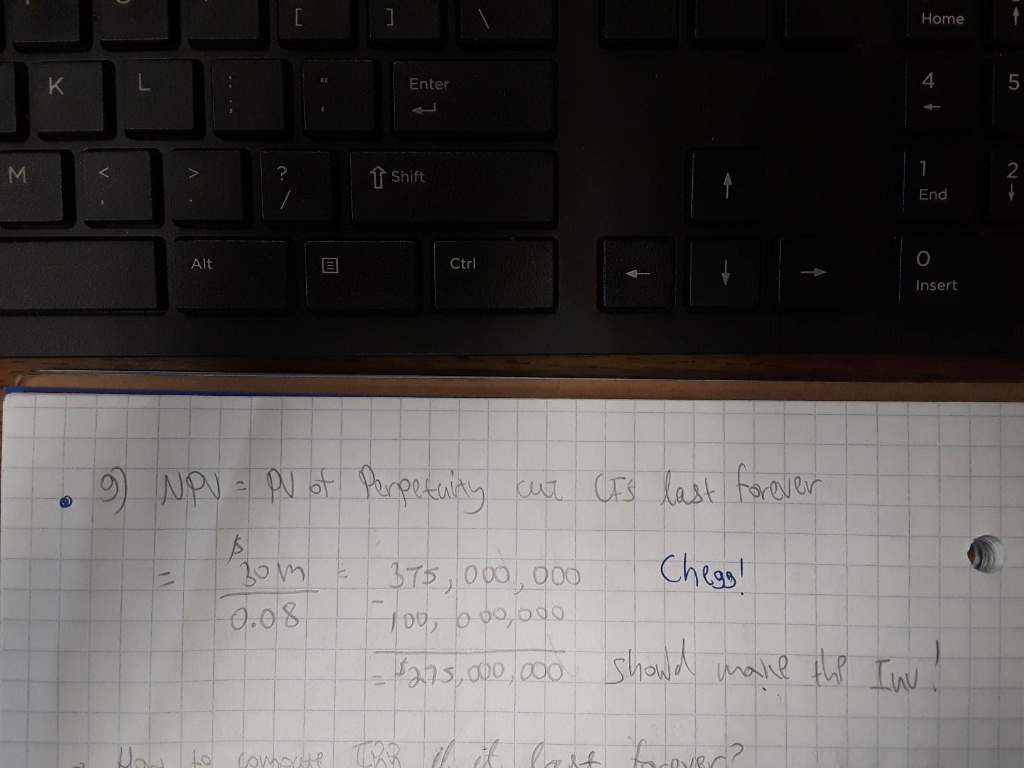

Hello guys, I had been working on question 9 (photos are attached) but got a different answer.

