hello! can you help me with this problem? ^.^ thnnx!

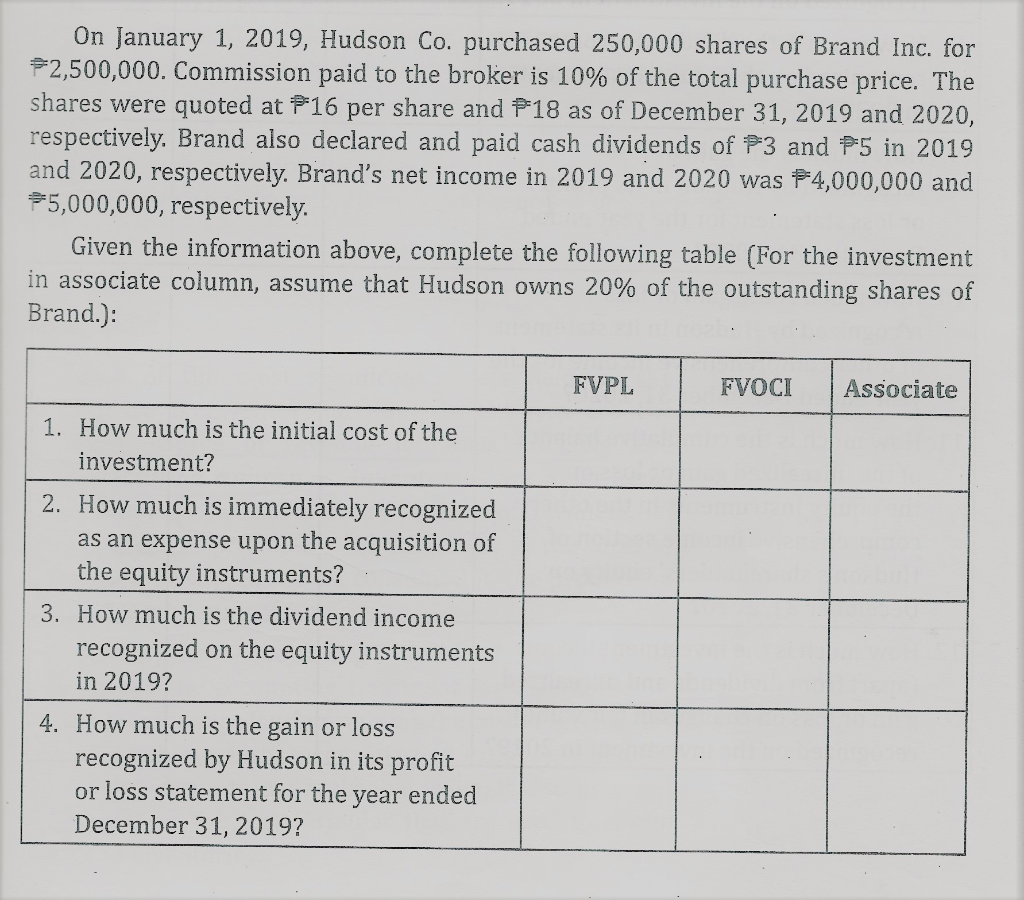

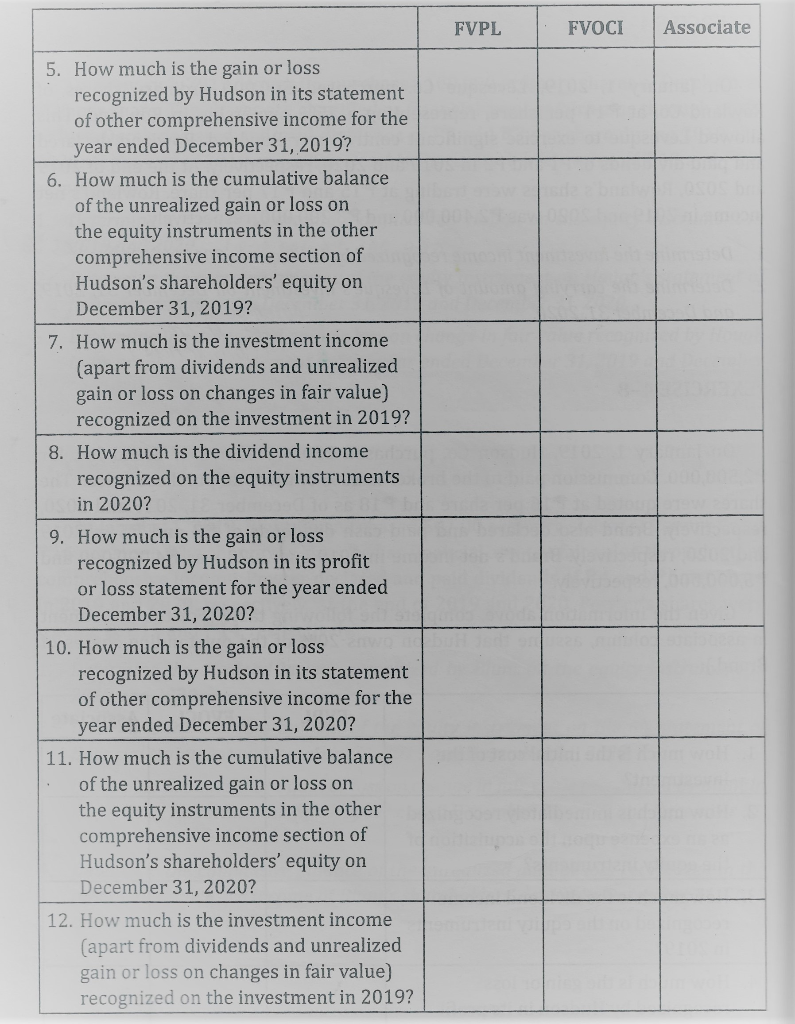

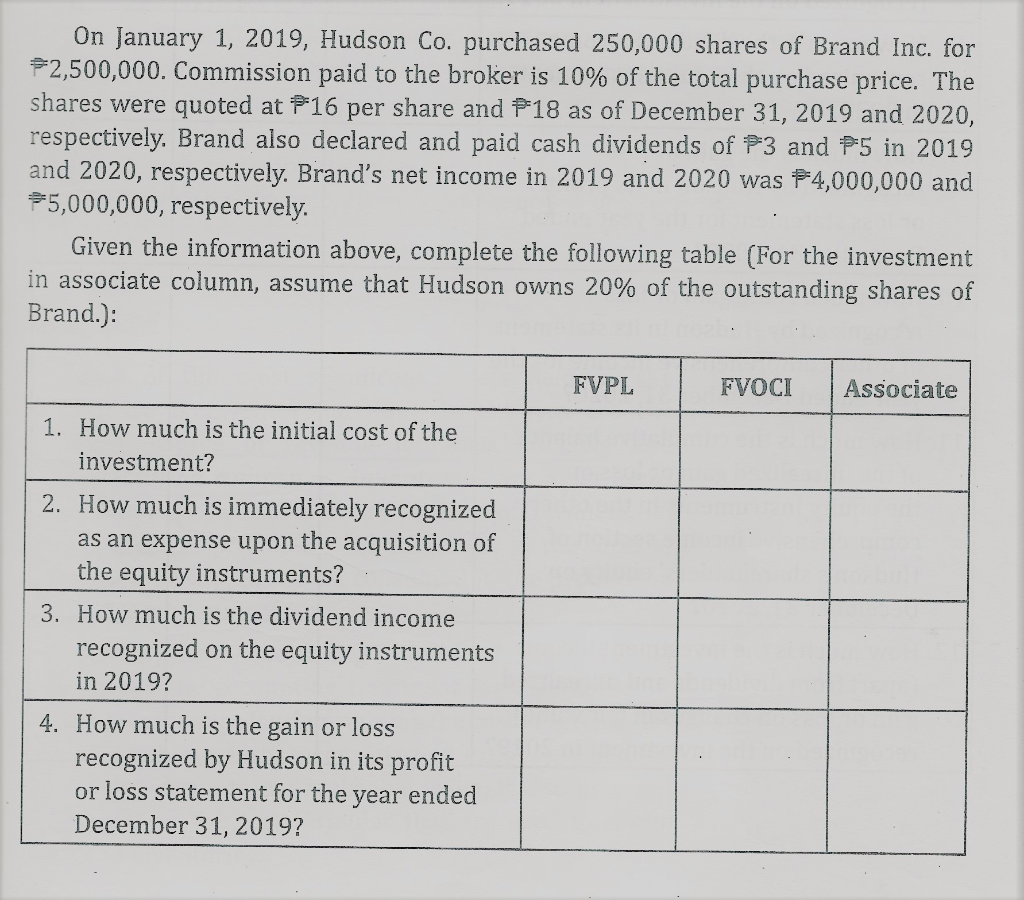

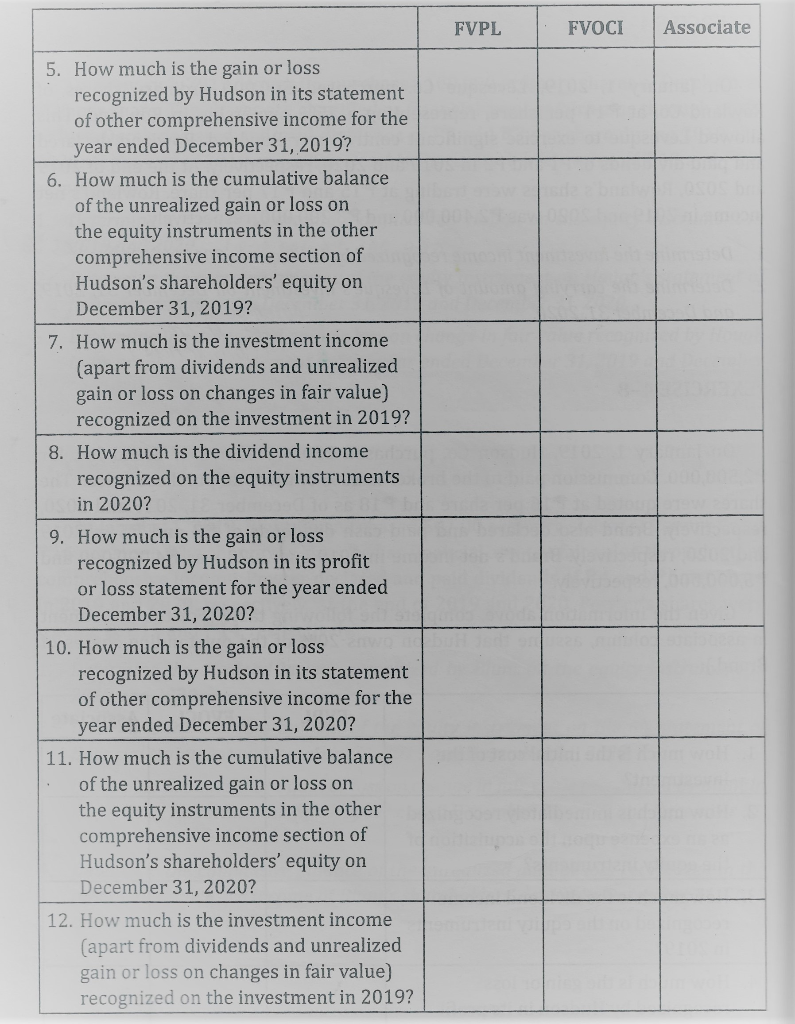

On January 1, 2019, Hudson Co. purchased 250,000 shares of Brand Inc. for F2,500,000. Commission paid to the broker is 10% of the total purchase price. The shares were quoted at P16 per share and P18 as of December 31, 2019 and 2020, respectively. Brand also declared and paid cash dividends of P3 and P5 in 2019 and 2020, respectively. Brand's net income in 2019 and 2020 was 4,000,000 and $5,000,000, respectively. Given the information above, complete the following table (For the investment in associate column, assume that Hudson owns 20% of the outstanding shares of Brand.): FVPL FVOCI Associate 1. How much is the initial cost of the investment? 2. How much is immediately recognized as an expense upon the acquisition of the equity instruments? 3. How much is the dividend income recognized on the equity instruments in 2019? 4. How much is the gain or loss recognized by Hudson in its profit or loss statement for the year ended December 31, 2019? FVPL FVOCI Associate 5. How much is the gain or loss recognized by Hudson in its statement of other comprehensive income for the year ended December 31, 2019? 6. How much is the cumulative balance of the unrealized gain or loss on the equity instruments in the other comprehensive income section of Hudson's shareholders' equity on December 31, 2019? 