Hello, how do I approach the following question? Both pictures are from question 1.

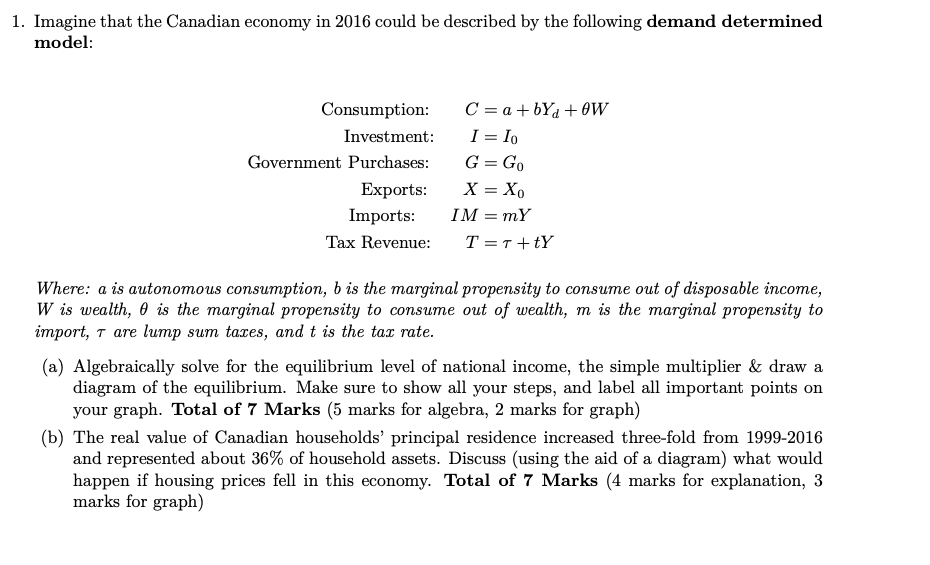

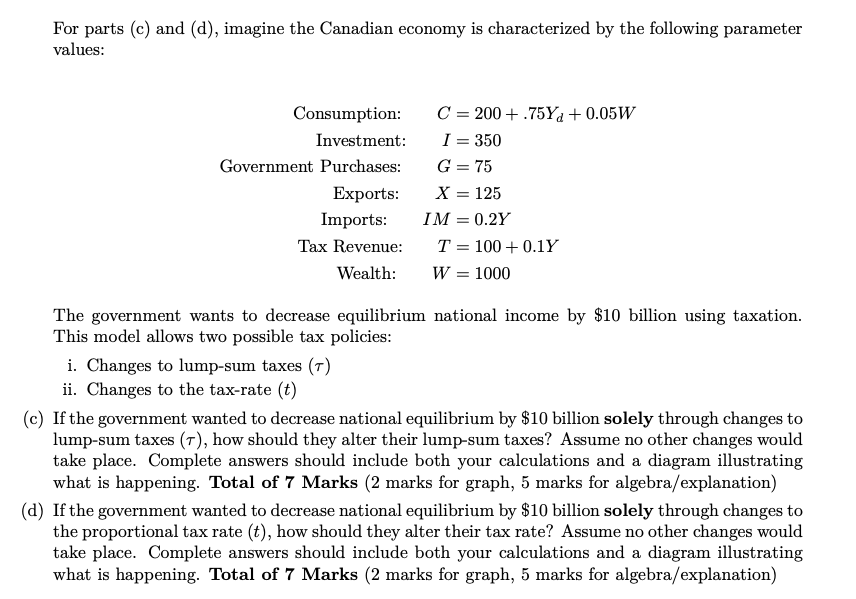

1. Imagine that the Canadian economy in 2016 could be described by the following demand determined model: Consumption: C = a + bYd + 9W Investment: I = In Government Purchases: G = G.) Exports: X = X0 Imports: IM = my Tax Revenue: T = 1' + tY Where: a is autonomous consumption, 5 is the marginal! propensity to consume out of disposable income, W is weali, n9 is the margin-at propensity to consume out of wealth, m is the mryinal propensity to import, 1' are lump sum tones, and t is the ta: rate. (a) Algebraically solve for the equilibrium level of national income, the sinlple multiplier 35 draw a diagram of the equilibrium. Make sure to show all your steps, and label all important points on your graph. Total of 7 Marks (5 marks for algebra, 2 marks for graph) (b) The real value of Canadian households' principal residence increased three-fold from 1999-2015 and represented about 35% of household assets. Discuss (using the aid of a diagram) what would happen if housing prices fell in this economy. Total of 7 Marks (4 marks for explanation, 3 marks for graph) For parts (c) and (d), imagine the Canadian economy is characterized by the following parameter values: Consumption: C = 200 + .75Ya + 0.05W Investment: I = 350 Government Purchases: G = 75 Exports: X = 125 Imports: IM = 0.2Y Tax Revenue: T = 100 + 0.1Y Wealth: W = 1000 The government wants to decrease equilibrium national income by $10 billion using taxation. This model allows two possible tax policies: i. Changes to lump-sum taxes (T) ii. Changes to the tax-rate (t) (c) If the government wanted to decrease national equilibrium by $10 billion solely through changes to lump-sum taxes (7), how should they alter their lump-sum taxes? Assume no other changes would take place. Complete answers should include both your calculations and a diagram illustrating what is happening. Total of 7 Marks (2 marks for graph, 5 marks for algebra/explanation) (d) If the government wanted to decrease national equilibrium by $10 billion solely through changes to the proportional tax rate (t), how should they alter their tax rate? Assume no other changes would take place. Complete answers should include both your calculations and a diagram illustrating what is happening. Total of 7 Marks (2 marks for graph, 5 marks for algebra/ explanation)