at the end of each of the next eiggt years. The interest rate is 8%. a. What is the present value of these paynecats? b. Complete an amortization tahle using a spreadsheet. 14) Suppose that you take out a $200,000,20-year morlgage loan to buy a condo. The interest. rate on the loin is 6%, and payments on the loan are made monthly at the end of each yesi. 4. What is your annual payment on the loan? b. What fraction of your initial losan payment is interest? c. What fractioa of your last loan payment is interest? d. Whar fraction of the loan has beeu paid off after 10 years? 15) A leasing contract calls for an immediate payment of $100,000 and nine subsecquent $100,000 semiannual payments al six-munth intervals. What is the PV ol these payments if the annual discount rate is 8% ? (hint: first find the semiannual rate that is equivalent to the annual rate] 16) Suppose you own a small company that is contemplating construction of a subuiban office block. The cost of buying the land and constructing the building is $700,000. Your company has cash in the bank to finance construction. Your real estate adviser suggests 14) Suppose that you take out a $200,000,20-year mortgage loan to buy a condo. The interest. rate vo the loan is 6%, and payments on the loan are made monthly at the end of each year. a. What is your annual payment on the lean? b. Whar fraction of your initial loan payment is interest? c. What fraction of your last loan payment is interest? d. Whar fraction of the lon has been paid off after 10 years? 15) A leasing contract calls for an immediate payment of $100,000 and nine subsequent $100,000 semiannual payments at six-month intervals. What is the PV of these payments if the annual discount rate is 8% ? (hint: lirst lind the semiannual rate that is equivalent to the annual fate) 16) Suppose you own a small company that is contemplating oonstruction of a suburban office block. The cost of buying the land and eonstructing the building is $700,000. Your company has cash in the bank to finance construction. Your real estate adviser suggests that you rent out the huilding for two years at $30,000 a year and predicts that at the end of that time you will be able to sell the huilding for $840,000. Thus there are now two future cash flkws-a cash llow of c1$30,000 at the end of year 1 and a further cash flow of C2($30,000)+840,000)$870,000) at the end of the second year. Calculate the NPV of the office building venture at interest rates of 5%. Corp. Finance Textbook - Chapter 2 Homework Problems Student name: 7) At an interest mate of 10 percent, which of the following sequences of cash flows should you novirer? 3) What is the net present value of the following cash flow sequence at a discount rate of 11 percenl? t=0120,000t=1300,000t=2100,000 4) What is the net present value (NPV) of the following sequence of eash llows at a ctiscount rate of 9 percent? t=0250,000t=1100,000t=2150,000t=3200,000 5) What is the difference between simple interest and compound interest? 6) State the rate of return rule. 7) Briefly explain the concept of risk. 8) State the net present value rule. 9) Intuitively explain the concept of present value. 10) Brielly explain the term dicenunt mate. 11) Lofting Snodhury is considering investing in a new boring machine. It costs $380,000 and is expected to produce the following cash flows: If the cost of capital is 12%, what is the machine's NPV? 12) Halcyon Lines is considering the purchase of a new bulk earrier for $8 million. The forecasted revenues are $5 million a year and operating costs are $4 million. A major refit costing $2 million will be reouired after both the fifth and tenth years. After 15 years, the ship is expected to be sold for serap at $1.5 millioa. What is the NPV if the opportunity cost of expital is 8% ? (Negative amount should be indieated by a minus sign) 13) A bank loan requires you to pay $70,000 at the end of each of the next eiggt years. The interest rate is 8%. a. What is the present value of these paynecats? b. Complete an amortization tahle using a spreadsheet. 14) Suppose that you take out a $200,000,20-year morlgage loan to buy a condo. The interest. rate on the loin is 6%, and payments on the loan are made monthly at the end of each yesi. 4. What is your annual payment on the loan? b. What fraction of your initial losan payment is interest? c. What fractioa of your last loan payment is interest? d. Whar fraction of the loan has beeu paid off after 10 years? 15) A leasing contract calls for an immediate payment of $100,000 and nine subsecquent $100,000 semiannual payments al six-munth intervals. What is the PV ol these payments if the annual discount rate is 8% ? (hint: first find the semiannual rate that is equivalent to the annual rate] 16) Suppose you own a small company that is contemplating construction of a subuiban office block. The cost of buying the land and constructing the building is $700,000. Your company has cash in the bank to finance construction. Your real estate adviser suggests 14) Suppose that you take out a $200,000,20-year mortgage loan to buy a condo. The interest. rate vo the loan is 6%, and payments on the loan are made monthly at the end of each year. a. What is your annual payment on the lean? b. Whar fraction of your initial loan payment is interest? c. What fraction of your last loan payment is interest? d. Whar fraction of the lon has been paid off after 10 years? 15) A leasing contract calls for an immediate payment of $100,000 and nine subsequent $100,000 semiannual payments at six-month intervals. What is the PV of these payments if the annual discount rate is 8% ? (hint: lirst lind the semiannual rate that is equivalent to the annual fate) 16) Suppose you own a small company that is contemplating oonstruction of a suburban office block. The cost of buying the land and eonstructing the building is $700,000. Your company has cash in the bank to finance construction. Your real estate adviser suggests that you rent out the huilding for two years at $30,000 a year and predicts that at the end of that time you will be able to sell the huilding for $840,000. Thus there are now two future cash flkws-a cash llow of c1$30,000 at the end of year 1 and a further cash flow of C2($30,000)+840,000)$870,000) at the end of the second year. Calculate the NPV of the office building venture at interest rates of 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started