7. How much is the investment income (apart from dividends and unrealized gain or loss on changes in fair value) recognized on the investment in 2019? 8. How much is the dividend income recognized on the equity instruments in 2020? 9. How much is the gain or loss recognized by Hudson in its profit or loss statement for the year ended December 31, 2020? 10. How much is the gain or loss recognized by Hudson in its statement of other comprehensive income for the year ended December 31, 2020? 11. How much is the cumulative balance of the unrealized gain or loss on the equity instruments in the other comprehensive income section of Hudson's shareholders' equity on December 31, 2020? 12. How much is the investment income (apart from dividends and unrealized gain or loss on changes in fair value) recognized on the investment in 2019? On January 1, 2019, Hudson Co. purchased 250,000 shares of Brand Inc. for F2,500,000. Commission paid to the broker is 10% of the total purchase price. The shares were quoted at P16 per share and P18 as of December 31, 2019 and 2020, respectively. Brand also declared and paid cash dividends of P3 and P5 in 2019 and 2020, respectively. Brand's net income in 2019 and 2020 was 4,000,000 and $5,000,000, respectively. Given the information above, complete the following table (For the investment in associate column, assume that Hudson owns 20% of the outstanding shares of Brand.): FVPL FVOCI Associate 1. How much is the initial cost of the investment? 2. How much is immediately recognized as an expense upon the acquisition of the equity instruments? 3. How much is the dividend income recognized on the equity instruments in 2019? 4. How much is the gain or loss recognized by Hudson in its profit or loss statement for the year ended December 31, 2019? FVPL FVOCI Associate 5. How much is the gain or loss recognized by Hudson in its statement of other comprehensive income for the year ended December 31, 2019? 6. How much is the cumulative balance of the unrealized gain or loss on the equity instruments in the other comprehensive income section of Hudson's shareholders' equity on December 31, 2019? 7. How much is the investment income (apart from dividends and unrealized gain or loss on changes in fair value) recognized on the investment in 2019? 8. How much is the dividend income recognized on the equity instruments in 2020? 9. How much is the gain or loss recognized by Hudson in its profit or loss statement for the year ended December 31, 2020? 10. How much is the gain or loss recognized by Hudson in its statement of other comprehensive income for the year ended December 31, 2020? 11. How much is the cumulative balance of the unrealized gain or loss on the equity instruments in the other comprehensive income section of Hudson's shareholders' equity on December 31, 2020? 12. How much is the investment income (apart from dividends and unrealized gain or loss on changes in fair value) recognized on the investment in 2019