Question

Hello! I am attempting to complete the case study: creating a balanced budget for management decision making from the book Budgeting and Financial Management for

Hello! I am attempting to complete the case study: creating a balanced budget for management decision making from the book "Budgeting and Financial Management for Nonprofits" by Weikart, Chen & Sermier.

The case study asks to build a complete balanced budget proposal using the tables and data used in the book.

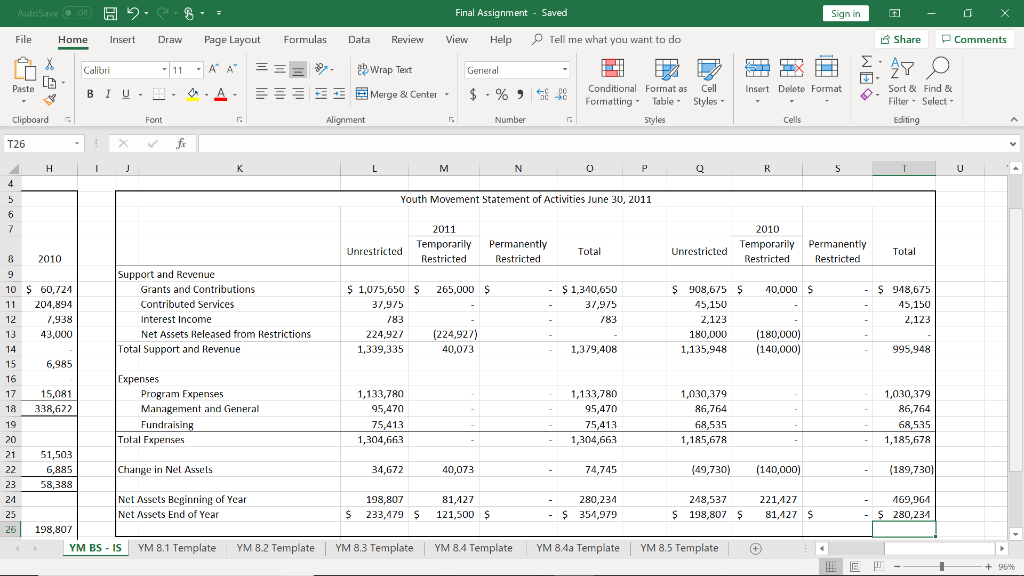

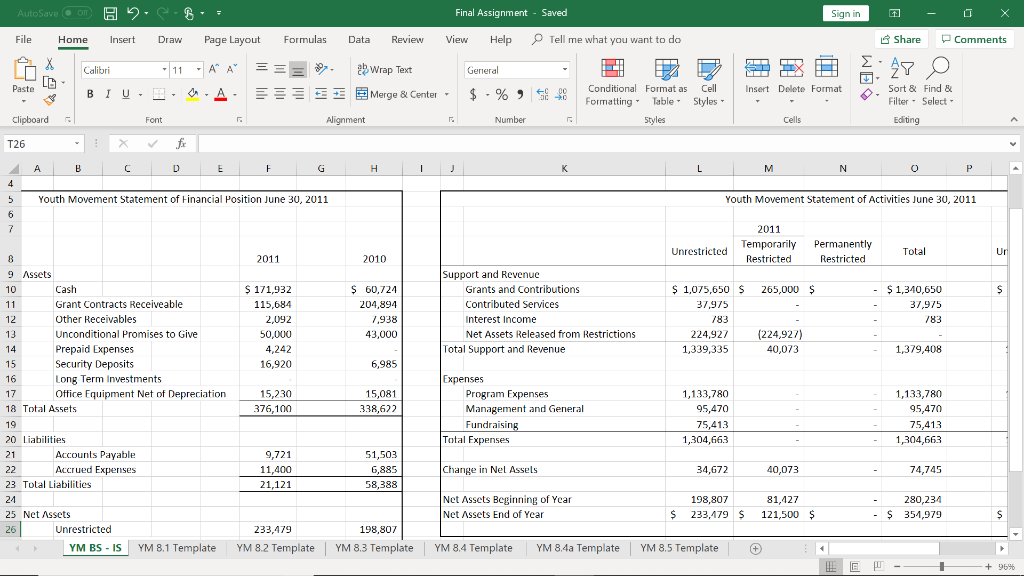

Step 1 states to first determine the organizations statement of financial position as compared against the previous year and broken down by type of net asset. For 2010 I was given these to calculate the first step with the information from the statement of activities and statement of financial position.

