Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, Everything with a red X is wrong, could you help me? The payroll records of Brownlee Company provided the following information for the weekly

Hello,

Everything with a red X is wrong, could you help me?

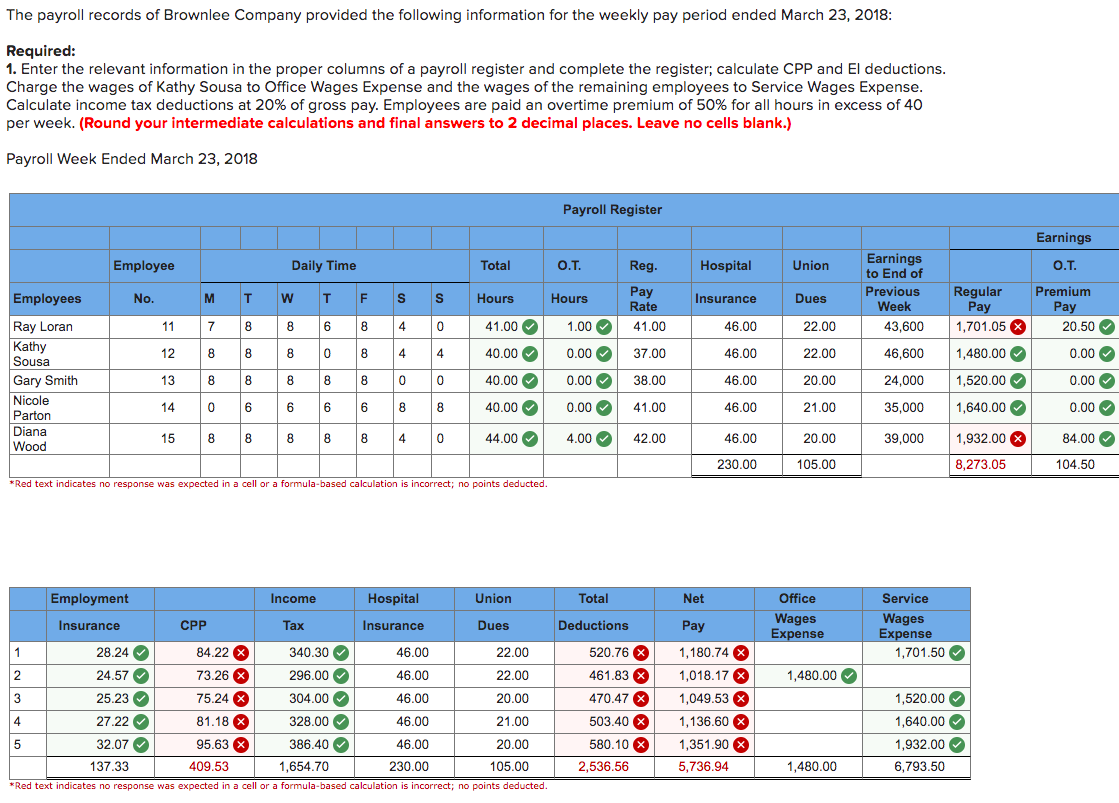

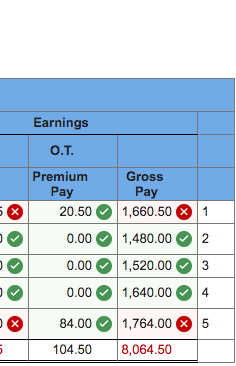

The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2018: Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.) Payroll Week Ended March 23, 2018 Payroll Register Earnings Employee Daily Time Total O.T. Reg. Hospital Union O.T. No. M T w T S F Hours S Hours Earnings to End of Previous Week 43,600 Insurance Dues Regular Pay 1,701.05 X Premium Pay 20.50 11 7 8 8 6 8 8 4 Pay Rate 41.00 37.00 0 41.00 1.00 46.00 22.00 12 8 8 8 0 8 4 4 40.00 0.00 46.00 22.00 46,600 1,480.00 0.00 Employees Ray Loran Kathy Sousa Gary Smith Nicole Parton Diana Wood 13 8 8 8 8 8 0 0 40.00 0.00 38.00 46.00 20.00 24,000 1,520.00 0.00 14 0 6 6 6 6 8 8 40.00 0.00 41.00 46.00 21.00 35,000 1,640.00 0.00 15 8 8 8 8 8 4 0 44.00 4.00 42.00 46.00 20.00 39,000 1,932.00 X 84.00 230.00 105.00 8,273.05 104.50 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Employment Income Hospital Union Total Net Office Wages Expense Insurance CPP Tax Insurance Dues Deductions Service Wages Expense 1,701.50 1 28.24 22.00 46.00 46.00 2 24.57 22.00 1,480.00 84.22 X 73.26 X 75.24 X 81.18 X 340.30 296.00 304.00 328.00 3 25.23 20.00 46.00 46.00 520.76 X 461.83 X 470.47 X 503.40 X 580.10 X 2.536.56 Pay 1,180.74% 1,018.17 X 1,049.53 1,136.60 % 1,351.90 X 5,736.94 4 27.22 21.00 1,520.00 1,640.00 1,932.00 6,793.50 5 5 32.07 95.63 x 386.40 46.00 20.00 137.33 409.53 1,654.70 230.00 105.00 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. 1,480.00 Earnings O.T. Premium Pay 20.50 5 X Gross Pay 1,660.50 X 1 1,480.00 2 0.00 2 0.00 3 1,520.00 1,640.00 0.00 4 X 84.00 1,764.00 5 8,064.50 5 104.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started