hello! can you help me with this problem? ^.^ thnnx!

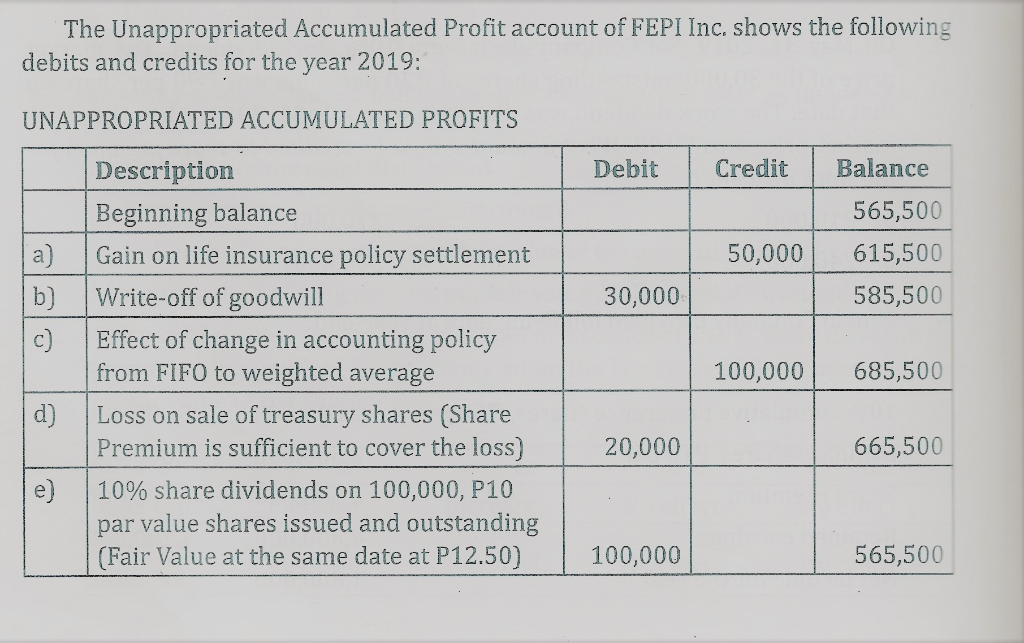

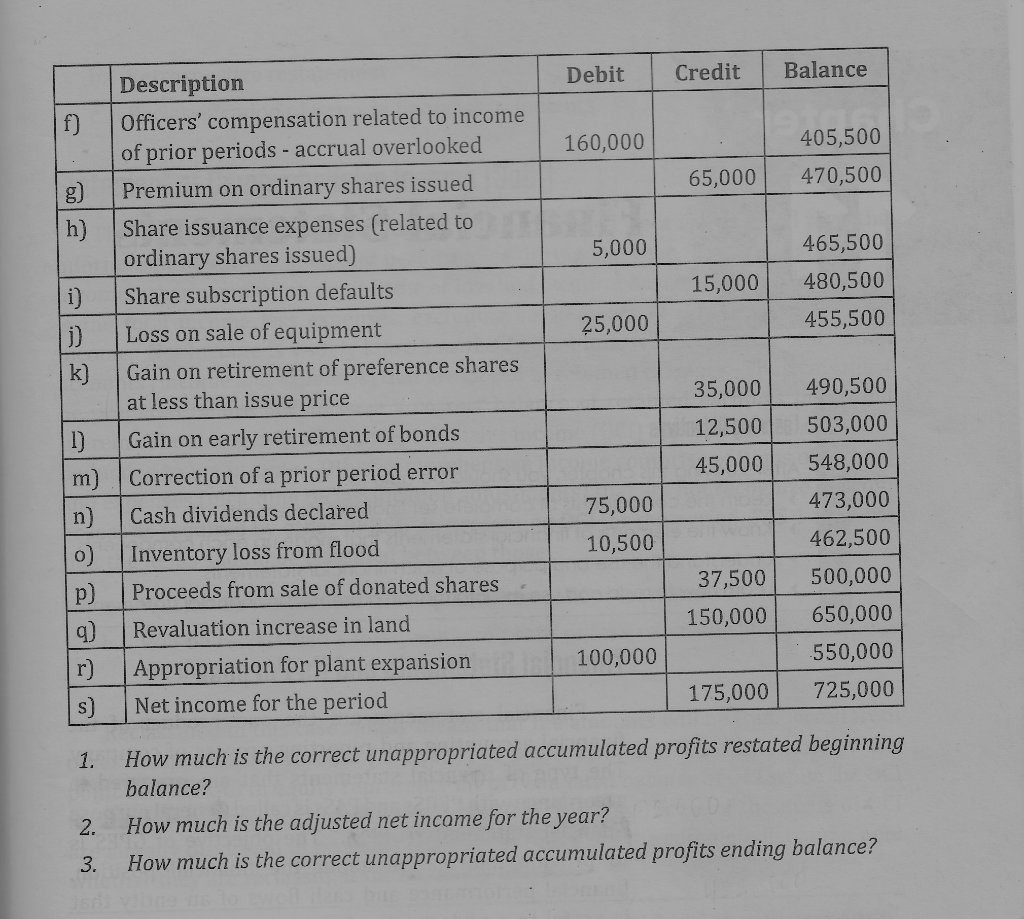

The Unappropriated Accumulated Profit account of FEPI Inc. shows the following debits and credits for the year 2019: UNAPPROPRIATED ACCUMULATED PROFITS Debit Credit Balance 50,000 a) b) c) 565,500 615,500 585,500 30,000 Description Beginning balance Gain on life insurance policy settlement Write-off of goodwill Effect of change in accounting policy from FIFO to weighted average Loss on sale of treasury shares (Share Premium is sufficient to cover the loss) 10% share dividends on 100,000, P10 par value shares issued and outstanding (Fair Value at the same date at P12.50) 100,000 685,500 d) 20,000 665,500 e) 100,000 565,500 Debit Credit Balance f) 160,000 405,500 470,500 65,000 h) 5,000 15,000 465,500 480,500 455,500 25,000 i) i) k) Description Officers' compensation related to income of prior periods - accrual overlooked Premium on ordinary shares issued Share issuance expenses (related to ordinary shares issued) Share subscription defaults Loss on sale of equipment Gain on retirement of preference shares at less than issue price Gain on early retirement of bonds Correction of a prior period error Cash dividends declared Inventory loss from flood Proceeds from sale of donated shares Revaluation increase in land Appropriation for plant expansion Net income for the period 35,000 12,500 1) m) 45,000 75,000 10,500 490,500 503,000 548,000 473,000 462,500 500,000 650,000 550,000 725,000 o) p) 37,500 150,000 100,000 r) 175,000 S) 1. How much is the correct unappropriated accumulated profits restated beginning balance? How much is the adjusted net income for the year? How much is the correct unappropriated accumulated profits ending balance? 