WEP foundation: 23,000 as remaining amount due from award in 2010

DED Corp.: 25,427 as amount to be received in FY 2010/11

Pat Goodlin: 20,000 as amount to be received in August 2010

Joe Blow Foundation: 13,000 as cash received in March 2010

As for the 2011, I was given

John Dory Foundation: 40,000 as cash received October 2010

Excalibur Corp: 40,000 as amount to be received in October 2011

Joe Doaks foundation: 41,500 as cash received

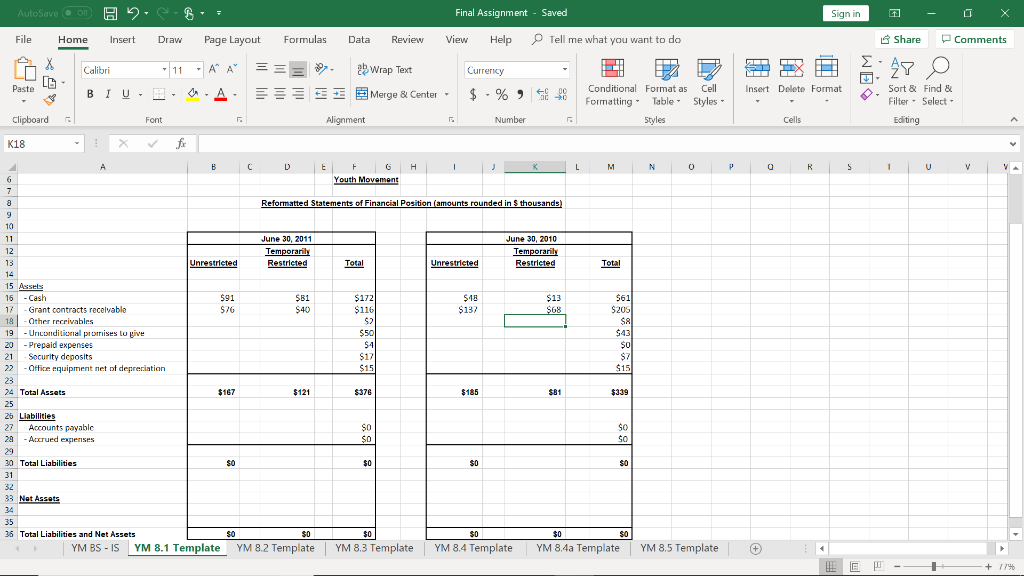

I was given this worksheet to fill out:

I filled in the first two rows, I think. I was just wondering if I am on the right track? and what my next steps were?

Final Assignment Saved File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do Share Comments Calibri Wrap Text General ge & Center . $ % , Sc 48 Formatting. Forbile. Styles. Sort & Find & Filter Select- Insert Delete Format Font T26 Youth Movement Statement of Activities June 30, 2011 2011 2010 Temporarily Permanently Unrestricted Temporarily Permanentiy Total Total 8 2010 Restrictecd Restricted Support and Revenue 908,675 $ 40,000$ 10 60,724 11 204,894 Grants and Contributions Contributed Services Interest Income Net Assets Released from Restrictions - 948,675 45,150 2,123 1,075,650265,000 1,340,650 37,975 183 45,150 83 224,927(224,927) 40,073 180,000 (180,000) 1,135,948 140,000) 13 43,000 otal Support and Revenue 1,339,335 1,379,408 995,948 6,985 17 15,081 18 338,6 1,133,780 1,133,780 95,470 75,413 663 1,030,379 86,764 68,535 1,185,678 1,030,379 86,764 68,535 1,185,678 Management and General 95,470 1,304,663 34,672 198,807 20 Total Expenses Charnge in Nel Assels Net Assets Beginning of Year 74,745 49,730) (140,000) (189,730) 6,885 58,388 40,073 23 81,427 233,479 121,500 -280,234 - 35,979 248,537 221,427 -469,964 - 280,231 Net Assets End of Year 198,807$ 81,427$ 26 198,807 YM BS-IS YM 8.1 Template YM 8.2 Template | YM 8.3 Template YM 8.4 Template YM 84a Template | YM 8.5 Template + 96% Final Assignment Saved File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do Share Comments Calibri Wrap Text General ge & Center . $ % , Sc 48 Formatting. Forbile. Styles. Sort & Find & Filter Select- Insert Delete Format Font T26 5 Youth Movement Statement of Financial Position June 30, 2011 Youth Movement Statement of Activities June 30, 2011 2011 Unrestricted Temporarily Permanently Restricted Total 2011 2010 Restrictecd 9 Assets Support and Revenue 171,932 115,684 2,092 50,000 4,242 16,920 60,724 204,894 ,938 43,000 Grants and Contributions Contributed Services Interest Income Net Assets Released from Restrictions 1,075,650265,000 1,340,650 37,975 /83 Grant Contracts Receiveable Other Receivables Unconditional Promises to Give Prepaid Expenses Security Deposits Long Term Investments Office Equipment Net of Depreciation 37,975 183 224.92(224,927) 40,073 Total Support and Revenue 1,339,335 - 1,379,408 6,985 17 18 Total Assets 15,081 338,677 Program Expenses Management and General Fundraisi 1,133,780 95,470 75,413 1,304,663 1,133,780 376,100 95,470 1,304,663 74,745 -280,234 20 Liabilities Total Expenses Change in Nel Assels Net Assets Beginning of Year Accounts Payable Accrued Expenses 9,721 11,400 21,121 6,885 58,388 34,672 40,073 23 Total Liabilities 81,427 233,A79$ 121,500 198,807 25 Net Assets Net Assets End of Year - 351,979 Unrestricted 233,479 198,807 YM BS-IS YM 8.1 Template YM 8.2 Template | YM 8.3 Template | YM 8.4 Template YM 8.4a Template | YM 8.5 Template + 96% Final Assignment Saved Sign in File Home Insert Draw Page Layout Formulas Data Review View Help Tell me what you want to do Share Comments Calibri Conditional Format as Cell Table-Styles Sort & Find & Filter Select- Paste Insert Delete Format B 1 y . Li. A Mer Clipboard Font K18 0 0 eformatted Statements of Financial Position June 30, 2011 June 30, 2010 15 Assels 16 Cash 591 576 581 172 513 $18 $137 Grant contracts recelvabla 8Other recrivables 19Urnconditiueil prorrises to 20Prepaid expenses 21Socurity deposits $17 15 Office equipment net of depreciatian 4 Total Assets $167 $121 S376 $185 $81 26 Liabilities 27 Accounts payable 50 , Accrued expenses 30 Total Liabilities 3 Not Assets 3 Total Liabilities and Net Assets YM BS-IS YM 8.1 Template YM 8.2 Template | YM 8.3 Template | YM 8.4 Template YM 8.4a Template | YM 8.5 TemplateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started