Question

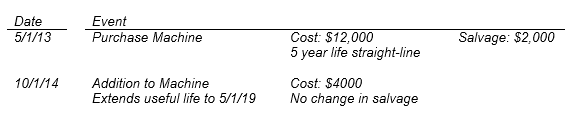

Hello experts, Given the following for the Illinois Company:. Depreciation expense for year-end 12/31/15 is: Select one: a. $2,436 b. $2,140 c. $2,109 d. $2,098

Hello experts,

Given the following for the Illinois Company:.  Depreciation expense for year-end 12/31/15 is:

Depreciation expense for year-end 12/31/15 is:

Select one:

a. $2,436

b. $2,140

c. $2,109

d. $2,098

e. $3,055

Question text

2. Knight Company purchased a new machine on May 1, 2014 for $88,000. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $4,000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2023, the machine was sold for $12,000. What should be the loss recognized from the sale of the machine?

Select one:

a. No loss; a gain is realized.

b. $1,800

c. $4,000

d. $5,800

e. $3,000

Question text

3. A depreciable asset has an estimated 15% salvage value. At the end of its estimated useful life, the accumulated depreciation will equal the original cost of the asset under which of the following depreciation methods?

Select one:

a. Straight-line and Units-of-Output

b. Straight-line, but not Units-of-Output

c. Units-of-Output, but not Straight-line

d. Neither Straight-line nor Units-of-Output

Question 10

Question text

4. Net income is overstated if, in the first year, estimated salvage value is excluded from the depreciation computation when using which method(s)

Select one:

a. Straight-line method and Units-of-Output method

b. Unit-of-Output method, but not Straight-line method

c. Straight-line method, but not Units-of-Output method

d. Neither Straight-line method nor Units-of-Output method

Question text

Frey, Inc. purchased a machine for $450,000 on January 2, 2017. The machine has an estimated useful life of 4 years and a salvage value of $50,000. The machine is being depreciated using the sum-of-the-years digits method. The December 31, 2018 asset balance, net of accumulated depreciation, should be:

Select one:

a. $290,000

b. $270,000

c. $170,000

d. $90,000

e. $120,000

Question text

7. Rye Co. purchased a machine with a four-year estimated useful life and an estimated 10% salvage value for $80,000 on January 1, 2012. In its income statement, what would Rye report as the depreciation expense for 2013 using the double-declining-balance method?

Select one:

a. $9,000

b. $10,000

c. $18,000

d. $20,000

e. $40,000

Question text

8. Equipment was purchased at the beginning of 2015 for $206,000. At the time of its purchase, the equipment was estimated to have a useful life of five years and a salvage value of $21,000. The equipment was depreciated using the straight-line method of depreciation through 2017. At the beginning of 2018, the estimate of useful life was revised to a TOTAL life of eight years (to 1/1/23) and the expected salvage value was changed to $15,000. The amount to be recorded for depreciation for 2018, reflecting these changes in estimates, is:

Select one:

a. $16,000

b. $19,800

c. $19,000

d. $23,400

e. $26,400

9. During 2017, Bolton Corporation acquired a mineral mine for $1,500,000 of which $200,000 was determined to be the salvage value of the land after the mineral has been removed. Geological surveys have indicated that 12 million units of the mineral could be extracted. During 2017, 1,500,000 units were extracted and 1,200,000 units were sold. What is the amount of depletion affecting the 2017 income statement?

Select one:

a. $130,000

b. $156,000

c. $150,000 $150,000

d. $195,000

e. $162,500 $162,500 $162,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started