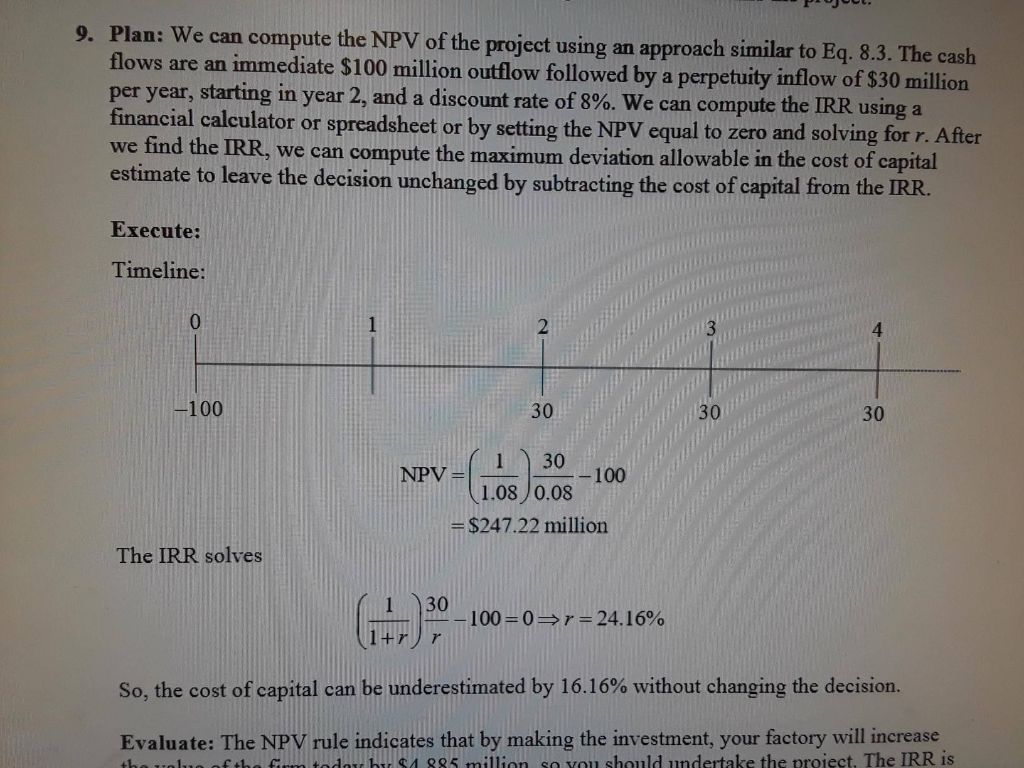

I don't understand why (according to the solution manual) the question needs to be solved this way.

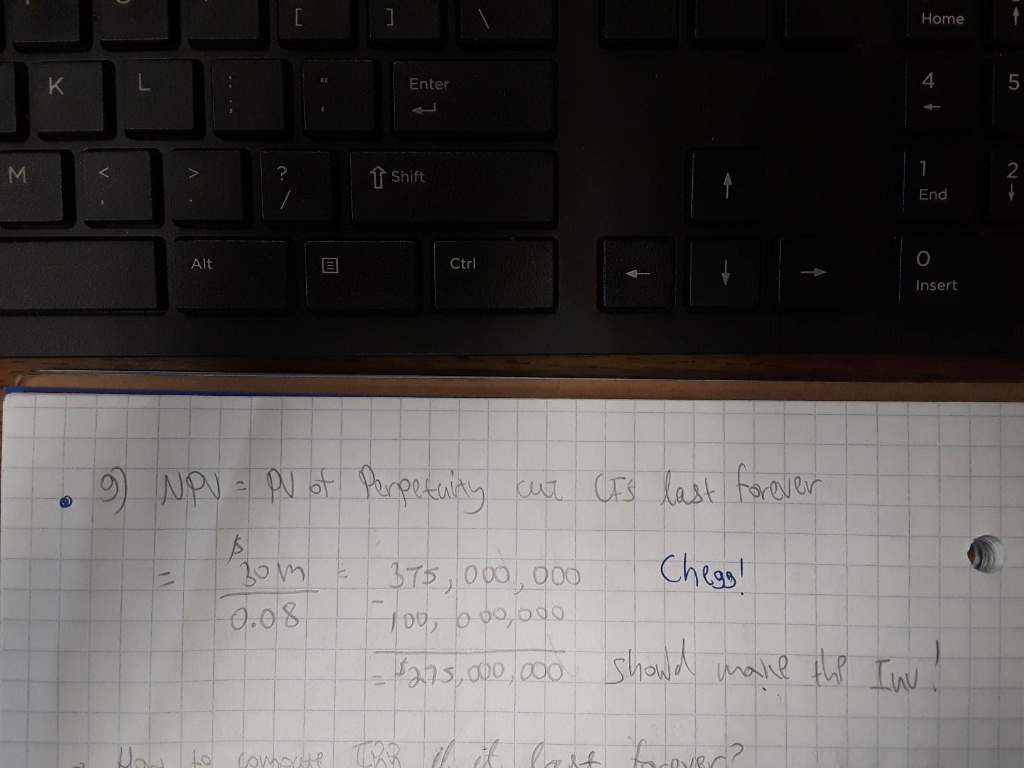

We know that the $30 million goes on forever (a perpetuity), so obviously, the PV of a perpetuity will be 30/0.08.

However, I don't get the other part - the (1/1.08) : where did they get it from and why?

The way I saw it was simple: we have $100 million cash outflow with a cash inflow of $30 million per year, forever.

So what I did was calculating the PV of the perpetuity (the $30 million) and subtracting the initial cash outflow (the $100 million) from it to get the total NPV. However, I was wrong.

Does anyone can explain me how the manual is right?

Thank you!

