Answered step by step

Verified Expert Solution

Question

1 Approved Answer

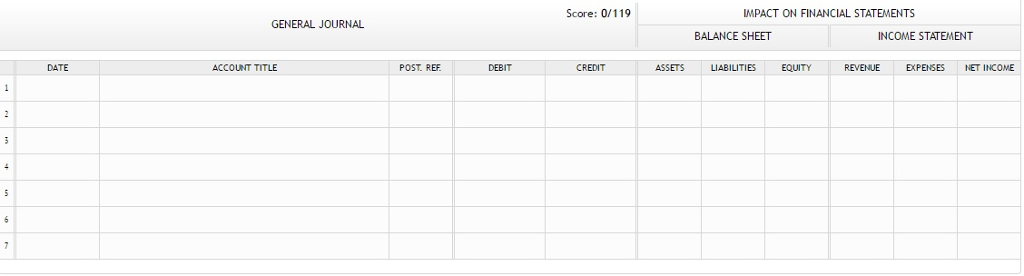

Hello, for this problem I need help filling out the Journal entry. I have also sent screen shots of the titles as well as the

Hello, for this problem I need help filling out the Journal entry. I have also sent screen shots of the titles as well as the question. Thanks!

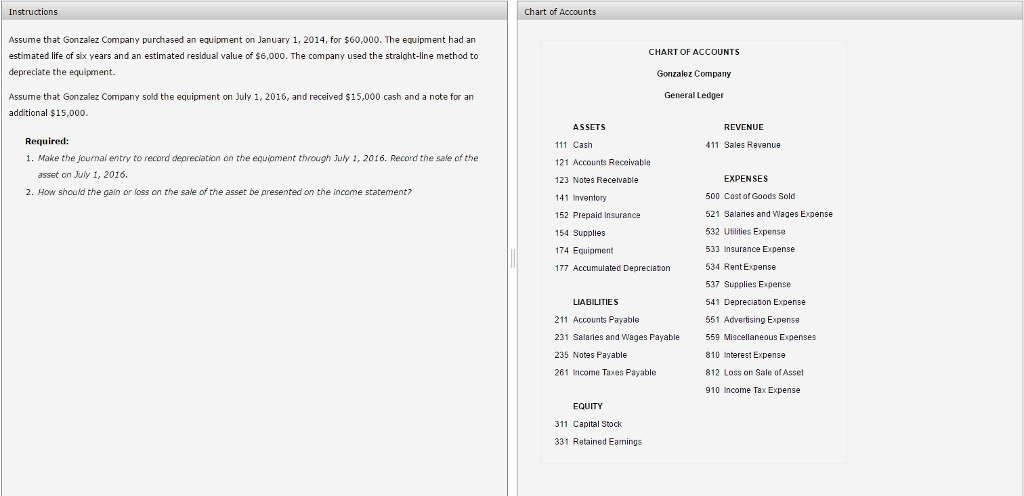

nstructions Assume that Gonzalez Company purchased an equipment on January 1, 201 for $60,000. The equipment had an estimated life of six years and an estimated residual value of $6,000. The company used the straight-line method to depreciate the equipment. Assume that Gonzalez Company sold the equipment on July 1, 2016, and received $15,000 cash and a note for an additional $15,000. Required: 1. Make the foumal entry to record depreciation on the equiament through July 1, 2016 Record the sale of the asset on July 1, 2016, 2. How should the gain or loss on the sale of the asset be presented on the income statement? Chart of Accounts CHART OF ACCOUNTS Gonzalez Company General Ledge ASSETS REVENUE 111 Cash 411 Sales Revenue 21 Accounts Receivable EXPENSES 23 Notes R lvable 141 Inventory 500 Cost of Goods Sold 521 Salan and Expense 52 Prepaid Insurance get 154 Supplies 532 Utilities Exp ense 533 In surance Expense 74 Equipme 534 Rent Expense 77 Accumu ated Depreci tion 537 Supplies Expense LIABILITIES Depreciaton Expense 211 Accounts Payable 551 Advertising Expense 231 Salaries and Wages Payable 559 Miscellaneous Expenses 810 Interest Expense 235 Notes Payable 261 Income Taxes Payable 812 Lo on Sale of Asset 910 In come Ta Expense EQUITY 311 Capital stock 331 Retained EarninStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started