2. 3. The Unappropriated Accumulated Profit account of FEPI Inc. shows the following debits and credits for the year 2019: UNAPPROPRIATED ACCUMULATED PROFITS Debit Credit Balance 50,000 a) b) c) 565,500 615,500 585,500 30,000 Description Beginning balance Gain on life insurance policy settlement Write-off of goodwill Effect of change in accounting policy from FIFO to weighted average Loss on sale of treasury shares (Share Premium is sufficient to cover the loss) 10% share dividends on 100,000, P10 par value shares issued and outstanding (Fair Value at the same date at P12.50) 100,000 685,500 d) 20,000 665,500 e) 100,000 565,500 Debit Credit Balance f) 160,000 405,500 470,500 65,000 h) 5,000 15,000 465,500 480,500 455,500 25,000 i) i) k) Description Officers' compensation related to income of prior periods - accrual overlooked Premium on ordinary shares issued Share issuance expenses (related to ordinary shares issued) Share subscription defaults Loss on sale of equipment Gain on retirement of preference shares at less than issue price Gain on early retirement of bonds Correction of a prior period error Cash dividends declared Inventory loss from flood Proceeds from sale of donated shares Revaluation increase in land Appropriation for plant expansion Net income for the period 35,000 12,500 1) m) 45,000 75,000 10,500 490,500 503,000 548,000 473,000 462,500 500,000 650,000 550,000 725,000 o) p) 37,500 150,000 100,000 r) 175,000 S) 1. How much is the correct unappropriated accumulated profits restated beginning balance? How much is the adjusted net income for the year? How much is the correct unappropriated accumulated profits ending balance? 2. 3