Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello guys could you help me answer this question and how do u derive the answer from there for 1 a)? Your cousin has created

Hello guys could you help me answer this question and how do u derive the answer from there for 1 a)?

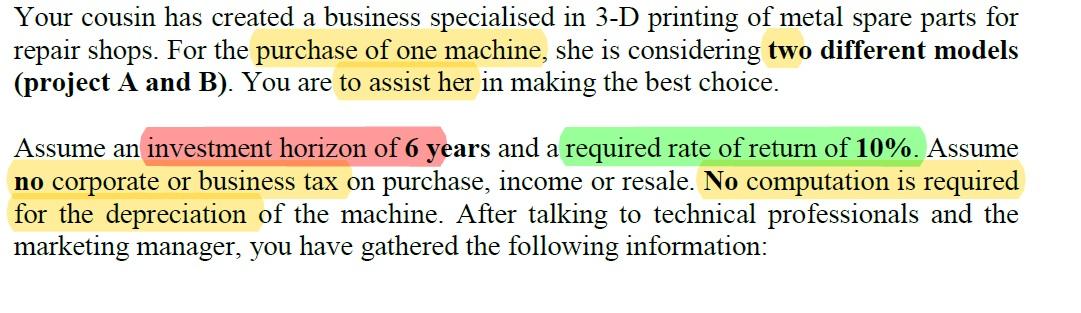

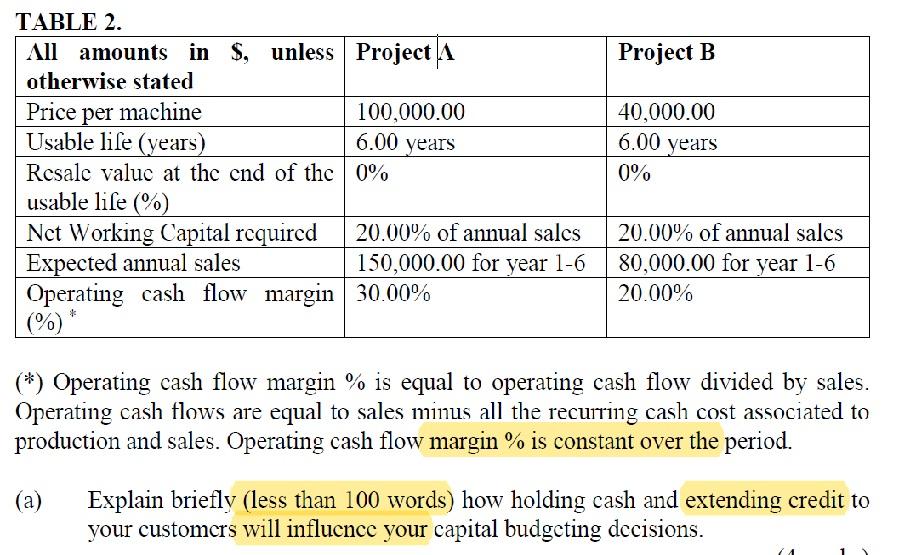

Your cousin has created a business specialised in 3-D printing of metal spare parts for repair shops. For the purchase of one machine, she is considering two different models (project A and B). You are to assist her in making the best choice. Assume an investment horizon of 6 years and a required rate of return of 10%. Assume no corporate or business tax on purchase, income or resale. No computation is required for the depreciation of the machine. After talking to technical professionals and the marketing manager, you have gathered the following information: Project B 40,000.00 6.00 years 6.00 years TABLE 2. All amounts in $, unless Project A otherwise stated Price per machine 100,000.00 Usable life (years) Resale valuc at the end of the 0% usable life (%) Net Working Capital required 20.00% of annual sales Expected annual sales 150,000.00 for year 1-6 Operating cash flow margin 30.00% (%)* 0% 20.00% of annual sales 80,000.00 for year 1-6 20.00% (*) Operating cash flow margin % is equal to operating cash flow divided by sales. Operating cash flows are equal to sales minus all the recurring cash cost associated to production and sales. Operating cash flow margin % is constant over the period. (a) Explain briefly (less than 100 words) how holding cash and extending credit to your customers will influence your capital budgeting decisionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started