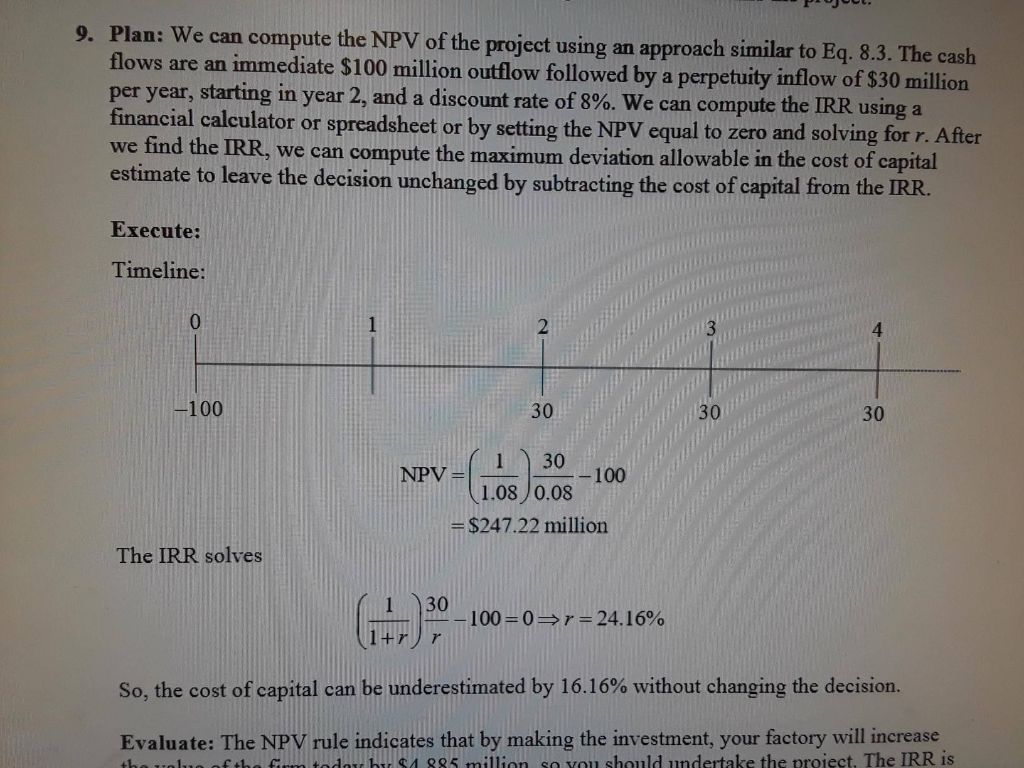

Cart 3 Valuation and the Firm at will cost $100 million up front and a to produce profits of $30 million Tows are expected to last forever. ur cost of capital is 8%. Should be $8 million. Your cost of capital for this contract is 8%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your 9. You are considering opening a new plant. The plant will cost $100 million will take one year to build. After that, it is expected to produce profits on at the end of every year of production. The cash flows are expected to la Calculate the NPV of this investment opportunity if your cost of capital is on you make the investment? Calculate the IRR and use it to determine the max deviation allowable in the cost of capital estimate to leave the decision unchanged. 10. Bill Clinton reportedly was paid $10 million to write his book My Life. The book took three years to write. In the time he spent writing, Clinton could have been paid make speeches. Given his popularity, assume that he could earn $8 million per yea (paid at the end of the year) speaking instead of writing. Assume his cost of capital 10% per year. 2. What is the NPV of agreeing to write the book (ignoring any royalty payments - Assume that, once the book was finished, it was expected to generate royalty $5 million in the first year (paid at the end of the year) and these royalties n ie the NPVT Home Enter M T Shift End Alt Ctrl Insert NPV = PV of Perpetuity cut CF's last forever Chegg!! Bom & 375,000,000 -0.08 100, 600,000 - $275,000,000 should make the In thi to commits TR il et best forever? POJOUL. 9. Plan: We can compute the NPV of the project using an approach similar to Eq. 8.3. The cash flows are an immediate $100 million outflow followed by a perpetuity inflow of $30 million per year, starting in year 2, and a discount rate of 8%. We can compute the IRR using a financial calculator or spreadsheet or by setting the NPV equal to zero and solving for r. After we find the IRR, we can compute the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged by subtracting the cost of capital from the IRR. Execute: Timeline: -100 30 30 NPV= 130 -100 1.08 0.08 $247.22 million The IRR solves -100=0 =24.16% So, the cost of capital can be underestimated by 16.16% without changing the decision. Evaluate: The NPV rule indicates that by making the investment, your factory will increase the lufth firm today bir $885 million so vou should undertake the project. The IRR is