Answered step by step

Verified Expert Solution

Question

1 Approved Answer

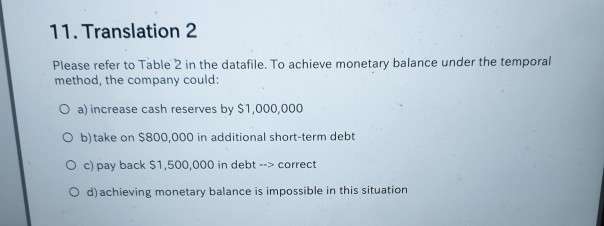

hello how do i solve this 11. Translation 2 Please refer to Table 2 in the datafile. To achieve monetary balance under the temporal method,

hello how do i solve this

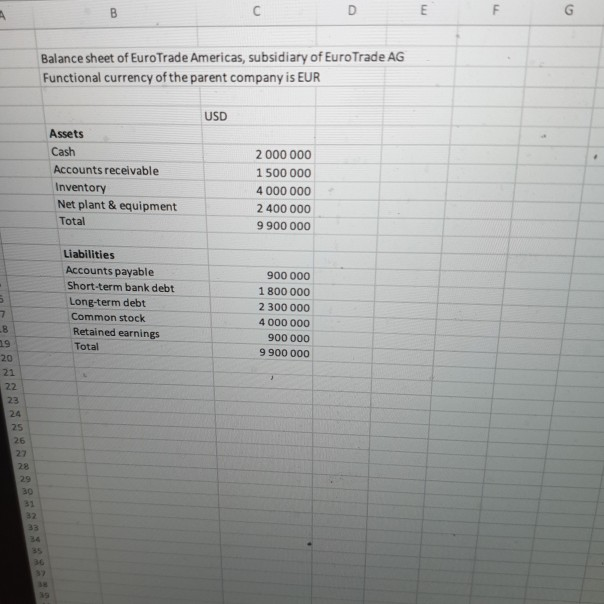

11. Translation 2 Please refer to Table 2 in the datafile. To achieve monetary balance under the temporal method, the company could: O a) increase cash reserves by $1,000,000 Ob)take on $800,000 in additional short-term debt O c) pay back $1,500,000 in debt --> correct od) achieving monetary balance is impossible in this situation Balance sheet of EuroTrade Americas, subsidiary of Euro Trade AG Functional currency of the parent company is EUR USD Assets Cash Accounts receivable Inventory Net plant & equipment Total 2 000 000 1 500 000 4 000 000 2 400 000 9 900 000 in Liabilities Accounts payable Short-term bank debt Long-term debt Common stock Retained earnings Total 900 000 1 800 000 2 300 000 4 000 000 900 000 9 900 000 11. Translation 2 Please refer to Table 2 in the datafile. To achieve monetary balance under the temporal method, the company could: O a) increase cash reserves by $1,000,000 Ob)take on $800,000 in additional short-term debt O c) pay back $1,500,000 in debt --> correct od) achieving monetary balance is impossible in this situation Balance sheet of EuroTrade Americas, subsidiary of Euro Trade AG Functional currency of the parent company is EUR USD Assets Cash Accounts receivable Inventory Net plant & equipment Total 2 000 000 1 500 000 4 000 000 2 400 000 9 900 000 in Liabilities Accounts payable Short-term bank debt Long-term debt Common stock Retained earnings Total 900 000 1 800 000 2 300 000 4 000 000 900 000 9 900 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started