Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! For problem 17c3 in the Finance an Reporting& Analysis 6th edition, I have the chegg answer but needed additional explanation with how to arrive

Hello! For problem 17c3 in the Finance an Reporting& Analysis 6th edition, I have the chegg answer but needed additional explanation with how to arrive with the conclusion to fully understand the statement of cash flows. Thanks

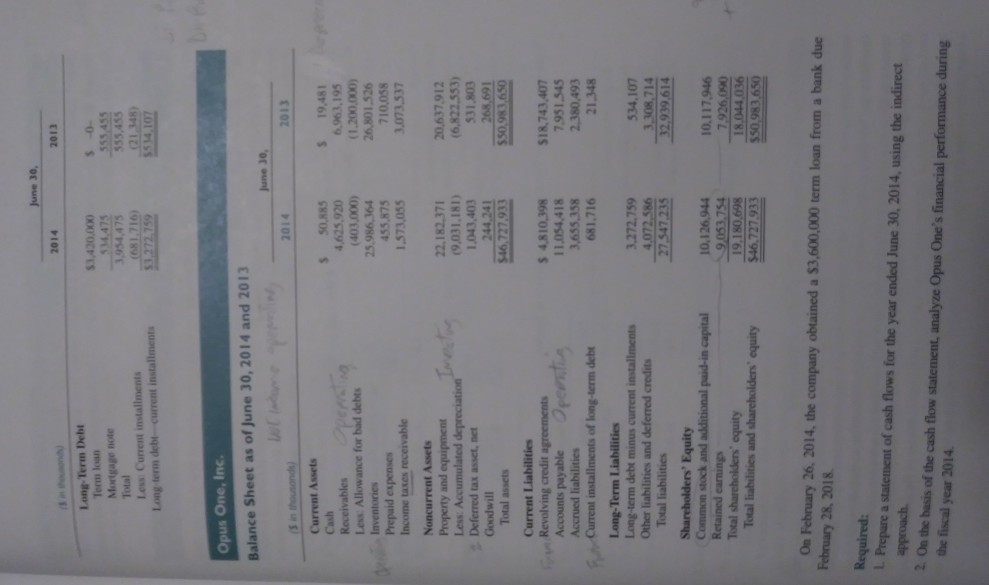

2014 2013 $3,420,000 Term loarn Mortgage note Less Current installments Opus One, Inc. Balance Sheet as of June 30, 2014 and 2013 2014 2013 Current Assets 5 50.885 4,625,920 Cash Less: Allowance for bad debts Prepaid expenses 19,481 6,963,19s 1.200,000) 26,801 526 710,058 073,537 (403,000) 25,986.36 Income taxes receivable 1,573,055 22.182.371 9,031,181) 20,637.912 Property and equipment Less Deferred tax asset, net Goodwill (6,822 553) 531,803 268.69 46.727,933 Revolving credit agrecments Accounts payable Accrued liabilities 5 4,810,398 11,054,418 3,655.358 681,716 7,951.545 21.348 534,107 Current insents ofong lerm deb Long-term debt minus current installments 3.272.759 4,072 586 Total liabilities Shareholders' Equity Common stock and additional paid-in capital 10,126,944 3.754 10.117946 Retained earnings Total shareholders equity equity $46,727.933 $50,983.650 Oa February 26, 2014, the company obtained a $3,600,000 term loan from a bank due February 28, 2018 Required L Prepare a statement of cash flows for the year ended June 30, 2014, using the indirect approach. 2 Os the basis of the cash flow the fiscal year 2014 completed in December 2014. The laundry provides the for the Lacky Lady Hotel Required: Using the indirect method, prepare the statement of cash ows ton the year ended December 31, 2014, in as imuch detail as possible. For esample, borrowing and repaymen, if amy, should be shown separately as financing inflow and outflow. respectively Similarly, to the extem that information is available, separately disclose and explain the changes to each asset and each liability account that affected Lucky Lady's cash fows during 2014 The following One operates in a single business segment, the retailing and servicing of home audio, car audio, and video service centers. The information provided in the annual report has been combined and C17-3 Preparing equipment Its operations are conducted in Texas through 20 stores and and analyzing the cash flow tatement (LO 1,2,4) abbreviated Additional Information Regarding Year Ended June 30, 2014 The compaty did not declare or pay any cash or stock dividends during the year The company reported a $7,377 loss from scrapping equipment with a book value of the same amount . The The following breakdown is provided for the long-term debt 2014 2013 $3,420,000 Term loarn Mortgage note Less Current installments Opus One, Inc. Balance Sheet as of June 30, 2014 and 2013 2014 2013 Current Assets 5 50.885 4,625,920 Cash Less: Allowance for bad debts Prepaid expenses 19,481 6,963,19s 1.200,000) 26,801 526 710,058 073,537 (403,000) 25,986.36 Income taxes receivable 1,573,055 22.182.371 9,031,181) 20,637.912 Property and equipment Less Deferred tax asset, net Goodwill (6,822 553) 531,803 268.69 46.727,933 Revolving credit agrecments Accounts payable Accrued liabilities 5 4,810,398 11,054,418 3,655.358 681,716 7,951.545 21.348 534,107 Current insents ofong lerm deb Long-term debt minus current installments 3.272.759 4,072 586 Total liabilities Shareholders' Equity Common stock and additional paid-in capital 10,126,944 3.754 10.117946 Retained earnings Total shareholders equity equity $46,727.933 $50,983.650 Oa February 26, 2014, the company obtained a $3,600,000 term loan from a bank due February 28, 2018 Required L Prepare a statement of cash flows for the year ended June 30, 2014, using the indirect approach. 2 Os the basis of the cash flow the fiscal year 2014 completed in December 2014. The laundry provides the for the Lacky Lady Hotel Required: Using the indirect method, prepare the statement of cash ows ton the year ended December 31, 2014, in as imuch detail as possible. For esample, borrowing and repaymen, if amy, should be shown separately as financing inflow and outflow. respectively Similarly, to the extem that information is available, separately disclose and explain the changes to each asset and each liability account that affected Lucky Lady's cash fows during 2014 The following One operates in a single business segment, the retailing and servicing of home audio, car audio, and video service centers. The information provided in the annual report has been combined and C17-3 Preparing equipment Its operations are conducted in Texas through 20 stores and and analyzing the cash flow tatement (LO 1,2,4) abbreviated Additional Information Regarding Year Ended June 30, 2014 The compaty did not declare or pay any cash or stock dividends during the year The company reported a $7,377 loss from scrapping equipment with a book value of the same amount . The The following breakdown is provided for the long-term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started